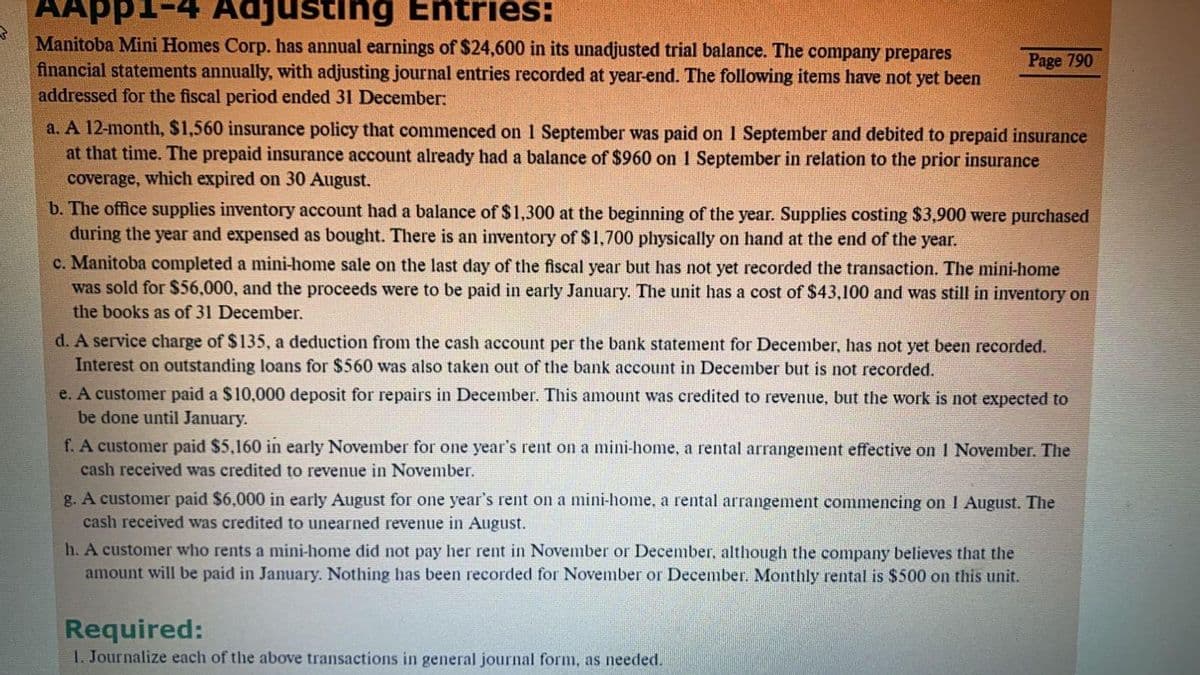

Manitoba Mini Homes Corp. has annual earnings of $24,600 in its unadjusted trial balance. The company prepares financial statements annually, with adjusting journal entries recorded at year-end. The following items have not yet been addressed for the fiscal period ended 31 December: Page 790 a. A 12-month, $1,560 insurance policy that commenced on 1 September was paid on 1 September and debited to prepaid insurance at that time. The prepaid insurance account already had a balance of $960 on 1 September in relation to the prior insurance coverage, which expired on 30 August. b. The office supplies inventory account had a balance of $1,300 at the beginning of the year. Supplies costing $3,900 were purchased during the year and expensed as bought. There is an inventory of $1,700 physically on hand at the end of the year. c. Manitoba completed a mini-home sale on the last day of the fiscal year but has not yet recorded the transaction. The mini-home was sold for $56,000, and the proceeds were to be paid in early January. The unit has a cost of $43,100 and was still in inventory on the books as of 31 December. d. A service charge of $135, a deduction from the cash account per the bank statement for December, has not yet been recorded. Interest on outstanding loans for $560 was also taken out of the bank account in December but is not recorded. e. A customer paid a $10,000 deposit for repairs in December. This amount was credited to revenue, but the work is not expected to be done until January. f. A customer paid $5,160 in early November for one year's rent on a mini-home, a rental arrangement effective on I November. The cash received was credited to revenue in November. g. A customer paid $6,000 in early August for one year's rent on a mini-home, a rental arrangement commencing on I August. The cash received was credited to unearned revenue in August. h. A customer who rents a mini-home did not pay her rent in November or December, although the company believes that the amount will be paid in January. Nothing has been recorded for November or December. Monthly rental is $500 on this unit. Required: 1. Journalize each of the above transactions in general journal form, as needed.

Manitoba Mini Homes Corp. has annual earnings of $24,600 in its unadjusted trial balance. The company prepares financial statements annually, with adjusting journal entries recorded at year-end. The following items have not yet been addressed for the fiscal period ended 31 December: Page 790 a. A 12-month, $1,560 insurance policy that commenced on 1 September was paid on 1 September and debited to prepaid insurance at that time. The prepaid insurance account already had a balance of $960 on 1 September in relation to the prior insurance coverage, which expired on 30 August. b. The office supplies inventory account had a balance of $1,300 at the beginning of the year. Supplies costing $3,900 were purchased during the year and expensed as bought. There is an inventory of $1,700 physically on hand at the end of the year. c. Manitoba completed a mini-home sale on the last day of the fiscal year but has not yet recorded the transaction. The mini-home was sold for $56,000, and the proceeds were to be paid in early January. The unit has a cost of $43,100 and was still in inventory on the books as of 31 December. d. A service charge of $135, a deduction from the cash account per the bank statement for December, has not yet been recorded. Interest on outstanding loans for $560 was also taken out of the bank account in December but is not recorded. e. A customer paid a $10,000 deposit for repairs in December. This amount was credited to revenue, but the work is not expected to be done until January. f. A customer paid $5,160 in early November for one year's rent on a mini-home, a rental arrangement effective on I November. The cash received was credited to revenue in November. g. A customer paid $6,000 in early August for one year's rent on a mini-home, a rental arrangement commencing on I August. The cash received was credited to unearned revenue in August. h. A customer who rents a mini-home did not pay her rent in November or December, although the company believes that the amount will be paid in January. Nothing has been recorded for November or December. Monthly rental is $500 on this unit. Required: 1. Journalize each of the above transactions in general journal form, as needed.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 3.6.1P: Adjustment process and financial statements Adjustment data for Ms. Ellen’s Laundry Inc. for the...

Related questions

Question

Transcribed Image Text:AApp1-4 Adjusting Entries:

Manitoba Mini Homes Corp. has annual earnings of $24,600 in its unadjusted trial balance. The company prepares

financial statements annually, with adjusting journal entries recorded at year-end. The following items have not yet been

addressed for the fiscal period ended 31 December:

Page 790

a. A 12-month, $1,560 insurance policy that commenced on 1 September was paid on 1 September and debited to prepaid insurance

at that time. The prepaid insurance account already had a balance of $960 on 1 September in relation to the prior insurance

coverage, which expired on 30 August.

b. The office supplies inventory account had a balance of $1,300 at the beginning of the year. Supplies costing $3,900 were purchased

during the year and expensed as bought. There is an inventory of $1,700 physically on hand at the end of the year.

c. Manitoba completed a mini-home sale on the last day of the fiscal year but has not yet recorded the transaction. The mini-home

was sold for $56,000, and the proceeds were to be paid in early January. The unit has a cost of $43,100 and was still in inventory on

the books as of 31 December.

d. A service charge of $135, a deduction from the cash account per the bank statement for December, has not yet been recorded.

Interest on outstanding loans for $560 wvas also taken out of the bank account in December but is not recorded.

e. A customer paid a $10,000 deposit for repairs in December. This amount was credited to revenue, but the work is not expected to

be done until January.

f. A customer paid $5,160 in early November for one year's rent on a mini-home, a rental arrangement effective on I November. The

cash received was credited to revenue in November.

g. A customer paid $6,000 in early August for one year's rent on a mini-home, a rental arrangement commencing on 1 August. The

cash received was credited to unearned revenue in August.

h. A customer who rents a mini-home did not pay her rent in November or December, although the company believes that the

amount will be paid in January. Nothing has been recorded for November or December. Monthly rental is $500 on this unit.

Required:

1. Journalize each of the above transactions in general journal form, as needed.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College