On November 5, 2021, MILES TRUCK RENTAL Co. was in an accident with an autom by MORALES. MILES received notice on January 12, 2022 of a lawsuit for P700,00 for personal injuries suffered by Jayson. MILES's counsel believes it is probable that will be awarded an estimated amount in the range of P250,000 and P450,000 and tha is the best estimate of potential liability. MILES's accounting year ends on Deceml 2021 financial statement were issued on March 2, 2022. How much loss should Miles accrue on December 31, 2021?

On November 5, 2021, MILES TRUCK RENTAL Co. was in an accident with an autom by MORALES. MILES received notice on January 12, 2022 of a lawsuit for P700,00 for personal injuries suffered by Jayson. MILES's counsel believes it is probable that will be awarded an estimated amount in the range of P250,000 and P450,000 and tha is the best estimate of potential liability. MILES's accounting year ends on Deceml 2021 financial statement were issued on March 2, 2022. How much loss should Miles accrue on December 31, 2021?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 4C: Pending Damage Suit Disclosure On December 15, 2019, a truck driver for Cork Transfer Company...

Related questions

Question

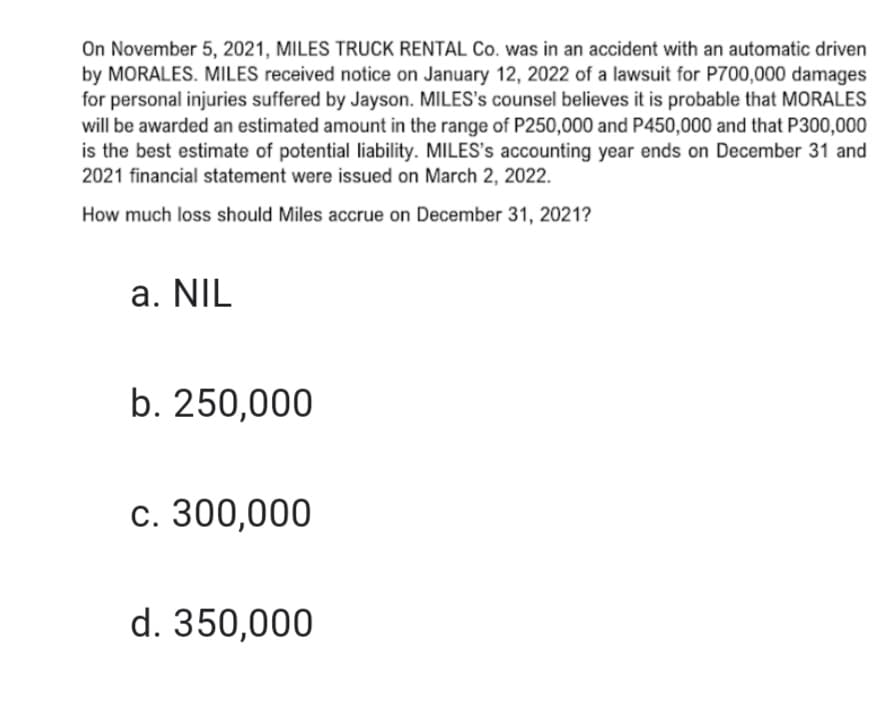

Transcribed Image Text:On November 5, 2021, MILES TRUCK RENTAL Co. was in an accident with an automatic driven

by MORALES. MILES received notice on January 12, 2022 of a lawsuit for P700,000 damages

for personal injuries suffered by Jayson. MILES's counsel believes it is probable that MORALES

will be awarded an estimated amount in the range of P250,000 and P450,000 and that P300,000

is the best estimate of potential liability. MILES's accounting year ends on December 31 and

2021 financial statement were issued on March 2, 2022.

How much loss should Miles accrue on December 31, 2021?

a. NIL

b. 250,000

c. 300,000

d. 350,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT