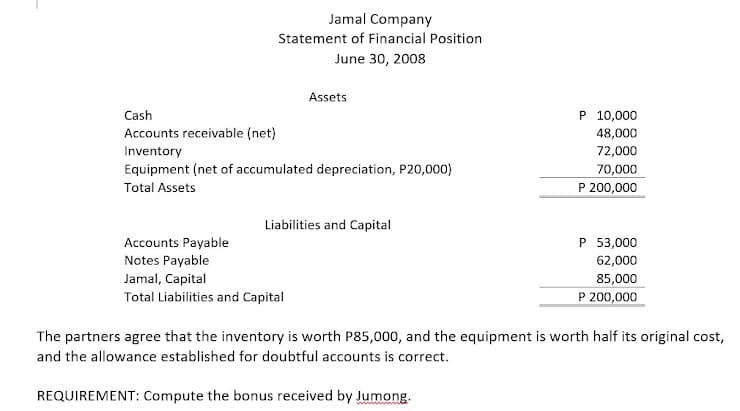

On June 30, 2008, Jamal, the sole proprietor of the Jamal Company, expands the company and establish a partnership with Jumong and Jabongga. The partners plan to share profits and losses as follows: Jamal, 50%; Jumong, 25%; and Jabongga, 25%. They also agree that the beginning capital balances of the partnership will reflect this same relationship. Jamal asked Jumong to join the partnership because his many business contacts are expected to be valuable during expansion. Jumong is also contributing P28,000 cash. Jabongga is contributing P11,000 cash and marketable securities costing P42,000 to Jabongga but are currently worth P57,500. Jamal’s investment in the partnership is the Jamal Company. He plans to pay off the notes with personal assets. The other partners have agreed that partnership will assume the accounts payable. The Statement of Financial Position for the Jamal Company follows:

Please help me with these

On June 30, 2008, Jamal, the sole proprietor of the Jamal Company, expands the company and establish a

Step by step

Solved in 2 steps