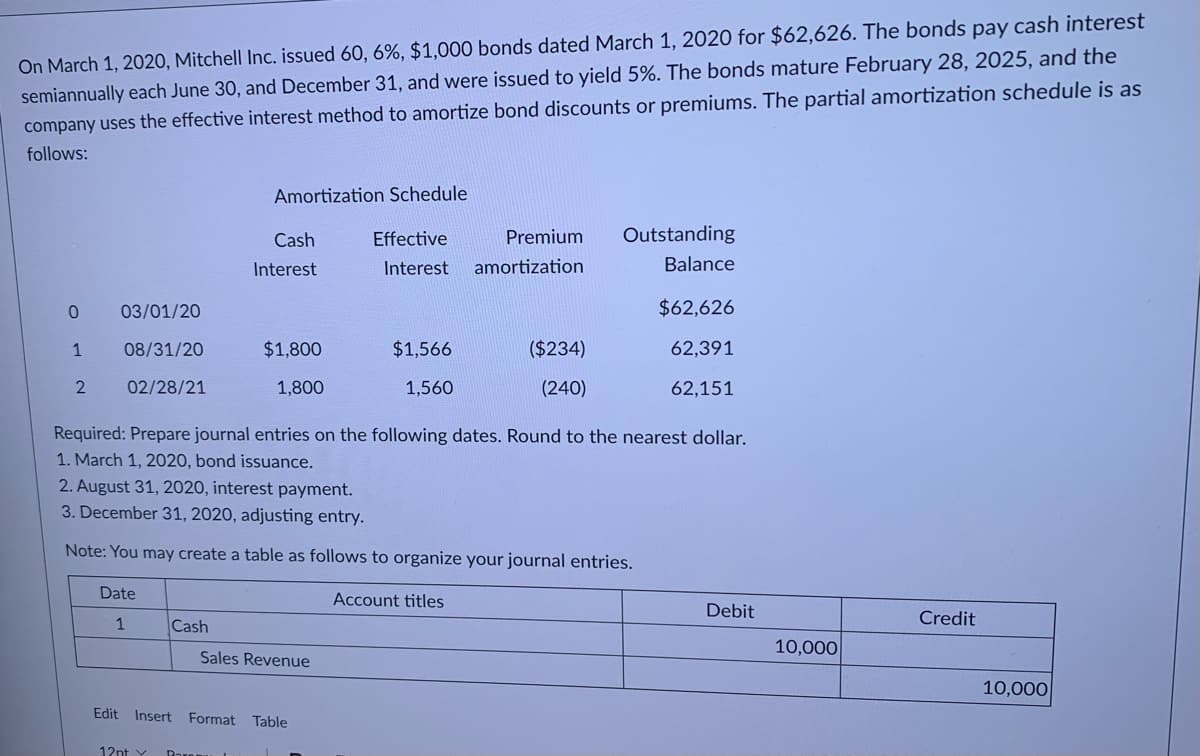

On March 1, 2020, Mitchell Inc. issued 60, 6%, $1,000 bonds dated March 1, 2020 for $62,626. The bonds pay cash interest semiannually each June 30, and December 31, and were issued to yield 5%. The bonds mature February 28, 2025, and the company uses the effective interest method to amortize bond discounts or premiums. The partial amortization schedule is as follows: Amortization Schedule Cash Effective Premium Outstanding Interest Interest amortization Balance 03/01/20 $62,626 1 08/31/20 $1,800 $1,566 ($234) 62,391 02/28/21 1,800 1,560 (240) 62,151 Required: Prepare journal entries on the following dates. Round to the nearest dollar. 1. March 1, 2020, bond issuance. 2. August 31, 2020, interest payment. 3. December 31, 2020, adjusting entry. Note: You may create a table as follows to organize your journal entries. Date Account titles Debit Credit 1 Cash 10,000 Sales Revenue 10,000 Edit Insert Format Table

On March 1, 2020, Mitchell Inc. issued 60, 6%, $1,000 bonds dated March 1, 2020 for $62,626. The bonds pay cash interest semiannually each June 30, and December 31, and were issued to yield 5%. The bonds mature February 28, 2025, and the company uses the effective interest method to amortize bond discounts or premiums. The partial amortization schedule is as follows: Amortization Schedule Cash Effective Premium Outstanding Interest Interest amortization Balance 03/01/20 $62,626 1 08/31/20 $1,800 $1,566 ($234) 62,391 02/28/21 1,800 1,560 (240) 62,151 Required: Prepare journal entries on the following dates. Round to the nearest dollar. 1. March 1, 2020, bond issuance. 2. August 31, 2020, interest payment. 3. December 31, 2020, adjusting entry. Note: You may create a table as follows to organize your journal entries. Date Account titles Debit Credit 1 Cash 10,000 Sales Revenue 10,000 Edit Insert Format Table

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 6PA: Aggies Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1,...

Related questions

Question

Please look at the picture - thank you

Transcribed Image Text:semiannually each June 30, and December 31, and were issued to yield 5%. The bonds mature February 28, 2025, and the

company uses the effective interest method to amortize bond discounts or premiums. The partial amortization schedule is as

On March 1, 2020, Mitchell Inc. issued 60, 6%, $1,000 bonds dated March 1, 2020 for $62,626. The bonds pay cash interest

follows:

Amortization Schedule

Cash

Effective

Premium

Outstanding

Interest

Interest

amortization

Balance

03/01/20

$62,626

1

08/31/20

$1,800

$1,566

($234)

62,391

2

02/28/21

1,800

1,560

(240)

62,151

Required: Prepare journal entries on the following dates. Round to the nearest dollar.

1. March 1, 2020, bond issuance.

2. August 31, 2020, interest payment.

3. December 31, 2020, adjusting entry.

Note: You may create a table as follows to organize your journal entries.

Date

Account titles

Debit

1

Cash

Credit

10,000

Sales Revenue

10,000

Edit Insert Format

Table

12nt Y Paren

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT