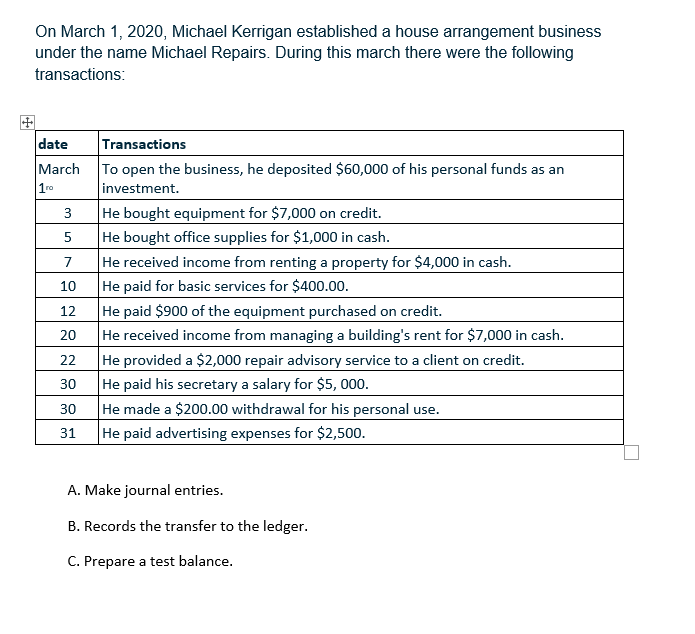

On March 1, 2020, Michael Kerrigan established a house arrangement business under the name Michael Repairs. During this march there were the following transactions: Transactions To open the business, he deposited $60,000 of his personal funds as an investment. He bought equipment for $7,000 on credit. He bought office supplies for $1,000 in cash. He received income from renting a property for $4,000 in cash. He paid for basic services for $400.0o. He paid $900 of the equipment purchased on credit. He received income from managing a building's rent for $7,000 in cash. He provided a $2,000 repair advisory service to a client on credit. He paid his secretary a salary for $5, 000. He made a $200.00 withdrawal for his personal use. He paid advertising expenses for $2,500. date March 10 3 5 7 10 12 20 22 30 30 31 A. Make journal entries. B. Records the transfer to the ledger. C. Prepare a test balance.

On March 1, 2020, Michael Kerrigan established a house arrangement business under the name Michael Repairs. During this march there were the following transactions: Transactions To open the business, he deposited $60,000 of his personal funds as an investment. He bought equipment for $7,000 on credit. He bought office supplies for $1,000 in cash. He received income from renting a property for $4,000 in cash. He paid for basic services for $400.0o. He paid $900 of the equipment purchased on credit. He received income from managing a building's rent for $7,000 in cash. He provided a $2,000 repair advisory service to a client on credit. He paid his secretary a salary for $5, 000. He made a $200.00 withdrawal for his personal use. He paid advertising expenses for $2,500. date March 10 3 5 7 10 12 20 22 30 30 31 A. Make journal entries. B. Records the transfer to the ledger. C. Prepare a test balance.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter1: Asset, Liability, Owner’s Equity, Revenue, And Expense Accounts

Section: Chapter Questions

Problem 1PB: In July of this year, M. Wallace established a business called Wallace Realty. The account headings...

Related questions

Question

100%

C.)

Transcribed Image Text:On March 1, 2020, Michael Kerrigan established a house arrangement business

under the name Michael Repairs. During this march there were the following

transactions:

Transactions

To open the business, he deposited $60,000 of his personal funds as an

date

March

1ro

investment.

He bought equipment for $7,000 on credit.

He bought office supplies for $1,000 in cash.

He received income from renting a property for $4,000 in cash.

He paid for basic services for $400.00.

He paid $900 of the equipment purchased on credit.

He received income from managing a building's rent for $7,000 in cash.

He provided a $2,000 repair advisory service to a client on credit.

30 He paid his secretary a salary for $5, 000.

He made a $200.00 withdrawal for his personal use.

He paid advertising expenses for $2,500.

3

7

10

12

20

22

30

31

A. Make journal entries.

B. Records the transfer to the ledger.

C. Prepare a test balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College