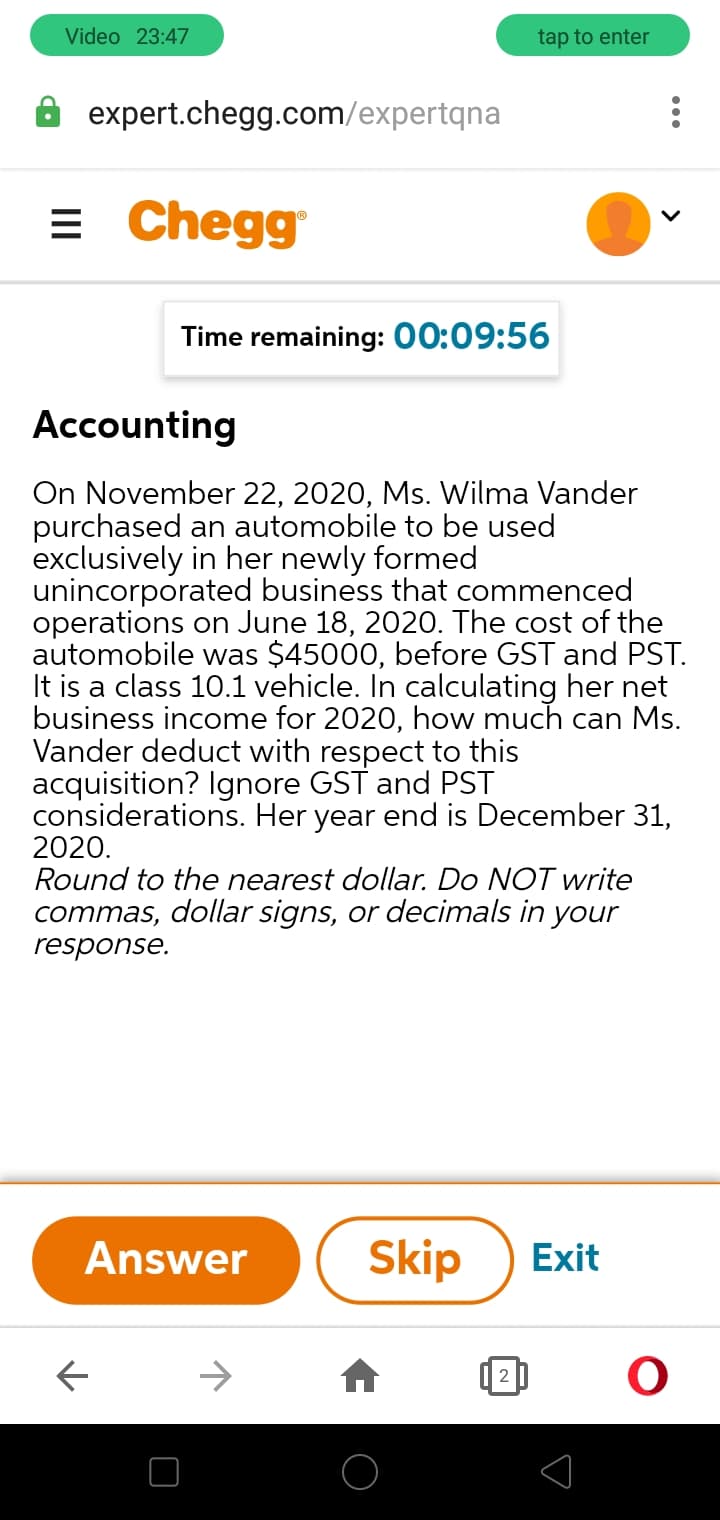

On November 22, 2020, Ms. Wilma Vander purchased an automobile to be used exclusively in her newly formed unincorporated business that commenced operations on June 18, 2020. The cost of the automobile was $45000, before GST and PST. It is a class 10.1 vehicle. In calculating her net business income for 2020, how much can Ms. Vander deduct with respect to this acquisition? Ignore GST and PST

Q: Allison acquires and places in service business equipment (a 5-year class asset) on February 1,…

A: Cost of the asset is the value of the asset which is recorded when it is purchased, when it is sold,…

Q: On April 5, 2019, Kinsey places in service a new automobile that cost $60,000.He does not elect §…

A: The depreciation allowed is lesser of MACRS depreciation and the recovery limitation.

Q: Jacob purchased business equipment for $89,100 in 2017 and has taken $53,460 of regular MACRS…

A: Income tax: It is the tax levied by the federal government on the income earned by individuals,…

Q: Franco converted a building from personal to business use in May 2018 when the fair market value was…

A: Solution:- Given, Franco converted a building from personal to business use in May 2018 The fair…

Q: Form it instead assumes a $100,000 recourse loan on Vee’s land, what are the realized and recognized…

A: Realized value were the value that is adjustable . For Frat $740000 For Van $ 660000 * Recognised…

Q: During 2019, Belk Corporation purchases $70,000 worth of equipment for use in its business. Belk’s…

A: This section allows the business entities to deduct the purchase price of qualifying equipment or…

Q: In May 2021, Cassie acquired a machine for $30,000 to use in her business. The machine is classified…

A: SOLUTION- MACRS RATES (5 YEAR RATES ) : YEAR 1 =20% .

Q: Randall Corporation (a C Corporation) acquires an apartment building for $200,000 on September 1,…

A: As per IRS rules you can depreciation apartment builidng used for business as…

Q: McKenzie purchased qualifying equipment for his business that cost $212,000 in 2021. The taxable…

A: Deduction- A deduction is an outflow that can be deducted from a taxpayer's gross income in order to…

Q: On july 1 2019 melissa acquired an antique camel statue for $300 which she kept in the hallway of…

A: When an individual sells an asset at a price greater than the purchase price of the asset, then…

Q: Lopez acquired a building on June 1 2014 for 1,000,000. Compute the depreciation deduction assuming…

A: Given that, Lopez acquired a building on June 1 2014 for 1,000,000 To calculate - Lopez's cost…

Q: After several profitable years running her business, Ingrid decided to acquire the assets of a small…

A: a. Calculations:

Q: Jacob purchased business equipment for $144,900 in 2018 and has taken $86,940 of regular MACRS…

A: Given, Cost of business 144900 Depreciation 86940 Sale price 65205

Q: Alphonso purchased an office building in 2010 for $650,000 and machinery (7-year property) in…

A: Solution- Step(1)-Alphonos purchased office building in 2010=$60000Machinery in september of…

Q: Renata Corporation paid $366,400 for equipment in 2019 and took $164,880 in standard MACRS…

A: Any sort of income that is taxed at regular rates is referred to as ordinary income.Salaries,…

Q: Explain in detail using relevant tax laws and cases whether this amount of $70,000 is deductible for…

A: Tax laws can be defined as the governing laws which helps the companies or the taxpayers to take…

Q: On February 2, 2020, Katie purchased and placed in service a new $18,500 car. The car was used 65%…

A: The answer is as fallows

Q: In June 2020, Sue exchanges a sport-utility vehicle (adjusted basis of $16,000; fair market value of…

A: No, Ms. S is not correct. The assumption on the basis of which she calculated adjusted basis is not…

Q: In 2019, the CEO and founder of Stan's Super Fans (SSF)-a firm that manages fan mail and fan clubs…

A: Depreciation:- Depreciation is considered as an accounting method of allocating the total cost of an…

Q: Taylor LLC purchased an automobile for $55,000 on July 5, 2020. What is Taylor's maximum…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: Alphonso purchased an office building in 2010 for $650,000 and machinery (7-year property) in…

A: In the above question we have to calculate Adjusted Gross Income for 2018 for Alphonso with the help…

Q: s) Green Bank Corporation follows a calendar year tax period. During its 2020 tax year, the business…

A: Bonus Depreciation: It is also called as additional depreciation on the purchase of new assets U/s…

Q: On January 1, 2011, Sam Johnson acquired depreciable real property for $50,000. He used…

A: Capital gain The amount of increment in the value of capital assets and will be realized on account…

Q: On January 1, 2011, Sam Johnson acquired depreciable real property for $50,000. He used…

A: Solution: Coast of the property = $50,000 Accumulated depreciation for 9 years as on jan 3, 2020 =…

Q: RK Co purchased a machine on 1st November 2020 at the cost of $110,000 (inclusive of GST) and…

A: Prime cost method: It is also called as straight-line method; in this method, the value of an asset…

Q: MJ Limited purchased machinery for $50,000 for its operations on 1 October 2015 and has been using…

A: Facts of the case:It is clear from the case that the maintenance was perhaps an improvement and not…

Q: Alphonso purchased an office building in 2010 for $650,000 and machinery (7-year property) in…

A: Alphonso Purchased Office building in 2010 = $650000 Machinery in September of 2015 = $60000 In…

Q: During 2020, Sienar Systems, Inc purchased Correalian Drives, Inc. (one of its suppliers) using the…

A: The question carries only goodwill amount, impairment of goodwill is needed as well. If we assume…

Q: On July 16, 2019 Logan acquires land and a building for $500,000 to use in his sole proprietorship.…

A: (a) On the acquisition date The adjusted basis for the land and building is Land = purchase price…

Q: John Rawls owns and operates Philosophical Consulting, Inc. During 2019 and 2020 he made the…

A: Office furniture has a recovery period of 7 years. Computer system has a recovery period of 5 years.…

Q: On August 4, 2021, calendar year taxpayer Ben Baker acquires and places in service in his sole…

A: Introduction: Depreciation is the process of reducing the complete cost of an expensive item…

Q: Kirk has the following depreciable assets in his business: Computer equipment (5 year) purchased…

A: RequiredTotal depreciation deduction for these assets in 2020.

Q: acob purchased business equipment for $144,900 in 2018 and has taken $86,940 of regular MACRS…

A: Solution Given Cost of business 144900 Depreciation 86940 Sale price 65205…

Q: Diana purchases an office building for $1,000,000, office equipment for $500,000 and computer…

A: MACRS consists of 2 deprecation systems: The General depreciation system (GDS) The Alternative…

Q: n, the owner of the solar company, purchased a Mercedes car and will be used 100% for business…

A: The prime cost method is based on the assumption that the value of a depreciating item drops…

Q: On July 15, 2019, Leo purchased and placed in service a new car that cost $52,200. The business use…

A: Depreciation is the method in which the cost of the asset is allocated over its estimated useful…

Q: In 2021, Ben purchases and places in service a new auto for his business. The auto costs $57,000 and…

A: Depreciation is the amount that is charged on the fixed assets and by which the asset value…

Q: Potomac LLC purchased an automobile for $65,000 on August 5, 2019. What is Potomac's depreciation…

A: Explanation: A luxury auto's maximum depreciation in the first year is the lesser of $10,000 orits…

Q: On January 1, 2019, KRIS KRINGLE Company purchased a ₱600,000 machine, with a five-year useful life…

A: Correct option is C. 36,000 Deferred tax liability as a result of change is P36,000

Q: Determine the total deductions in calculating taxable income related to the machine for 2020…

A: According to Section 179, we can claim complete machine value for depreciating.

Q: On February 8, 2020, Holly purchased a residential apartment building. The cost basis assigned to…

A: Depreciation is a reduction in the value of assets due to the usage of that asset. We can evaluate…

Q: On June 25, 2020, Ms. Annie Rawlings purchased an automobile to be used exclusively in her…

A: Depreciation refers to the fall in the book value of an asset each year. Depreciable amount is…

Q: On 1 July 2019, Clarabel sold two assets: (a) diamond ring for $1741 (purchased for $600), (b) a…

A: A capital gain tax refers to the tax levied on the profits realized from the sale of items other…

Q: Arlington LLC purchased an automobile (5-year property) for $74,000 on July 5, 2020. What is…

A: MACRS Depreciation: It will be calculated by multiplying the cost of the automobile with the rate of…

Q: On April 30, 2019, Leo purchased and placed in service a new car that cost $76,200. The business use…

A: Given information is: Cost of new car = $76200

Q: Zaki LLC purchased computer equipment (five-year property) on April 20, 2018, for $36,000 and used…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Blue Company, a calendar year taxpayer, purchased new equipment for $2,100,000 on November 1, 2021…

A: If equipment acquired and sell same year. There is no deprecated on equipment. Following is the…

Q: Amway Corporation acquires a used desk on December 26, 2019, and places the desk in service on…

A: IRC deduction is better than depreciation.

Q: During 2019, Quill Corporation, a calendar year C corporation, sold the following business assets on…

A: Section 1231 property implies the following: Property utilized in the process of trading or…

Step by step

Solved in 2 steps

- tudent question Time to preview question: 00:09:37 Hauswirth Corporation sold (or exchanged) a warehouse in year 0. Hauswirth bought the warehouse several years ago for $102,000, and it has claimed $33,800 of depreciation expense against the building. Note: Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable. Round your final answers to the nearest whole dollar amount. Required: Assuming that Hauswirth receives $80,500 in cash for the warehouse, compute the amount and character of Hauswirth's recognized gain or loss on the sale. Assuming that Hauswirth exchanges the warehouse in a like-kind exchange for some land with a fair market value of $80,500, compute Hauswirth's realized gain or loss, recognized gain or loss, deferred gain or loss, and basis in the new land. Assuming that Hauswirth receives $27,500 in cash in year 0 and a $88,500 note receivable that is payable in year 1, compute the amount and character of Hauswirth's…Nn.57. Subject :- Account Company purchased a machine for $9,800 on January 1, 2019. The machine has been depreciated using the straight-line method assuming it has a five-year life with a $1,400 residual value. Taylor sold the machine on January 1, 2021, for $7,600. What is the book value of the machine on December 31, 2020? A.$ 2 comma 100 $2,100 B.$ 6 comma 440 $6,440 C.$ 8 comma 400 $8,400 D.$ 9 comma 800 $9,800i) Company X Financial Year ends March 31. A laptop purchased 02 August 2018 at a cost of P9,500 was disposed off in January 2020 for P6800. Assuming the organisation follows local GAAPS on depreciation, provide the Journal Entries for this transaction. Outline all assumptions used. (ii) The following in being considered: Purchase of an office building worth P1M from unrestricted funding. Currently, the office building is on a 2-year lease, with rentals of BWP22,000 per month. 11 Provide your recommendations to the Finance Manager. What would be the possible effect on the Financial Health of the organisation if these transactions are approved (iii) List any key financial controls for an NGO and why these are important. (iv) Company X’s year-end is March 31. It is now April 4. A staff member asks you to process an unpaid invoice with details as follows: The invoice is for bus transportation in the amount of P800 and is dated April 2. The invoice indicates the charges relate to…

- Accounting 11) Jill purchased a printing press for her business on 6/15/21 costing $60,000. The installation cost $2,000 and the sales tax was $5,000. (a)What is Jill's basis in the equipment? (b)Using the info in question 11, what is the amount of depreciation for 2021?WITH SOLUTION /COMPUTATION 64.On December 31,2019, an entity sold a machine with useful life of 10 years to another entity andsimultaneously leased it back for two years at annual rental of P360,000. Sale price at fair value 3,600,000 Caryingamount 3,300,000 What amount of revenue from sale of the machine should be reported in 2019? 150,000 300,000 360,000 180,000Exercise 12-16 b-c Blossom Company from time to time embarks on a research program when a special project seems to offer possibilities. In 2019, the company expends $325,500 on a research project, but by the end of 2019 it is impossible to determine whether any benefit will be derived from it. The project is completed in 2020, and a successful patent is obtained. The R&D costs to complete the project are $115,500. The administrative and legal expenses incurred in obtaining patent number 472-1001-84 in 2020 total $17,500. The patent has an expected useful life of 5 years. Record these costs in journal entry form. Also, record patent amortization (full year) in 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit…

- 11 NANGUTANG started constructing a building for its own use on January 1, 2020. NANGUTANG provided the following information related to the construction: Outstanding loans of the Company at January 1, 2020: Interest Rate Amount of loan Interest Cost 5% P10,000,000 P 500,000 10% 20,000,000 2,000,000 Total P30,000,000 P2,500,000 Construction expenditures: July 1, 2020 7,000,000 November 31,2020 3,000,000 December 31, 2020 1,000,000 The amount of borrowing cost that should be charged to profit or loss for the period is? Group of answer choices 340,142 312,375 2,208,450 2,187,625V4. 3. Vaden Company purchased a patent from Williams Co. for $260,000 on January 1, 2016 when there was 15 years remaining in the legal life of the patent. Vaden estimates that the useful life of the patent will be 10 years from the date of acquisition. Expenditures of $25,000 for successful litigation in defense of the patent were paid on January 1, 2022. Required: a. Compute the carrying value of the patent at December 31, 2022. b. At the beginning of 2023, new market research indicates that the fair value of the patent is $90,000. Estimated future cash flows from the patent are $94,000 on January 1, 2023. Determine if the patent is impaired and, if so, prepare the journal entry necessary.The Problem 24-6 (IAA) Zephyr Company is provided a grant by a foreign governme for. the purpose of acquiring land for a building site grant is a zero-interest loan for 5 years evidenced hu promissory note. The loan was granted on January 1, 2020 for P8,000;000, The market rate of interest is 6%. The present value of 1 for fiv periods at 6% is .7473. Required: Prepare journal entries for 2020 and 2021.

- 24.The Danica Company self constructed an asset for its own use. Construction started on January 1, 2021 and the asset was completed on October 31, 2021. Costs incurred during the period of construction were as follows:January 1-P400,000 April 1-P500,000 August 1-P480,000October 1-P180,000 At the beginning of the year, the company obtained a two-year, 18% loan of P500,000, specifically to finance the asset construction. In addition to the specific borrowing, prior to the construction, Danica Company had a general borrowing amounting to P600,000 with interest of 15% and a five-year term that was used in part in the self construction.What is the total cost of the self constructed asset? a. 1,686,500 b. 1,711,800 c. 1,728,000 d. 1,770,000Q10.3 On February 1, 2020, Sheridan Company purchased a parcel of land as a factory site for $315000. An old building on the property was demolished, and construction began on a new building which was completed on November 1, 2020. Costs incurred during this period are listed below: Demolition of old building $ 18600 Architect's fees 35500 Legal fees for title investigation and purchase contract 5700 Construction costs 1387000 (Salvaged materials resulting from demolition were sold for $9700.) Sheridan should record the cost of the land and new building, respectively, as $323900 and $1428200. $323900 and $1422500. $329600 and $1422500. $339300 and $1412800.tudent question Time to preview question: PART A: Happy House Cleaning Inc. (“HHC”) was incorporated on May 5, 2020 to provide on-demand house cleaning services. At the time of incorporation, HHC establishes December 31 as its year-end for both tax and accounting purposes. On May 9, 2020, HHC purchased nine cars (CCA Class 10; 30% rate) to be used by the cleaning personnel at a cost of $23,000 per vehicle. On December 2, 2021, HHC trades in two of its old cars for three new minivans. The list price of the new minivans is $28,000 per vehicle and HHC receives a trade-in allowance towards this list price of $12,000 per old vehicle. HHC paid cash for the remaining balance. —REQUIRED Calculate the maximum Class 10 CCA that can be deducted for the years ending December 31, 2020, and 2021. Ignore the leap year. Calculate the opening UCC balance for the following 2022 year. PART B: Cool Rugs Inc., “The Company”, has a December 31 year-end. On January 1, 2021, The Company’s Class…