On March 2, 2020, Zoe Moreau, Karen Krneta, and Veronica Visentin start a partnership to operate a personal coaching and lifestyle consulting practice for professional women. Zoe will focus on work-life balance issues, Karen on matters of style, and Veronica on health and fitness. They sign a partnership agreement to split profits in a 3:2:3 ratio for Zoe, Karen, and Veronica, respectively. The following are the transactions for CARLA VISTA Personal Coaching: 2020Mar. 2 The partners contribute assets to the partnership at the following agreed amounts: Z. Moreau K. Krneta V. VisentinCash $14,900 $10,500 $19,90OFurniture 17,400 Equipment 19,600 14,600Total $34,500 $27,900 $34,500 They also agree that the partnership will assume responsibility for Karen's note payable of $4,900. Dec. 20 Zoe, Karen, and Veronica each withdraw $29,900 cash as a "year-end bonus." No other withdrawals were made during the year. 31 Total profit for 2020 was $109,000. 2021Jan. 5

On March 2, 2020, Zoe Moreau, Karen Krneta, and Veronica Visentin start a partnership to operate a personal coaching and lifestyle consulting practice for professional women. Zoe will focus on work-life balance issues, Karen on matters of style, and Veronica on health and fitness. They sign a partnership agreement to split profits in a 3:2:3 ratio for Zoe, Karen, and Veronica, respectively. The following are the transactions for CARLA VISTA Personal Coaching: 2020Mar. 2 The partners contribute assets to the partnership at the following agreed amounts: Z. Moreau K. Krneta V. VisentinCash $14,900 $10,500 $19,90OFurniture 17,400 Equipment 19,600 14,600Total $34,500 $27,900 $34,500 They also agree that the partnership will assume responsibility for Karen's note payable of $4,900. Dec. 20 Zoe, Karen, and Veronica each withdraw $29,900 cash as a "year-end bonus." No other withdrawals were made during the year. 31 Total profit for 2020 was $109,000. 2021Jan. 5

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 20P: Julie James is opening a lemonade stand. She believes the fixed cost per week of running the stand...

Related questions

Question

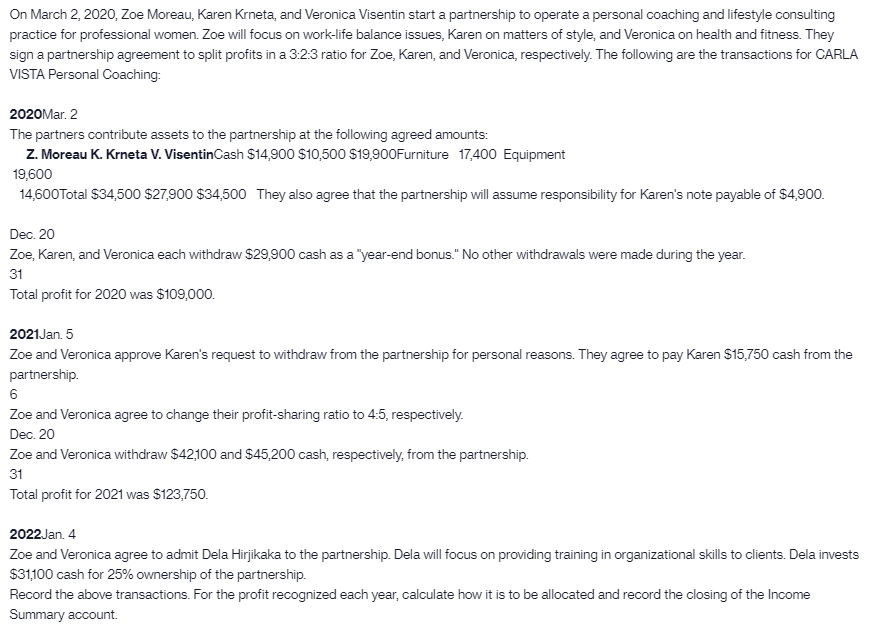

Transcribed Image Text:On March 2, 2020, Zoe Moreau, Karen Krneta, and Veronica Visentin start a partnership to operate a personal coaching and lifestyle consulting

practice for professional women. Zoe will focus on work-life balance issues, Karen on matters of style, and Veronica on health and fitness. They

sign a partnership agreement to split profits in a 3:23 ratio for Zoe, Karen, and Veronica, respectively. The following are the transactions for CARLA

VISTA Personal Coaching:

2020Mar. 2

The partners contribute assets to the partnership at the following agreed amounts:

Z. Moreau K. Krneta V. VisentinCash S14,900 $10,500 $19,900Furniture 17,400 Equipment

19,600

14,600Total $34,500 $27,900 $34,500 They also agree that the partnership will assume responsibility for Karen's note payable of S4,900.

Dec. 20

Zoe, Karen, and Veronica each withdraw $29,900 cash as a "year-end bonus." No other withdrawals were made during the year.

31

Total profit for 2020 was $109,000.

2021Jan. 5

Zoe and Veronica approve Karen's request to withdraw from the partnership for personal reasons. They agree to pay Karen $15,750 cash from the

partnership.

6

Zoe and Veronica agree to change their profit-sharing ratio to 4:5, respectively.

Dec. 20

Zoe and Veronica withdraw $42,100 and $45,200 cash, respectively, from the partnership.

31

Total profit for 2021 was $123,750.

2022Jan. 4

Zoe and Veronica agree to admit Dela Hirjikaka to the partnership. Dela will focus on providing training in organizational skills to clients. Dela invests

$31,100 cash for 25% ownership of the partnership.

Record the above transactions. For the profit recognized each year, calculate how it is to be allocated and record the closing of the Income

Summary account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Production and Operations Analysis, Seventh Editi…

Operations Management

ISBN:

9781478623069

Author:

Steven Nahmias, Tava Lennon Olsen

Publisher:

Waveland Press, Inc.