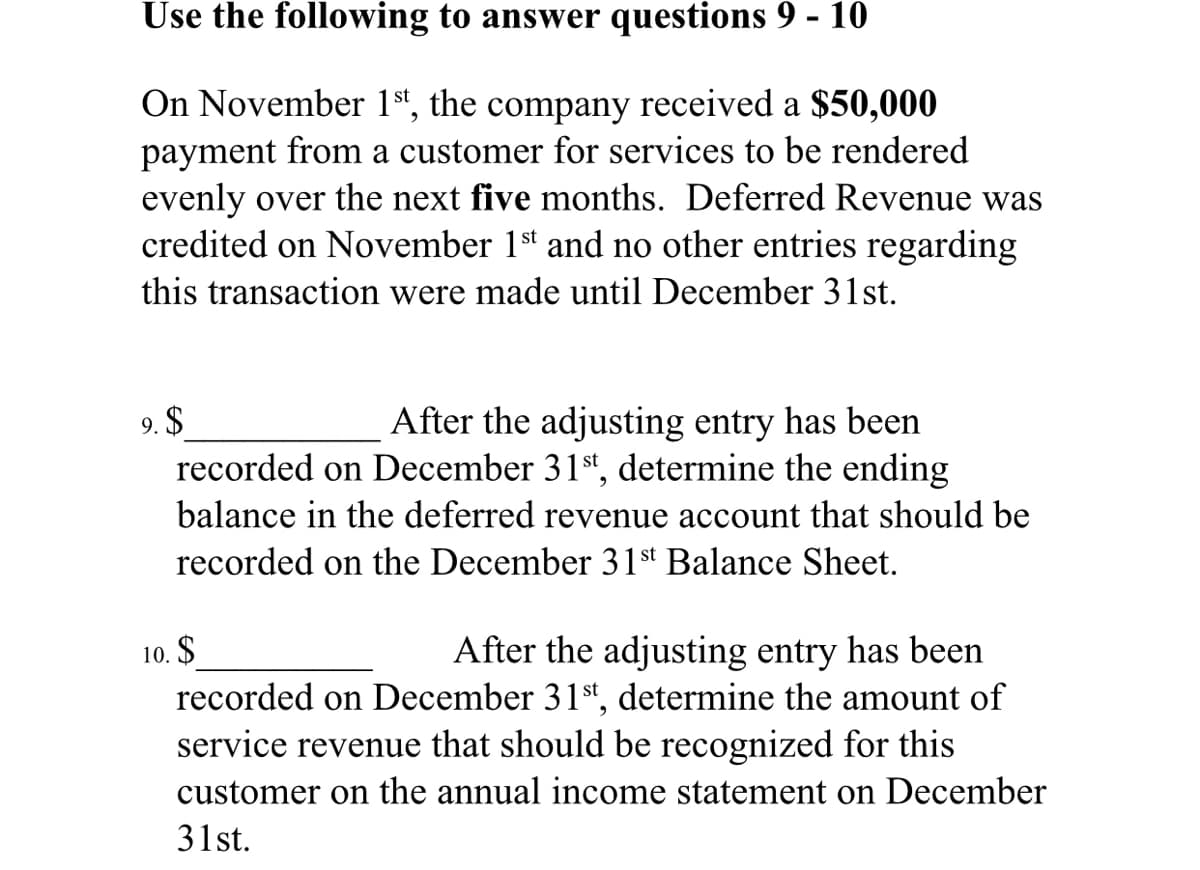

On November 1s*, the company received a $50,000 payment from a customer for services to be rendered evenly over the next five months. Deferred Revenue was credited on November 1st and no other entries regarding this transaction were made until December 31st. 9. $ After the adjusting entry has been %24

On November 1s*, the company received a $50,000 payment from a customer for services to be rendered evenly over the next five months. Deferred Revenue was credited on November 1st and no other entries regarding this transaction were made until December 31st. 9. $ After the adjusting entry has been %24

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 6EA: On July 1, a client paid an advance payment (retainer) of $5,000 to cover future legal services....

Related questions

Question

I need the answer for 9 only

Transcribed Image Text:Use the following to answer questions 9 - 10

On November 1st,

the

company

received a $50,000

payment from a customer for services to be rendered

evenly over the next five months. Deferred Revenue was

credited on November 1st and no other entries regarding

this transaction were made until December 31st.

9. $

recorded on December 31st, determine the ending

After the adjusting entry has been

balance in the deferred revenue account that should be

recorded on the December 31st Balance Sheet.

After the adjusting entry has been

recorded on December 31st, determine the amount of

service revenue that should be recognized for this

10. $

customer on the annual income statement on December

31st.

Expert Solution

Step 1

Payments collected in advance for goods or services that will be supplied or performed in the future are referred to as deferred revenue, also known as unearned income. The corporation that receives the prepayment records the amount as deferred revenue, a liability, on its balance sheet.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage