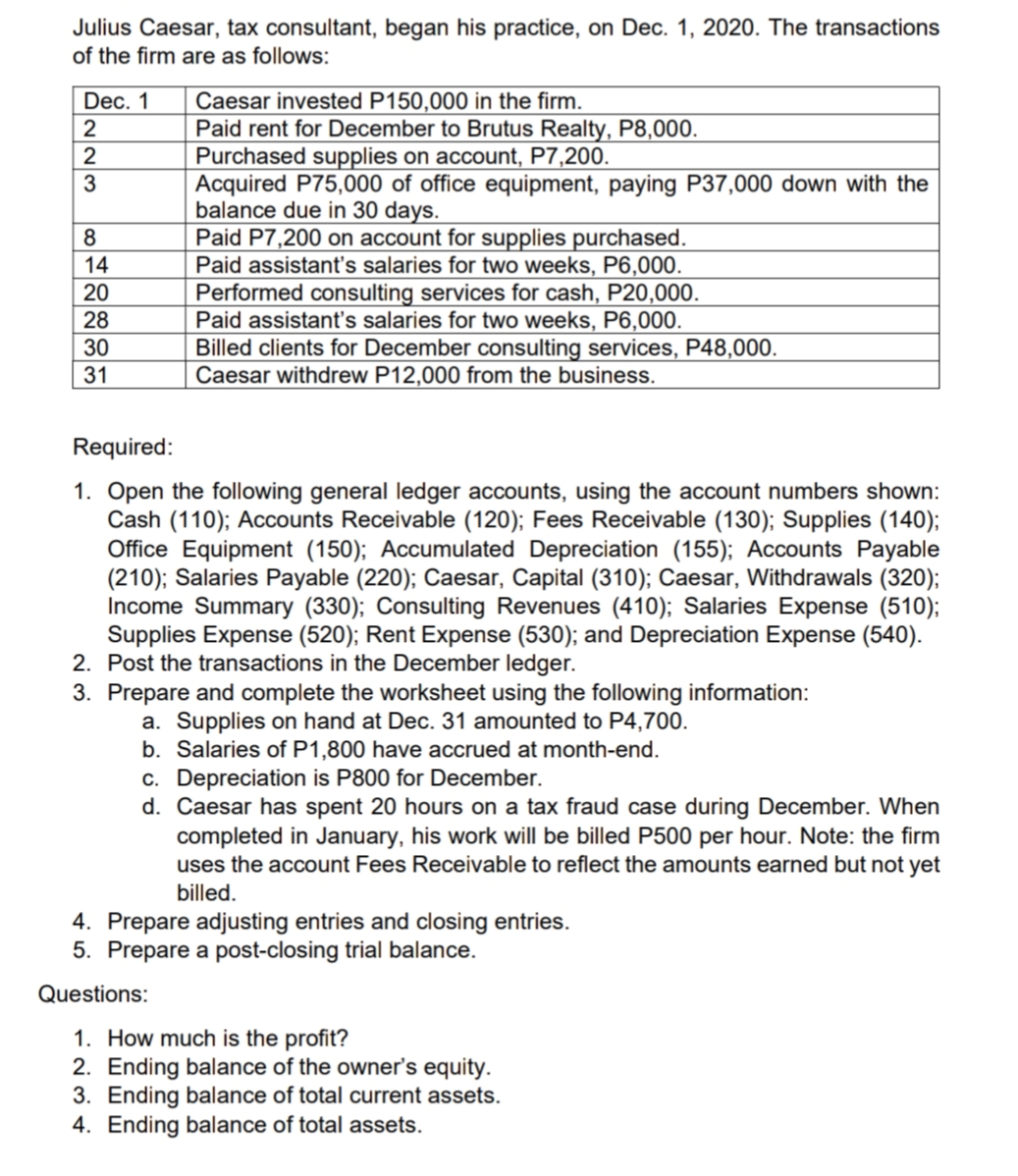

Julius Caesar, tax consultant, began his practice, on Dec. 1, 2020. The transactions of the firm are as follows: Dec. 1 Caesar invested P150,000 in the firm. Paid rent for December to Brutus Realty, P8,000. Purchased supplies on account, P7,200. Acquired P75,000 of office equipment, paying P37,000 down with the balance due in 30 days. Paid P7,200 on account for supplies purchased. Paid assistant's salaries for two weeks, P6,000. Performed consulting services for cash, P20,000. Paid assistant's salaries for two weeks, P6,000. Billed clients for December consulting services, P48,000. Caesar withdrew P12,000 from the business. 2 2 3 14 20 28 30 31 Required: 1. Open the following general ledger accounts, using the account numbers shown: Cash (110); Accounts Receivable (120); Fees Receivable (130); Supplies (140); Office Equipment (150); Accumulated Depreciation (155); Accounts Payable (210); Salaries Payable (220); Caesar, Capital (310); Caesar, Withdrawals (320); Income Summary (330); Consulting Revenues (410); Salaries Expense (510); Supplies Expense (520); Rent Expense (530); and Depreciation Expense (540). 2. Post the transactions in the December ledger. 3. Prepare and complete the worksheet using the following information: a. Supplies on hand at Dec. 31 amounted to P4,700. b. Salaries of P1,800 have accrued at month-end. c. Depreciation is P800 for December. d. Caesar has spent 20 hours on a tax fraud case during December. When completed in January, his work will be billed P500 per hour. Note: the firm uses the account Fees Receivable to reflect the amounts earned but not yet billed. 4. Prepare adjusting entries and closing entries. 5. Prepare a post-closing trial balance. Questions: 1. How much is the profit? 2. Ending balance of the owner's equity. 3. Ending balance of total current assets. 4. Ending balance of total assets.

Julius Caesar, tax consultant, began his practice, on Dec. 1, 2020. The transactions of the firm are as follows: Dec. 1 Caesar invested P150,000 in the firm. Paid rent for December to Brutus Realty, P8,000. Purchased supplies on account, P7,200. Acquired P75,000 of office equipment, paying P37,000 down with the balance due in 30 days. Paid P7,200 on account for supplies purchased. Paid assistant's salaries for two weeks, P6,000. Performed consulting services for cash, P20,000. Paid assistant's salaries for two weeks, P6,000. Billed clients for December consulting services, P48,000. Caesar withdrew P12,000 from the business. 2 2 3 14 20 28 30 31 Required: 1. Open the following general ledger accounts, using the account numbers shown: Cash (110); Accounts Receivable (120); Fees Receivable (130); Supplies (140); Office Equipment (150); Accumulated Depreciation (155); Accounts Payable (210); Salaries Payable (220); Caesar, Capital (310); Caesar, Withdrawals (320); Income Summary (330); Consulting Revenues (410); Salaries Expense (510); Supplies Expense (520); Rent Expense (530); and Depreciation Expense (540). 2. Post the transactions in the December ledger. 3. Prepare and complete the worksheet using the following information: a. Supplies on hand at Dec. 31 amounted to P4,700. b. Salaries of P1,800 have accrued at month-end. c. Depreciation is P800 for December. d. Caesar has spent 20 hours on a tax fraud case during December. When completed in January, his work will be billed P500 per hour. Note: the firm uses the account Fees Receivable to reflect the amounts earned but not yet billed. 4. Prepare adjusting entries and closing entries. 5. Prepare a post-closing trial balance. Questions: 1. How much is the profit? 2. Ending balance of the owner's equity. 3. Ending balance of total current assets. 4. Ending balance of total assets.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter4: Completing The Accounting Cycle

Section: Chapter Questions

Problem 5CP

Related questions

Question

Transcribed Image Text:Julius Caesar, tax consultant, began his practice, on Dec. 1, 2020. The transactions

of the firm are as follows:

Dec. 1

Caesar invested P150,000 in the firm.

Paid rent for December to Brutus Realty, P8,000.

Purchased supplies on account, P7,200.

Acquired P75,000 of office equipment, paying P37,000 down with the

balance due in 30 days.

Paid P7,200 on account for supplies purchased.

Paid assistant's salaries for two weeks, P6,000.

Performed consulting services for cash, P20,000.

Paid assistant's salaries for two weeks, P6,000.

Billed clients for December consulting services, P48,000.

Caesar withdrew P12,000 from the business.

2

2

3

8

14

20

28

30

31

Required:

1. Open the following general ledger accounts, using the account numbers shown:

Cash (110); Accounts Receivable (120); Fees Receivable (130); Supplies (140);

Office Equipment (150); Accumulated Depreciation (155); Accounts Payable

(210); Salaries Payable (220); Caesar, Capital (310); Caesar, Withdrawals (320);

Income Summary (330); Consulting Revenues (410); Salaries Expense (510);

Supplies Expense (520); Rent Expense (530); and Depreciation Expense (540).

2. Post the transactions in the December ledger.

3. Prepare and complete the worksheet using the following information:

a. Supplies on hand at Dec. 31 amounted to P4,700.

b. Salaries of P1,800 have accrued at month-end.

c. Depreciation is P800 for December.

d. Caesar has spent 20 hours on a tax fraud case during December. When

completed in January, his work will be billed P500 per hour. Note: the firm

uses the account Fees Receivable to reflect the amounts earned but not yet

billed.

4. Prepare adjusting entries and closing entries.

5. Prepare a post-closing trial balance.

Questions:

1. How much is the profit?

2. Ending balance of the owner's equity.

3. Ending balance of total current assets.

4. Ending balance of total assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT