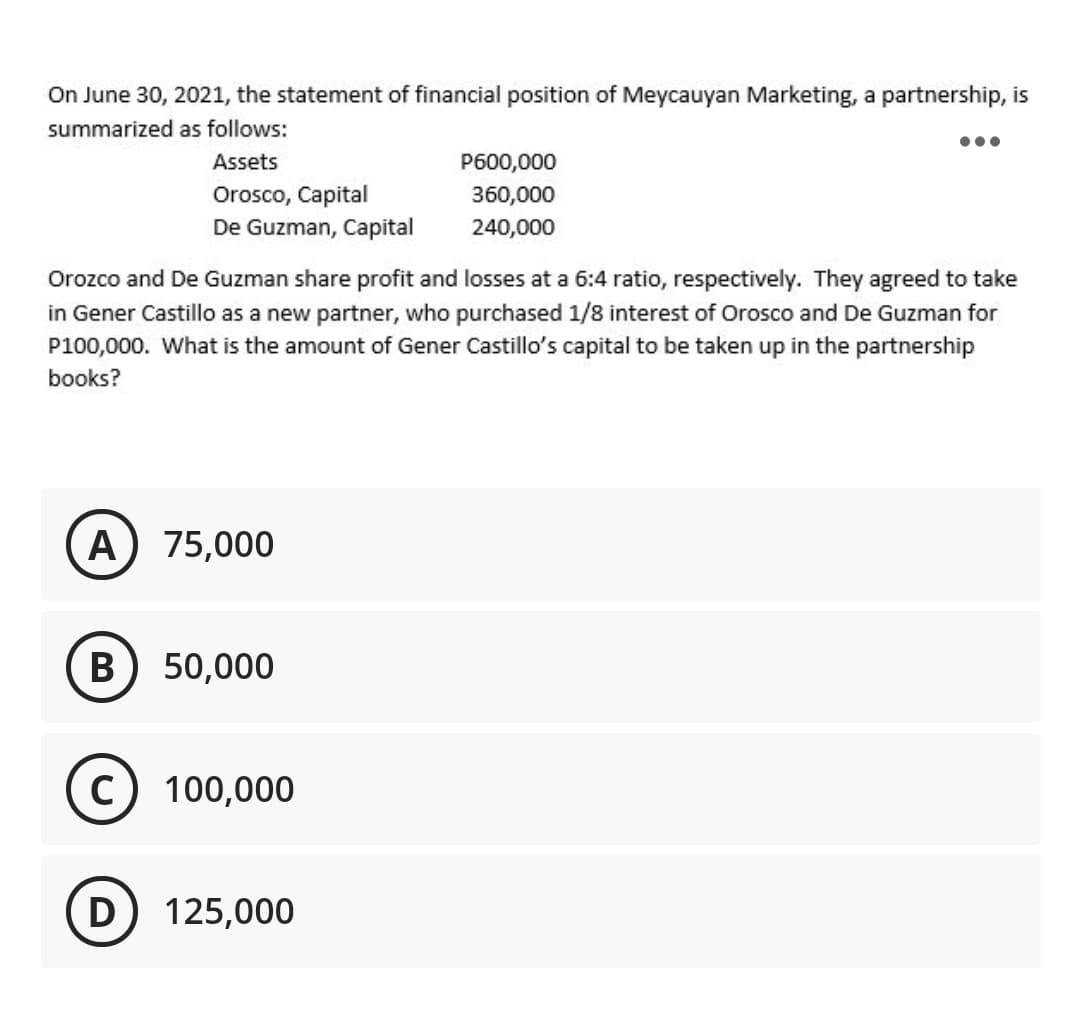

On June 30, 2021, the statement of financial position of Meycauyan Marketing, a partnership, is summarized as follows: Assets P600,000 Orosco, Capital De Guzman, Capital 360,000 240,000 Orozco and De Guzman share profit and losses at a 6:4 ratio, respectively. They agreed to take in Gener Castillo as a new partner, who purchased 1/8 interest of Orosco and De Guzman for P100,000. What is the amount of Gener Castillo's capital to be taken up in the partnership books?

On June 30, 2021, the statement of financial position of Meycauyan Marketing, a partnership, is summarized as follows: Assets P600,000 Orosco, Capital De Guzman, Capital 360,000 240,000 Orozco and De Guzman share profit and losses at a 6:4 ratio, respectively. They agreed to take in Gener Castillo as a new partner, who purchased 1/8 interest of Orosco and De Guzman for P100,000. What is the amount of Gener Castillo's capital to be taken up in the partnership books?

Chapter11: Partnerships: Distributions, Transfer Of Interests, And Terminations

Section: Chapter Questions

Problem 4BCRQ

Related questions

Question

What is the answer to this question?

Transcribed Image Text:On June 30, 2021, the statement of financial position of Meycauyan Marketing, a partnership, is

summarized as follows:

Assets

P600,000

Orosco, Capital

De Guzman, Capital

360,000

240,000

Orozco and De Guzman share profit and losses at a 6:4 ratio, respectively. They agreed to take

in Gener Castillo as a new partner, who purchased 1/8 interest of Orosco and De Guzman for

P100,000. What is the amount of Gener Castillo's capital to be taken up in the partnership

books?

A

75,000

В

50,000

c) 100,000

D

125,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT