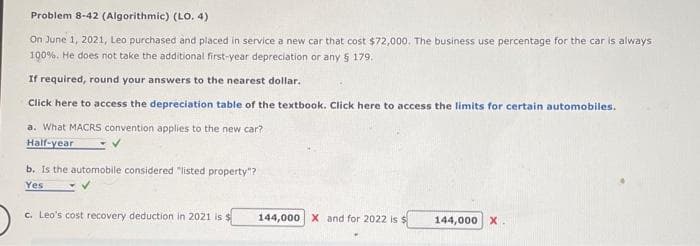

On June 1, 2021, Leo purchased and placed in service a new car that cost $72,000. The business use percentage for the car is always 100%. He does not take the additional first-year depreciation or any § 179. If required, round your answers to the nearest dollar. Click here to access the depreciation table of the textbook. Click here to access the limits for certain automobiles. new car? a. What MACRS convention applies to the new Half-year b. Is the automobile considered "listed property?

Q: AGGREGATE OUTPUT/INCOME 2,000 2,500 3,000 3,500 4,000 4,500 5,000 5,500 CONSUMPTION 2,100 2,500…

A: Aggregate Output/Income: It's the total value of all goods and services produced in an economy,…

Q: Company A has been selling 200 units per month of a product at a price of $12 per unit. The two…

A: Price elasticity is an economic concept where the responsiveness of one variable is recorded towards…

Q: official income distribution estimates for the united states since 1970 show that the gini…

A: The Gini coefficient is an index for measuring the degree of inequality in the distribution of…

Q: . Assuming Aggregate Demand and Aggregate Supply are initially at ADo and ASo respectively, which of…

A: When the labor force is fully employed, the economy is effectively using its resources, which…

Q: Drawing upon the new trade theory. What kinds of policies would you recommend the government adopt?…

A: Free trade alludes to the economic policy and practice of permitting goods and services to be traded…

Q: Units of capital 80 60 A 0 BD E 60 80 120 Units of labor

A: In economics, an isocost is a term derived from the combination of the words "iso" (meaning equal)…

Q: The ________ of money at i0 leads firms and households to ________ bonds, which leads to a(n)…

A: Total amount of money that is available in the economy forms the money supply in the economy. It…

Q: In competitive markets the long-run profit for firms is zero. Once the market reaches this point,…

A: Perfect competition is a hypothetical market structure in which there are many buyers and sellers,…

Q: 1. Which of the following could have caused the AD curve to shift from ADo to AD1 in Figure B?…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Use the payoff matrix below to identify a tariff rate (7) that causes cooperate-cooperate to be the…

A: The Nash Equilibrium is a concept where no player can benefit by changing their strategy while the…

Q: The inverse demand for milk is, PD = 96 - 1.4 Now suppose that the market in the previous que was…

A: The monopoly market is characterized by presence of single firm in the market. Firm is price maker.…

Q: Figure 8-6 Price $22 16 10 9 2 Tax 300 600 S a. It would fall by $2400. b. It would fall by $600. C.…

A: Equilibrium in the market occurs at the intersection of the demand and supply curves. Consumer…

Q: The population of Gilligan’s Island is 100 people: 40 work full-time, 20 work half-time but prefer…

A: The objective of the question is to calculate the unemployment rate and the employment-to-population…

Q: Endowment Effect and Willingness to Accept An experiment gives 50 students a coffee mug valued at…

A: The psychological phenomenon known as the "endowment effect" describes how people prefer to place a…

Q: Consider two countries with friendly trade relations, Canada and Mexico. Suppose that the real…

A: An exchange rate is the conversion of currency from one nation to another nation. It is the movement…

Q: 2. Suppose you run a regression with quantity as your dependent variable and advertising as one of…

A: Regression analysis is a statistical technique used in economics to examine the connection between…

Q: Explain why in the period of 2014-2018 the TFP contribution to GDP growth diminished to 0.8…

A: The 1980s stand out as a period of significant change in the dynamic of Country T's economic…

Q: A $5,000 balance in a tax-deferred savings plan will grow to $159,602.00 in 45 years at an 8% per…

A: If it is subject to a 30% income tax rate, we first need to calculate the present value of the…

Q: Cheetah Air and Eagle Air are comper industry. First, Cheetah Air decides w service to Maul or not.…

A: In game theory, a dominant strategy is a strategy that is the best choice for a player, regardless…

Q: If C=38,000+.6DI and the government increases its spending on infrastructure by 2 billion dollars,…

A: Aggregate Demand: The total quantity of goods and services demanded by all sectors of an economy at…

Q: Suppose one uses the single-index model to estimate characteristics of securities.Which of the…

A: It can be defined as a concept that shows how much currency of one nation is valuable in terms of…

Q: Assume that health insurance is private in a country, and the market for insurance is competitive.…

A: The market equilibrium quantity is where the private marginal benefit curve intersects the private…

Q: Calculate producer surplus at the equilibrium price for the graph below

A: Producer surplus measures the benefit enjoyed by seller by selling its product at a price larger…

Q: What are the logical fallacies and manipulative language used by the author, Zeynep Tufekci in "Why…

A: The article, titled "Why Smart Objects may be a Dumb Idea," expresses concerns about the security…

Q: The population of Gilligan’s Island is 100 people: 40 work full-time, 20 work half-time but prefer…

A: The objective of the question is to calculate the unemployment rate and the employment-to-population…

Q: Consider Molly in workout problem 10.2. True or False: You can analyze Mollys choices of consumption…

A: The objective of the question is to determine whether the given utility function V(C₁, C₂) = ln(c₁)…

Q: Foster, Inc. makes a new type of rubber gloves for assembly-line workers and will sell them to…

A: Cost Price of a pair of gloves = $4.15Selling Price of a pair of gloves = $6.25Increase in…

Q: Suppose the demand for a product is P = 150-Q and that the marginal cost of producing the product is…

A: In a Cournot oligopoly, firms compete on the quantity of output they produce, assuming their rivals'…

Q: Consider the production function q(L, K) = LK. Exercise 1 a) Derive the expressions for the input…

A: Production function: .... (1)The input demand function of labor and capital is the…

Q: What is total fixed cost when output is 2, fixed cost is 25, and average cost is 30

A: Fixed cost are such cost that do not vary with the level of output i.e it remains constant at every…

Q: Most people do not steal, because Multiple Choice O O stolen goods are subject to the law of…

A: Stealing is an act of doing certain sort of theft or robbery with the motive of generating profit.

Q: A supplier supplies a product at a unit cost of $15. The retailer acts as a newsvendor and pays a…

A: In an integrated supply chain, the retailer and the supplier work together to optimize the supply…

Q: QUESTION 8 (Table: Martinez Family Household Income and Expenditures) Use Table: Martinez Family…

A: Income elasticity of demand shows the responsiveness of a percentage change in income to a…

Q: A company produces a special new type of TV. The company has fixed costs of $477,000, and it costs…

A: Profit target: the desired financial goal a company aims to achieve, influencing pricing and sales…

Q: The publisher of a magazine gives his staff the following information: Current price Current sales…

A: Price elasticity of demand measures the responsiveness of change in quantity demand to change in…

Q: True or False (and why): Recessions are good for your health

A: Recession is a significant and prolonged downturn in economic activity. It is typically…

Q: The figure below shows the market for cotton. Suppose that the cotton growers use a chemical to…

A: External costs or negative externalities are the harmful side effects arise out of production of…

Q: A talented musician earns more money than other musicians in the industry. This is an example of…

A: The concept of economic rent refers to the scenario where the person receives an income amount which…

Q: Suppose you are interested in studying the effect of time spent in an SAT preparation course on…

A: The objective of the question is to understand the assumption made in the regression model about the…

Q: Assume that health insurance is private in a country, and the market for insurance is competitive.…

A: The market equilibrium quantity is where the private marginal benefit curve intersects the private…

Q: The table below shows the total expenditure on a basket of goods and services; use this information…

A: A price index measures the average change in prices of a basket of goods and services over time. It…

Q: Which of the following would be included in Canadian GDP for a given year? The market value of: A.…

A: Gross Domestic Product (GDP) is the total monetary or market value of all the finished goods and…

Q: An investor is considering two possible investment alternatives, Portfolio A and Portfolio B. The…

A: Utility function of investorThis function represents the investor's level of satisfaction or utility…

Q: Sheena, Lory and Kate decided to open three savings account for each of them which earned 10% per…

A: Sheena decided to deposit Php 2000 per year in the savings account, the deposit is made at the end…

Q: What is the average cost, when output is 1, total cost is 7, total revenue is 10, average revenue is…

A: Average cost, in economics, refers to the total cost of producing a certain quantity of output…

Q: The diagram at right shows the demand curve, marginal revenue curve, and cost curves for a…

A: Price discrimination in a monopoly means the practice of charging different prices to different…

Q: Ulysses Corporation has the following output data. We are in the short-run and thus all factors of…

A: Marginal product refers to that additional output which is obtained by employing additional unit of…

Q: Figure 8-5 Price P3 P1 P₂ A B o b. D C. F -Tax G P. a. P2 and Q2 C E H P2 and Q1 X P1 and Q1 d. P3…

A: The money paid by the consumers and producers of an economy to the government is referred to as tax.…

Q: Price of Carnations $14 $400 $100 $500 $200 12- 10- 8 6 4 2 Domestic Supply Tariff World Price…

A: The demand curve is the downward-sloping curve. The supply curve is the upward-sloping curve.The…

Q: Figure 8-7 Price $22 20- 18- 16 14 12 10. 8 6- 4- 2 0 -Tax- 5 10 15 20 25 30 35 40 45 50 D .a. $4 X…

A: Tax is an amount paid by sellers to government.Tax is an important tool for government to control…

can you please solve it? it was incorrect 4 times.

Step by step

Solved in 3 steps with 1 images

- Bob lives in Miami and operates a small company selling bikes. On average, he receives $778,000 per year from selling bikes. Out of this revenue from sales, he must pay the manufacturer a wholesale cost of $462,000. He also pays several utility companies, as well as his employees wages totaling $257,000. He owns the building that houses his storefront; if he choose to rent it out, he would receive a yearly amount of $12,000 in rent. Assume there is no depreciation in the value of his property over the year. Further, if Bob does not operate the bike business, he can work as a blogger and earn a yearly salary of $50,000 with no additional monetary costs, and rent out his storefront at the $12,000 per year rate. There are no other costs faced by Bob in running this bike company. Accounting Profit Economic ProfitCharles lives in Houston and operates a small company selling drones. On average, he receives $849,000 per year from selling drones. Out of this revenue from sales, he must pay the manufacturer a wholesale cost of $390,000. He also pays several utility companies, as well as his employees wages totaling $359,000. He owns the building that houses his storefront; if he choose to rent it out, he would receive a yearly amount of $72,000 in rent. Assume there is no depreciation in the value of his property over the year. Further, if Charles does not operate the drone business, he can work as a programmer and earn a yearly salary of $25,000 with no additional monetary costs, and rent out his storefront at the $72,000 per year rate. There are no other costs faced by Charles in running this drone company. Identify each of Charles’s costs in the following table as either an implicit cost or an explicit cost of selling drones. Implicit Cost Explicit Cost The salary Charles could…This question contains two parts and they are independent of each other. Part 1: During a year of operation, a firm collects $450,000 in revenue and spends $100,000 on labor expenses, raw materials, rent, and utilities. The firm’s owner has provided $750,000 of her own money instead of investing the money and earning a 10 percent annual rate of return. The accounting costs of the firm are $_______________ The opportunity cost is $_______________ Total economic costs are $_______________ Accounting profits are $_______________ Economic profits are $_______________ Part 2: Higher personal taxes in the U.S. will affect personal disposable income which in turn will affect the domestic demand for goods and services. Costs of production, however, continue declining resulting from outsourcing overseas. What do you expect the U.S. output and prices in the near future?…

- You have the opportunity to get a VEGGIE Café franchise (this specializes in BOCA veggie Burgers and other heart-healthy, non-GMO fast foods). You now manage three Big Bird Stick-e-Chicken shops for another owner, and feel you are ready to be your own boss. You estimate you can gross 70% of Stick-e-Chicken’s gross sales (which last year totaled $600,000). You will have to pay Veggie, Inc., an annual franchise fee of $1,500 plus another 4% of gross sales. You will have to pay two types of advertising expenses: local advertising (which will cost $6,000 a year) and your share of National advertising (which will be 2% of gross sales). A store location (formerly a Burger Hut) is available for only $6,000 a year plus a yearend rent bonus of 1% of estimated gross sales greater than $60,000. You will have to borrow money from a bank at 10% per annum (which will cost you $18,500 a year in interest). Your life savings of $50,000 will have to be invested in the business (thus you will…You have the opportunity to get a VEGGIE Café franchise (this specializes in BOCA veggie Burgers and other heart-healthy, non-GMO fast foods). You now manage three Big Bird Stick-e-Chicken shops for another owner, and feel you are ready to be your own boss. You estimate you can gross 70% of Stick-e-Chicken’s gross sales (which last year totaled $600,000). You will have to pay Veggie, Inc., an annual franchise fee of $1,500 plus another 4% of gross sales. You will have to pay two types of advertising expenses: local advertising (which will cost $6,000 a year) and your share of National advertising (which will be 2% of gross sales). A store location (formerly a Burger Hut) is available for only $6,000 a year plus a yearend rent bonus of 1% of estimated gross sales greater than $60,000. You will have to borrow money from a bank at 10% per annum (which will cost you $18,500 a year in interest). Your life savings of $50,000 will have to be invested in the business (thus you will…You have the opportunity to get a VEGGIE Café franchise (this specializes in BOCA veggie Burgers and other heart-healthy, non-GMO fast foods). You now manage three Big Bird Stick-e-Chicken shops for another owner, and feel you are ready to be your own boss. You estimate you can gross 70% of Stick-e-Chicken’s gross sales (which last year totaled $600,000). You will have to pay Veggie, Inc., an annual franchise fee of $1,500 plus another 4% of gross sales. You will have to pay two types of advertising expenses: local advertising (which will cost $6,000 a year) and your share of National advertising (which will be 2% of gross sales). A store location (formerly a Burger Hut) is available for only $6,000 a year plus a yearend rent bonus of 1% of estimated gross sales greater than $60,000. You will have to borrow money from a bank at 10% per annum (which will cost you $18,500 a year in interest). Your life savings of $50,000 will have to be invested in the business (thus you will…

- Q1. The Laundromat Corporation is considering opening another coin-operated laundry in a city. It has estimated that opening the laundry would involve an initial cost of $100,000 and would generate a net cash flow of $32,000 in each of the following five years, with no salvage value for the equipment and no recovery of operating expenses at the end of the five years. The corporation estimates that it would have to pay a rate of 12% on its bonds and that it would face a marginal income tax rate of 40%. The interest on government securities is 10%. During the current year, the corporation expects to pay a dividend of $20 on each share of its common stock, which sells for 10 times current earnings. Management and outside analysts expects the growth rate of earnings and dividends of the corporation to be 7% per year. The return on the average stock of all firms in the market is 14%, and the estimated beta coefficient () for the common stock of the corporation is 1.25. The corporation…Definition of economic costs Hubert lives in Detroit and runs a business that sells boats. In an average year, he receives $728,000 from selling boats. Of this sales revenue, he must pay the manufacturer a wholesale cost of $428,000; he also pays wages and utility bills totaling $262,000. He owns his showroom; if he chooses to rent it out, he will receive $18,000 in rent per year. Assume that the value of this showroom does not depreciate over the year. Also, if Hubert does not operate this boat business, he can work as a paralegal, receive an annual salary of $21,000 with no additional monetary costs, and rent out his showroom at the $18,000 per year rate. No other costs are incurred in running this boat business. Identify each of Hubert’s costs in the following table as either an implicit cost or an explicit cost of selling boats. Implicit Cost Explicit Cost The wholesale cost for the boats that Hubert pays the manufacturer The wages and utility…The sole proprietor of the Alton Plumbing Supply Company receives all accounting profits earned by his firm and a $30,000 a year salary. He has a standing salary offer of $40,000 a year working for a large corporation. If he had invested his capital outside his company, he estimates that would have returned $15,000 this year. If accounting profits for the year were $65,000, economic profits were:

- Definition of economic costs Edison lives in Detroit and runs a business that sells guitars. In an average year, he receives $793,000 from selling guitars. Of this sales revenue, he must pay the manufacturer a wholesale cost of $430,000; he also pays wages and utility bills totaling $301,000. He owns his showroom; if he chooses to rent it out, he will receive $15,000 in rent per year. Assume that the value of this showroom does not depreciate over the year. Also, if Edison does not operate this guitar business, he can work as a financial advisor, receive an annual salary of $50,000 with no additional monetary costs, and rent out his showroom at the $15,000 per year rate. No other costs are incurred in running this guitar business.Big Bird Air is legally obligated to purchase 50 jet engines from ERUS at the end of two years at a price of $200,000 per engine. Confident that it is protected from opportunism with this contract, Big Bird begins making aircraft bodies designed to fit ERUS’s engines. Due to unforeseen events in the aerospace industry, in the second year of the contract ERUS is on the brink of bankruptcy. It tells Big Bird that unless it increases the engine price to $300,000, it will go bankrupt. 1. What should the manager of Big Bird Air do? 2. How could this problem have been avoided? 3. Did the manager of Big Bird Air use the wrong method of acquiring inputs?5 Pulsar Plc is considering of exporting its products to the Swedish market. It expects to earn an annual accounting profit of £200m from doing so. It has also the option to begin exporting to India, Brasil or South Africa, but it has the production capacity for only one of the four possible markets (including Sweden). The expected annual accounting profit for the above three markets is £250m, £200m, and £150m respectively. On the basis of this information, the economic profit of exporting to Sweden is equal to: a. -£50m. b. £0m. c. £50m. d. £200m.