On June 30, 2017, Sharper Corporation's common stock is priced at $62 per share before any stock dividend or split, and the stockholders' equity section of its balance sheet appears as follows. Common stock-$10 par value, 120,000 shares authorized, 50,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings $ 500,000 200,000 660,000 Total stockholders' equity $ 1,360,000 1. Assume that the company declares and immediately distributes a 50% stock dividend. This event is recorded by capitalizing retained earnings equal to the stock's par value. Answer these questions about stockholders' equity as it exists after issuing the new shares. a.,b.& c. Complete the below table to calculate the retained earnings balance, total stockholders' equity and number of outstanding shares. 2. Assume that the company implements a 3-for-2 stock split instead of the stock dividend in part 1. Answer these questions about stockholders' equity as it exists after issuing the new shares. a.,b.& c. Complete the below table to calculate the retained earnings balance, total stockholders' equity and number of outstanding shares. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that the company declares and immediately distributes a 50% stock dividend. This event is recorded by capitalizing retained earnings equal to the stock's par value. Answer these questions about stockholders' equity as it exists after issuing the new shares. Complete the below table to calculate the retained earnings balance, total stockholders' equity and number of outstanding shares. Before Stock Dividend Impact of Stock After Stock Dividend Stock Dividend Dividend Common stock Paid in capital in excess of par value Total contributed capital Retained earnings Total stockholders' equity Number of common shares outstanding

On June 30, 2017, Sharper Corporation's common stock is priced at $62 per share before any stock dividend or split, and the stockholders' equity section of its balance sheet appears as follows. Common stock-$10 par value, 120,000 shares authorized, 50,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings $ 500,000 200,000 660,000 Total stockholders' equity $ 1,360,000 1. Assume that the company declares and immediately distributes a 50% stock dividend. This event is recorded by capitalizing retained earnings equal to the stock's par value. Answer these questions about stockholders' equity as it exists after issuing the new shares. a.,b.& c. Complete the below table to calculate the retained earnings balance, total stockholders' equity and number of outstanding shares. 2. Assume that the company implements a 3-for-2 stock split instead of the stock dividend in part 1. Answer these questions about stockholders' equity as it exists after issuing the new shares. a.,b.& c. Complete the below table to calculate the retained earnings balance, total stockholders' equity and number of outstanding shares. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that the company declares and immediately distributes a 50% stock dividend. This event is recorded by capitalizing retained earnings equal to the stock's par value. Answer these questions about stockholders' equity as it exists after issuing the new shares. Complete the below table to calculate the retained earnings balance, total stockholders' equity and number of outstanding shares. Before Stock Dividend Impact of Stock After Stock Dividend Stock Dividend Dividend Common stock Paid in capital in excess of par value Total contributed capital Retained earnings Total stockholders' equity Number of common shares outstanding

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 12.3APR: Stock transactions for corporate expansion On December 1 of the current year, the following accounts...

Related questions

Question

Transcribed Image Text:Exercise 11-5 Stock dividends and splits LO P2

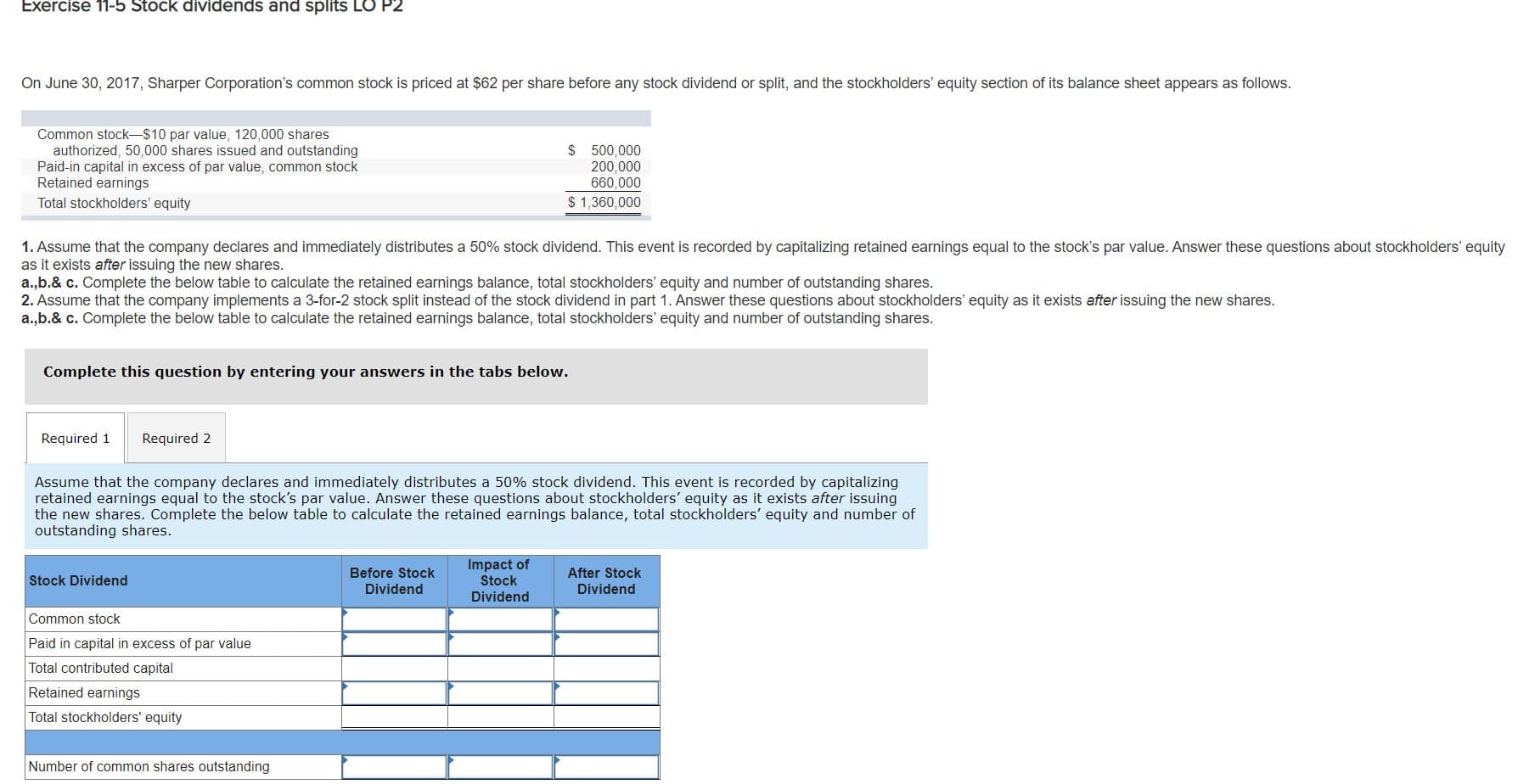

On June 30, 2017, Sharper Corporation's common stock is priced at $62 per share before any stock dividend or split, and the stockholders' equity section of its balance sheet appears as follows.

Common stock-$10 par value, 120,000 shares

authorized, 50,000 shares issued and outstanding

Paid-in capital in excess of par value, common stock

Retained earnings

$ 500,000

200,000

660,000

$ 1,360,000

Total stockholders' equity

1. Assume that the company declares and immediately distributes a 50% stock dividend. This event is recorded by capitalizing retained earnings equal to the stock's par value. Answer these questions about stockholders' equity

as it exists after issuing the new shares.

a.,b.& c. Complete the below table to calculate the retained earnings balance, total stockholders' equity and number of outstanding shares.

2. Assume that the company implements a 3-for-2 stock split instead of the stock dividend in part 1. Answer these questions about stockholders' equity as it exists after issuing the new shares.

a.,b.& c. Complete the below table to calculate the retained earnings balance, total stockholders' equity and number of outstanding shares.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Assume that the company declares and immediately distributes a 50% stock dividend. This event is recorded by capitalizing

retained earnings equal to the stock's par value. Answer these questions about stockholders' equity as it exists after issuing

the new shares. Complete the below table to calculate the retained earnings balance, total stockholders' equity and number of

outstanding shares.

Impact of

Stock

Dividend

Before Stock

After Stock

Stock Dividend

Dividend

Dividend

Common stock

Paid in capital in excess of par value

Total contributed capital

Retained earnings

Total stockholders' equity

Number of common shares outstanding

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning