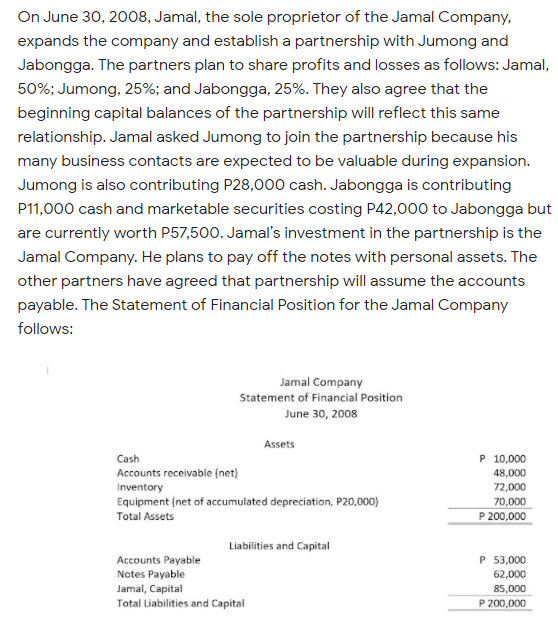

On June 30, 2008, Jamal, the sole proprietor of the Jamal Company, expands the company and establish a partnership with Jumong and Jabongga. The partners plan to share profits and losses as follows: Jamal, 50%; Jumong, 25%; and Jabongga, 25%. They also agree that the beginning capital balances of the partnership will reflect this same relationship. Jamal asked Jumong to join the partnership because his many business contacts are expected to be valuable during expansion. Jumong is also contributing P28,000 cash. Jabongga is contributing P11,000 cash and marketable securities costing P42,000 to Jabongga but are currently worth P57,500. Jamal's investment in the partnership is the Jamal Company. He plans to pay off the notes with personal assets. The other partners have agreed that partnership will assume the accounts payable. The Statement of Financial Position for the Jamal Company follows: Jamal Company Statement of Financial Position June 30, 2008 Assets Cash P 10,000 Accounts receivable (net) 48,000 Inventory 72,000 Equipment (net of accumulated depreciation, P20,000) 70,000 P 200,000 Total Assets Liabilities and Capital P 53,000 62,000 Accounts Payable Notes Payable Jamal, Capital Total Liabilities and Capital 85,000 P 200,000

On June 30, 2008, Jamal, the sole proprietor of the Jamal Company, expands the company and establish a partnership with Jumong and Jabongga. The partners plan to share profits and losses as follows: Jamal, 50%; Jumong, 25%; and Jabongga, 25%. They also agree that the beginning capital balances of the partnership will reflect this same relationship. Jamal asked Jumong to join the partnership because his many business contacts are expected to be valuable during expansion. Jumong is also contributing P28,000 cash. Jabongga is contributing P11,000 cash and marketable securities costing P42,000 to Jabongga but are currently worth P57,500. Jamal's investment in the partnership is the Jamal Company. He plans to pay off the notes with personal assets. The other partners have agreed that partnership will assume the accounts payable. The Statement of Financial Position for the Jamal Company follows: Jamal Company Statement of Financial Position June 30, 2008 Assets Cash P 10,000 Accounts receivable (net) 48,000 Inventory 72,000 Equipment (net of accumulated depreciation, P20,000) 70,000 P 200,000 Total Assets Liabilities and Capital P 53,000 62,000 Accounts Payable Notes Payable Jamal, Capital Total Liabilities and Capital 85,000 P 200,000

Chapter21: Partnerships

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

ADDITIONAL INFORMATION:

The partners agree that the inventory is worth P85,000, and the equipment is worth half of its original cost, and the allowance established for doubtful accounts is correct.

REQUIRED: Compute the Bonus received by Jumong.

Transcribed Image Text:On June 30, 2008, Jamal, the sole proprietor of the Jamal Company,

expands the company and establisha partnership with Jumong and

Jabongga. The partners plan to share profits and losses as follows: Jamal,

50%; Jumong, 25%; and Jabongga, 25%. They also agree that the

beginning capital balances of the partnership will reflect this same

relationship. Jamal asked Jumong to join the partnership because his

many business contacts are expected to be valuable during expansion.

Jumong is also contributing P28,000 cash. Jabongga is contributing

P11,000 cash and marketable securities costing P42,000 to Jabongga but

are currently worth P57,500. Jamal's investment in the partnership is the

Jamal Company. He plans to pay off the notes with personal assets. The

other partners have agreed that partnership will assume the accounts

payable. The Statement of Financial Position for the Jamal Company

follows:

Jamal Company

Statement of Financial Position

June 30, 2008

Assets

Cash

P 10,000

Accounts receivable (net)

48,000

Inventory

72,000

Equipment (net of accumulated depreciation, P20,000)

70,000

Total Assets

P 200,000

Liabilities and Capital

P 53,000

Accounts Payable

Notes Payable

Jamal, Capital

Total Liabilities and Capital

62,000

85,000

P 200,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning