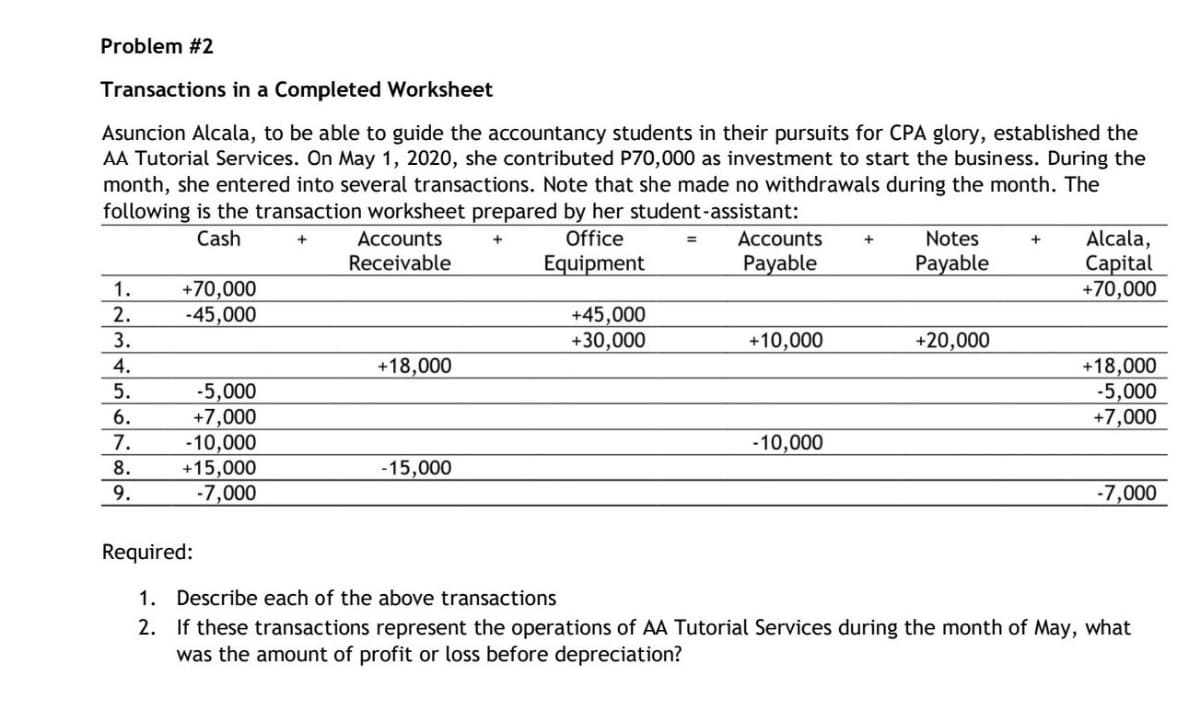

Asuncion Alcala, to be able to guide the accountancy students in their pursuits for CPA glory, established the AA Tutorial Services. On May 1, 2020, she contributed P70,000 as investment to start the business. During the month, she entered into several transactions. Note that she made no withdrawals during the month. The following is the transaction worksheet prepared by her student-assistant: Alcala, Capital +70,000 Cash Accounts Office Accounts Notes Receivable Equipment Payable Payable +70,000 -45,000 2. +45,000 +30,000 3. +10,000 +20,000 +18,000 +18,000 -5,000 +7,000 4. -5,000 +7,000 -10,000 +15,000 -7,000 7. -10,000 8. -15,000 9. -7,000 Required: 1. Describe each of the above transactions 2. If these transactions represent the operations of AA Tutorial Services during the month of May, what was the amount of profit or loss before depreciation? F11561

Q: Arnina established a service business to be known as Arnina Photography on July 1, 2021. During the…

A: Your journal entries may not be seen if you use accounting software or outsource your accounting,…

Q: Wendy opened a hair care products shop in Georgetown in September 2020. During the first month of…

A: Journal entry: It is also called as book of original entry. All financial transactions occurred in a…

Q: Asuncion Alcala, to be able to guide the accountancy students in their pursuits for.CPA glory,…

A: Accounting equation of the business says that total assets will be always equal to total liabilities…

Q: Ms. Maryam opened training services company in January 2020. She plans to prepare the monthly…

A: Journalize the given transaction: Date Accounts title and explanation Debit (OMR) Credit (OMR)…

Q: Mr J Mwero, a wholesale merchant had the following balances in his ledger at 1 March 2019.Cash in…

A: It is prepared for knowing the final balances of the accounts.

Q: On August 1, 2019, Rafael Masey established Planet Realty, which completed the following…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: For the past several years, Jolene Upton has operated a part-timeconsulting business from her home.…

A: "Since you have asked multiple sub part question we will solve the first three sub part question for…

Q: Domingo Company started its business on January 1, 2019. The following transactions occurred during…

A: The bank reconciliation statement is prepared to adjust the balances of cash book and pass book with…

Q: Ms. Maryam opened training services company in January 2020. She plans to prepare the monthly…

A: The accounting equation is as follow:

Q: Use the Following information for the Question Numbers 5 to 10. Ms. Maryam opened training services…

A: Trial balance: Trial balance is a summary of all the ledger accounts balances presented in a tabular…

Q: Kathy Wintz formed a lawn service business as a summer job. To start the corporation on May 1, 2018,…

A: Requirement 1:

Q: Nihal started an accounting service business. The following transactions took place in the business…

A: Three golden rules of accounting are, Debit the receiver, credit the giver. Debit what comes in,…

Q: Domingo Company started its business on January 1, 2019. The following transactions occurred during…

A: Bank reconciliation statement is used to determine the differences between the bank statement…

Q: Wernan Peralta, Attorney-at-Law, opened his office on September 1, 2018. The following transactions…

A: Accounting equation of the business says that total assets in the business must be always equal to…

Q: AaaArnina established a service business to be known as Arnina Photography on July 1, 2021. During…

A: Journal entry is the process of recording business transactions for the first time in the books of…

Q: Loida Cardenas recently established her own business, which she called Cardenas Delivery Service.…

A: Trial balance is the statement that accumulates the balances of all the accounts in the books of…

Q: Mr. George opened a janitorial services business called "George Johnny" on January 1, 2021. The…

A: 1. Supply is purchased not used. So, Office supply is debited. When it will be used, supply expense…

Q: Sammi started her business on 1 January 2021 called Trendy. You are required to prepare the GENERAL…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: Carlos Young started an engineering firm called Young Engineering. He began operations in March 2020…

A: The trial balance included both types of accounts i.e temporary accounts and permanent accounts. All…

Q: Jean Smith, who retails wooden ornaments, has been so busy since she commenced business on 1 April…

A: Income Statement An income statement's purpose is to disclose the business transactions' as a result…

Q: Domingo Company started its business on January 1, 2019. The following transactions occurred during…

A: Journal entries refer to the record of any transaction as per the double-entry bookkeeping system,…

Q: Prepare the following below) Ms. Smith established an enterprise to be known as New york Designs, on…

A: Journal entry: It is the first step of recording transactions of a company. Before this, no other…

Q: Mr J Mwero, a wholesale merchant had the following balances in his ledger at 1 March 2019. Cash in…

A: Since you have asked two questions under single question. We have solved question number 1 for you…

Q: Domingo Company started its business on January 1, 2019. The following transactions occurred during…

A: The bank reconciliation statement is prepared to equate the balances of cash book and passbook with…

Q: RR Claro, a public relation man, opened his business on May 1, 2020. Below are the transactions…

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal.…

Q: Jean Smith, who retails wooden ornaments, has been so busy since she commenced business on 1 April…

A: Jean Smith Profit and Loss A/c for the Year ended 31-03-206…

Q: Arnina established a service business to be known as Arnina Photography on July 1, 2021. During the…

A: The procedure of entering business transactions for the first time in the books of accounts is known…

Q: relanado established the EG Travels on May 15. 2019 The following transactions occurred during the…

A: Journal entries are recording of the transaction in the accounting journal in a chronological order.…

Q: Open accounts in Mr J Mwero’s ledger and post above transactions in the ledger and the three column…

A: Three Column Cash Book: It is exhaustive form of cash book It is having three money columns on…

Q: Inner Resources Company started its business on April 1, 2019. The following transactions occurred…

A:

Q: Vilma Cuneta recently established her own business, which she called Cuneta Delivery Service. During…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Sammi started her business on 1 January 2021 called Trendy. You are required to prepare the GENERAL…

A: Journal entry is a primary entry that records the financial transactions initially.

Q: Mr. Naveed decided to start a courier service Business in Ibra that named as Courier delivery…

A: The accounting equation states that assets equals to sum of liabilities and shareholders equity.

Q: Kathy Wintz formed a lawn service business as a summer job. To start the corporation on May 1, 2018,…

A:

Q: Pio Baconga started Baconga Industrial Spray Service on Apr. 1, 2019. During April, Baconga…

A: As per accounting equation, assets equal to sum of liabilities and equity.

Q: Ikaw passed the very difficult CPA board examination in October and immediately set-up his…

A: Accounting equation refers the double entry system of each transaction and the way the journal entry…

Q: Your friend, Dean McChesney, requested that you advise him on the effects that certain transactions…

A: T-account refers to a set of financial records that uses the method of double-entry bookkeeping. It…

Q: Ms. Maryam opened training services company in January 2020. She plans to prepare the monthly…

A: Journal entry refers to the recording made by the business in the books of accounts, of all the…

Q: Prepare the journal entries. If an amount box does not require an entry, leave it blank.

A: Journal entries are the initial form of recording a transaction for having financial records in a…

Q: On August 1, 2019, Rafael Masey established Planet Realty, which completed the following…

A: 1.Process of entering the transaction in journal is known as journalizing a transaction. General…

Q: On July 01, 2020, Maria initially invested P200,000 cash into Maria Merchandising. On the same date,…

A: Journal entries are the first recording of any transaction in the books of accounts on a…

Q: On July 01, 2020, Maria initially invested P200,000 cash into Maria Merchandising. On the same date,…

A: The practice of recording commercial transactions for the first time in the books of accounts is…

Q: On August 1, 2019, Rafael Masey established Planet Realty, which completed the following…

A: Since you have posted a question with multiple parts. we will be answering you first three subparts…

Q: aaArnina established a service business to be known as Arnina Photography on July 1, 2021. During…

A: Journal entry refers to the process of recording commercial transactions for the first time in the…

Q: On January 1, 2019, Sharon Matthews established Tri-City Realty, which completed the following…

A: The day to day transactions are recorded in Journal and then the transactions are posted to ledger.…

Q: Domingo Company started its business on January 1, 2019. The following transactions occurred during…

A: A bank reconciliation statement aligns an organization's bank account with its book records by…

Q: Ms. Maryam opened training services company in January 2020. She plans to prepare the monthly…

A: Hey, since there are multiple questions posted, we will answer the first three questions. If you…

Q: Mark Young opens his own company, Sunrise Travel and Tours, and completes the following transactions…

A: Accounting equation is an equation which indicates about that the total of assets balance is equal…

Q: Juana dela Cruz, to be able to guide the accountancy students in their pursuits for passing the CPA…

A: Transaction: It is an event between a buyer and seller which involves money. It is an exchange of…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.Comprehensive problem 1 Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2016. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: May 3. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, 4,500. 5. Received cash from clients on account, 2,450. 9. Paid cash for a newspaper advertisement. 225. 13. Paid Office Station Co. for part of the debt incurred on April 5, 640. 15. Recorded services provided on account for the period May 1-15; 9,180. 16. Paid part-time receptionist for two weeks salary including the amount owed on April 30, 750. 17. Recorded cash from cash clients for fees earned during the period May 1-16, 8,360. Record the following transactions on Page 6 of the journal: 20. Purchased supplies on account, 735. 21. Recorded services provided on account for the period May 16-20, 4,820. 25. Recorded cash from cash clients for fees earned for the period May 17-23, 7,900. 27. Received cash from clients on account, 9,520. 28. Paid part-time receptionist for two weeks salary, 750. 30. Paid telephone bill for May, 260. 31. Paid electricity bill for May, 810. 31. Recorded cash from cash clients for fees earned for the period May 26-31, 3,300. 31. Recorded services provided on account for the remainder of May, 2,650. 31. Paid dividends, 10,500. Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2016, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2016, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a two- column journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a retained earnings statement, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. (Income Summary is account 34 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance.

- Problem 2-56A Analyzing Transactions Luis Madero, after working for several years with a large public accounting firm decided to open his own accounting service. The business is operated as a corporation under the name Madero Accounting Services. The following captions and amounts summarize Maderos balance sheet at July 31, 2019. The following events occurred during August 2019. Issued common stock to Ms. Garriz in exchange for $15,000 cash. Paid $850 for first months rent on office space. Purchased supplies of $2,250 on credit. Borrowed $8,000 from the bank. Paid $1,080 on account for supplies purchased earlier on credit. Paid secretarys salary for August of $2,150. Performed amounting services for clients who paid cash upon completion of the service in the total amount of $4,700. Used $3,180 of the supplies on hand. Perfumed accounting services for clients on credit in the total amount of $1,920. Purchased $500 in supplies for cash. Collected $1,290 cash from clients for whom services were performed on credit. Paid $1,000 dividend to stockholders. Required: Record the effects of the transactions listed above on the accounting equation. Use the format given in the problem, starting with the totals at July 31, 20l9. Prepare the trial balance at August 31, 2019.Brief Exercise 2-2? Events and Transactions Several events are listed below. Paid $30,000 for land. Purchased office supplies for cash. Perfumed consulting services for a client with the amount to be collected in 30 days. Signed a contract to perform consulting services over the next 6 months. Required: For each of the events, identify which ones qualify for recognition in the financial statements. If an event does not qualify for recognition, explain why.Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2016. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: May 3. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, 4,500. 5. Received cash from clients on account, 2,450. 9. Paid cash for a newspaper advertisement, 225. 13. Paid Office Station Co. for part of the debt incurred on April 5, 640. 15. Recorded services provided on account for the period May 115, 9,180. 16. Paid part-time receptionist for two weeks' salary including the amount owed on April 30, 750. 17. Recorded cash from cash clients for fees earned during the period May 116, 8,360. Record the following transactions on Page 6 of the journal: 20. Purchased supplies on account, 735. 21. Recorded services provided on account for the period May 1620, 4,820. 25. Recorded cash from cash clients for fees earned for the period May 1723, 7,900. 27. Received cash from clients on account, 9,520. 28. Paid part-time receptionist for two weeks' salary, 750. 30. Paid telephone bill for May, 260. 31. Paid electricity bill for May, 810. 31. Recorded cash from cash clients for fees earned for the period May 2631, 3,300. 31. Recorded services provided on account for the remainder of May, 2,650. 31. Kelly withdrew 10,500 for personal use. Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2016, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2016, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a two-column journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. (Income Summary is account #33 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance.

- Problem 2-62B Comprehensive Problem Mulberry Services sells electronic data processing services to firms too Email to own their own computing equipment. Mulberry had the following amounts and amount balances as of January 1, 2019: During 2019, the following transactions occurred (the events described below are aggregations of many individual events): During 2019, Mulberry sold $690,000 of computing services, all on credit. Mulberry collected $570,000 from the credit sales in Transaction a and an additional $129,000 from the accounts receivable outstanding at the beginning of the year. Mulberry paid the interest payable of $8,000. A Wages of $379,000 were paid in cash. Repairs and maintenance of $9,000 were incurred and paid. The prepaid rent at the beginning of the year was used in 2019. In addition, $28,000 of computer rental costs were incurred and paid. There is no prepaid rent or rent payable at year-end. Mulberry purchased computer paper for $13,000 cash in late December. None of the paper was used by year-end. Advertising expense of $26,000 was incurred and paid. Income tax of $10,300 was incurred and paid in 2019. Interest of $5,000 was paid on the long-term loan. (Continued) Required: 1. Establish a ledger for the accounts listed above and enter the beginning balances. Use a chart of accounts to order the ledger accounts. 2. Analyze each transaction, Journalize as appropriate. (Note: Ignore the date because these events are aggregations of individual events.) 3. Post your journal entries to T-accounts, Add additional T-accounts when needed. 4. Use the ending balances in the T-accounts to prepare a trial balanceCase 2-69 CONTINUING PROBLEM: FRONT ROW ENTERTAINMENT After much consideration, Cam and Anna decide to organize their company as a corporation. On January 11 2019, Front Row Entertainment Inc begins operations. Due to Cams family connections in the entertainment industry, Cam assumes the major responsibility for signing artists to a promotion contract. Meanwhile. Anna assumes the financial accounting and reporting responsibilities. The following business activities occurred during January: Jan. 1 Cam and Anna invest $8,000 each in the company in exchange for common stock. 1 The company obtains a $25,000 loan from a local bank. Front Row Entertainment agreed to pay annual interest of 9% each January I, starting in 202.0. It will repeat the amount borrowed in 5 years. 1 The company paid $1,200 in legal fees associated with incorporation. 1 Office equipment was purchased with $1000 in cash. 1 The company pays $800 to rent office space for January. 3 A 1-year insurance policy was purchased for $3,600. 3 Office supplies of $2,500 were purchased from Equipment Supply Services. Equipment Supply Services agreed to accept $1,000 in 15 days with the remainder due in 30 days. 5 The company signs Charm City, a local band with a growing cult following, to a four-city tour that starts on February 15. 8 Venues for all four Charm City concerts were reserved by paying $10,000 cash. 12 Advertising costs of $4,500 were paid to promote the concert tour. 18 Paid $1,000 to Equipment Supply Services for office supplies purchased on January 3. 25 To aid in the promotion of the upcoming tour, Front Row Entertainment arranged for Charm City to perform a 20-minute set at a local festival. Front Row Entertainment received $1,000 for Charm Citys appearance. Of this total amount. $400 was received immediate with the remainder due in 15 days. The festive] took place on January 23. 25 Paid Charm City $800 for performing at the festival. Note: Front Row Entertainment records the fees paid to the artist in an operating expense account called Artist Fee Expense. 23 Due to the success of the marketing efforts, Front Row Entertainment received $3300 in advance ticket sales for the upcoming tour. 30 The company collected $200 of the amount due from the January 25 festival. 30 Paid salaries of S1,200 each to Cam and Anna for the month of January. Required: 2. Post the transactions to the general ledger.Case 2-69 CONTINUING PROBLEM: FRONT ROW ENTERTAINMENT After much consideration, Cam and Anna decide to organize their company as a corporation. On January 11 2019, Front Row Entertainment Inc begins operations. Due to Cams family connections in the entertainment industry, Cam assumes the major responsibility for signing artists to a promotion contract. Meanwhile. Anna assumes the financial accounting and reporting responsibilities. The following business activities occurred during January: Jan. 1 Cam and Anna invest $8,000 each in the company in exchange for common stock. 1 The company obtains a $25,000 loan from a local bank. Front Row Entertainment agreed to pay annual interest of 9% each January I, starting in 202.0. It will repeat the amount borrowed in 5 years. 1 The company paid $1,200 in legal fees associated with incorporation. 1 Office equipment was purchased with $1000 in cash. 1 The company pays $800 to rent office space for January. 3 A 1-year insurance policy was purchased for $3,600. 3 Office supplies of $2,500 were purchased from Equipment Supply Services. Equipment Supply Services agreed to accept $1,000 in 15 days with the remainder due in 30 days. 5 The company signs Charm City, a local band with a growing cult following, to a four-city tour that starts on February 15. 8 Venues for all four Charm City concerts were reserved by paying $10,000 cash. 12 Advertising costs of $4,500 were paid to promote the concert tour. 18 Paid $1,000 to Equipment Supply Services for office supplies purchased on January 3. 25 To aid in the promotion of the upcoming tour, Front Row Entertainment arranged for Charm City to perform a 20-minute set at a local festival. Front Row Entertainment received $1,000 for Charm Citys appearance. Of this total amount. $400 was received immediate with the remainder due in 15 days. The festive] took place on January 23. 25 Paid Charm City $800 for performing at the festival. Note: Front Row Entertainment records the fees paid to the artist in an operating expense account called Artist Fee Expense. 23 Due to the success of the marketing efforts, Front Row Entertainment received $3300 in advance ticket sales for the upcoming tour. 30 The company collected $200 of the amount due from the January 25 festival. 30 Paid salaries of S1,200 each to Cam and Anna for the month of January. Required: Prepare a trial balance at January 31, 2019.

- Problem 3-64B Identification and Preparation of Entries Morgan Dance Inc. provides ballet, tap, and jazz dancing instruction to promising young dancers. Morgan began operations in January 2020 and is preparing its monthly financial statements. The following items describe Morgans transactions in January 2020: Morgan requires that dance instruction be paid in advance-either monthly or quarterly. On January 1, Morgan received $4,125 for dance instruction to be provided during 2020. On January 31, Morgan noted that $825 of dance instruction revenue is still unearned. On January 20, Morgans hourly employees were paid $1,415 for work performed in January. Morgans insurance policy requires semiannual premium payments. Morgan paid the $3,000 insurance policy which covered the first half of 2020 in December 2019. When there are no scheduled dance classes, Morgan rents its dance studio for birthday parties for $100 per two-hour party. Four birthday parties were held during January. Morgan will not bill the parents until February. Morgan purchased $350 of office supplies on January 10. On January 31, Morgan determined that Office supplies of $770 were unused. Morgan received a January utility bill for S770. The bill will not be paid until it is due in February. Required: Identify whether each transaction is an adjusting entry or a regular journal entry. If the entry is an adjusting entry, identify it as an accrued revenue, accrued expense, deferred revenue, or deferred expense. Prepare the entries necessary to record the transactions above and on the previous page.On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?Case 2-68 Accounting for Partially Completed Events: 3 Prelude to Chapter 3 Ehrlich Smith. the owner of The Shoe Bone has asked you to help him understand the proper way to account for certain accounting items as he prepares his 2019 financial statements. Smith has provided the following information and observations: (Continued) a. A 3-year fire insurance policy was purchased on 2019, for $2,400. Smith believes that a part of the cost of the insurance policy should be allocated to each period that benefits from its coverage. b. The store building was purchased for 580,000 in January 2011. Smith expected then (as he does now) that the building will be serviceable as a shoe store for 20 years from the date of purchase. In 2011, Smith estimated that he could sell the property for $6,000 at the end of its serviceable life. He feels that each period should bear some portion of the cost of this long-lived asset that is slowly being consumed. c. The Shoe Box borrowed 520300 on a 1-year, 8% note that is due on September 1 next year) Smith notes that $21,600 cash will be required to repay the note at maturity. The $1,600 difference is, he feels, a cost of using the loaned funds and should be spread over the periods that benefit from the use of' the loan funds; Required: Explain what Smith is trying to accomplish with the three items. Are his objectives supported by the concepts that underlie accounting?