On March 1, 2020, Sandollar Inc. issued $90,000 of bonds at 105, paying 8% cash interest semiannually on June 30 and December 31. The bonds are scheduled to mature December 31, 2023. On September 1, 2020, $10,000 of the bonds were retired when the bonds were selling at 89. Assume the straight-line interest method is used to amortize bond discounts and premiums. Required a. Provide the entry for the bond issuance on March 1, 2020. b. Provide the entry for the interest payment on June 30, 2020. c. Provide the entry to recognize interest expense for the portion of the bond issue retired on September 1, 2020. d. Provide the entry to record the bond retirement on September 1, 2020.

On March 1, 2020, Sandollar Inc. issued $90,000 of bonds at 105, paying 8% cash interest semiannually on June 30 and December 31. The bonds are scheduled to mature December 31, 2023. On September 1, 2020, $10,000 of the bonds were retired when the bonds were selling at 89. Assume the

Required

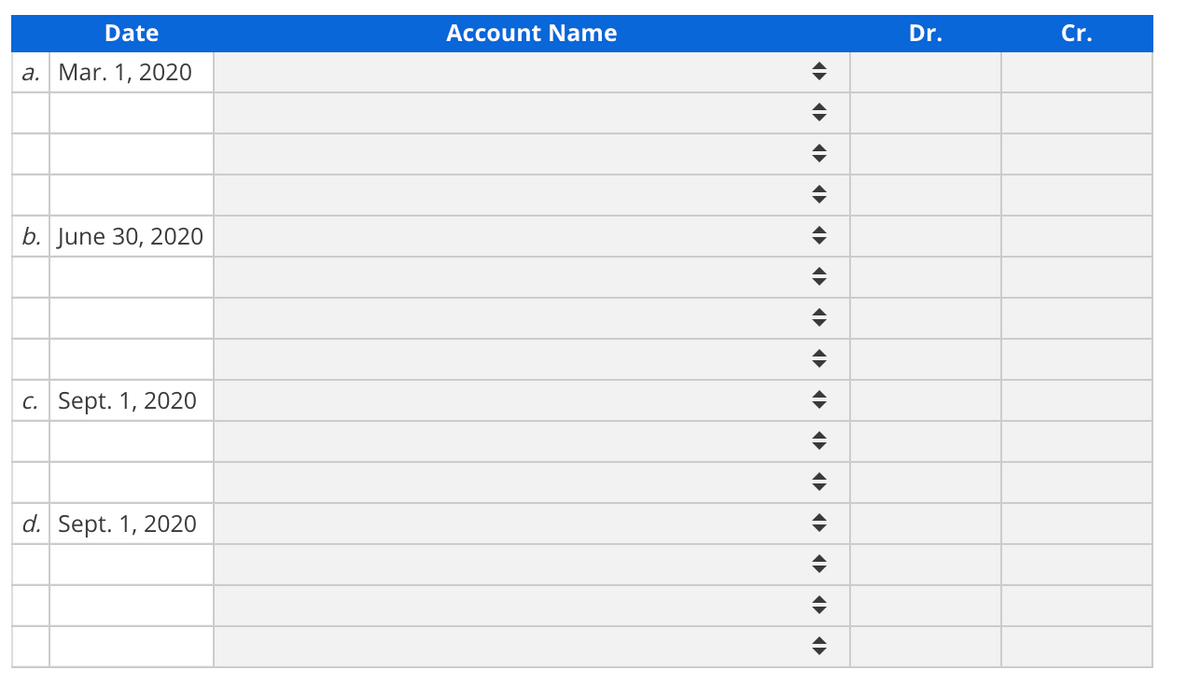

a. Provide the entry for the bond issuance on March 1, 2020.

b. Provide the entry for the interest payment on June 30, 2020.

c. Provide the entry to recognize interest expense for the portion of the bond issue retired on September 1, 2020.

d. Provide the entry to record the bond retirement on September 1, 2020.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images