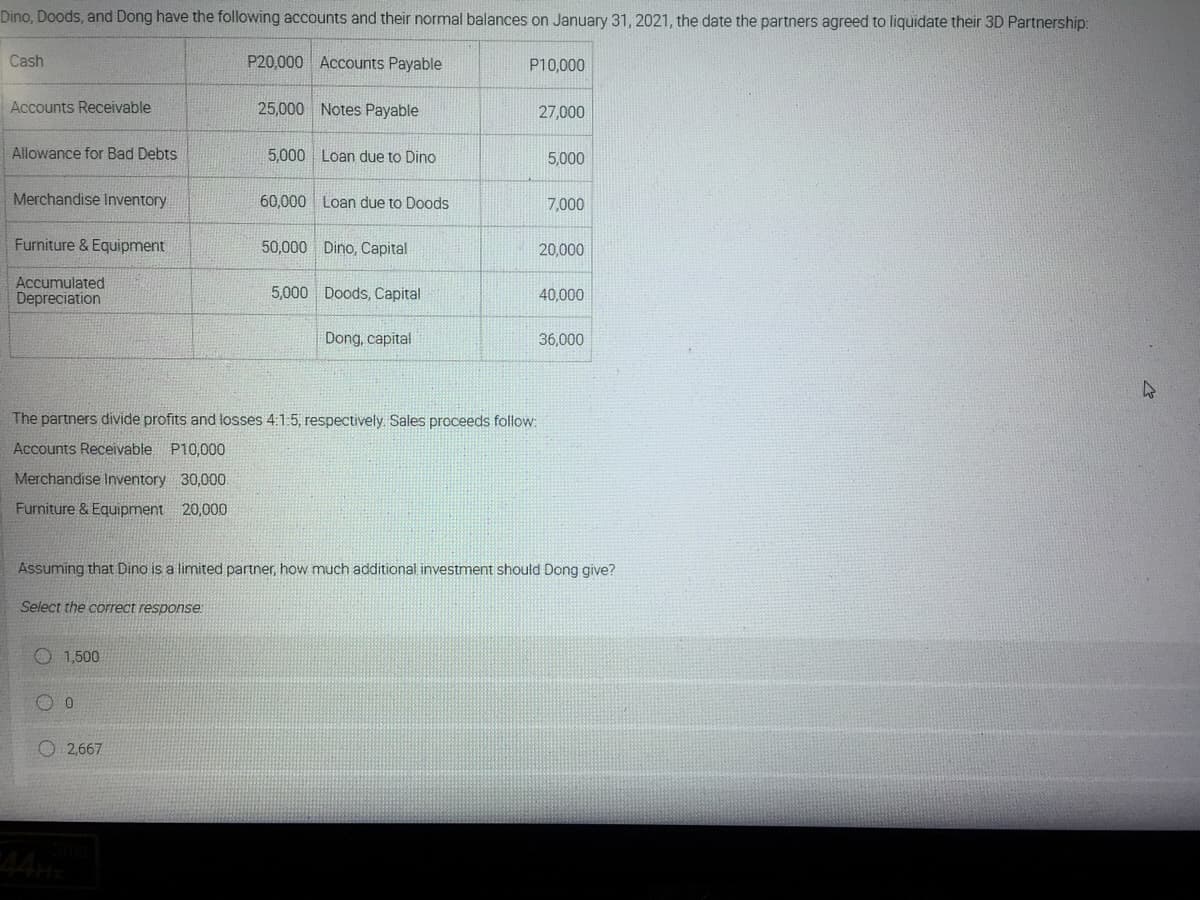

Dino, Doods, and Dong have the following accounts and their normal balances on January 31, 2021, the date the partners agreed to liquidate their 3D Partnership: Cash P20,000 Accounts Payable P10,000 Accounts Receivable 25,000 Notes Payable 27,000 Allowance for Bad Debts 5,000 Loan due to Dino 5,000 Merchandise Inventory 60,000 Loan due to Doods 7,000 Furniture & Equipment 50,000 Dino, Capital 20,000 Accumulated Depreciation 5,000 Doods, Capital 40,000 Dong, capital 36,000 The partners divide profits and losses 4:1:5, respectively. Sales proceeds follow: Accounts Receivable P10,000 Merchandise Inventory 30,000. Furniture & Equipment 20,000

Dino, Doods, and Dong have the following accounts and their normal balances on January 31, 2021, the date the partners agreed to liquidate their 3D Partnership: Cash P20,000 Accounts Payable P10,000 Accounts Receivable 25,000 Notes Payable 27,000 Allowance for Bad Debts 5,000 Loan due to Dino 5,000 Merchandise Inventory 60,000 Loan due to Doods 7,000 Furniture & Equipment 50,000 Dino, Capital 20,000 Accumulated Depreciation 5,000 Doods, Capital 40,000 Dong, capital 36,000 The partners divide profits and losses 4:1:5, respectively. Sales proceeds follow: Accounts Receivable P10,000 Merchandise Inventory 30,000. Furniture & Equipment 20,000

Chapter10: Partnerships: Formation, Operation, And Basis

Section: Chapter Questions

Problem 59P

Related questions

Question

Transcribed Image Text:Dino, Doods, and Dong have the following accounts and their normal balances on January 31, 2021, the date the partners agreed to liquidate their 3D Partnership:

Cash

P20,000 Accounts Payable

P10,000

Accounts Receivable

25,000 Notes Payable

27,000

Allowance for Bad Debts

5,000 Loan due to Dino

5,000

Merchandise Inventory

60,000 Loan due to Doods

7,000

Furniture & Equipment

50,000 Dino, Capital

20,000

Accumulated

Depreciation

5,000 Doods, Capital

40,000

Dong, capital

36,000

The partners divide profits and losses 4:1:5, respectively. Sales proceeds follow:

Accounts Receivable P10,000

Merchandise Inventory 30,000.

Furniture & Equipment 20,000

Assuming that Dino is a limited partner, how much additional investment should Dong give?

Select the correct response

O1,500

O 2,667

44H

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College