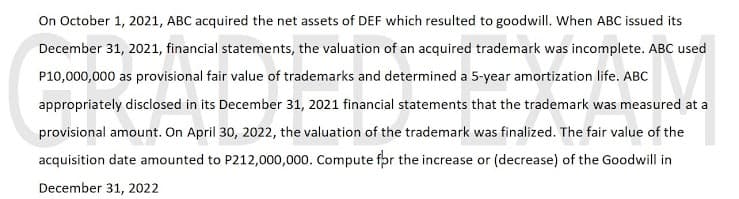

On October 1, 2021, ABC acquired the net assets of DEF which resulted to goodwill. When ABC issued its December 31, 2021, financial statements, the valuation of an acquired trademark was incomplete. ABC used P10,000,000 as provisional fair value of trademarks and determined a 5-year amortization life. ABC appropriately disclosed in its December 31, 2021 financial statements that the trademark was measured at a provisional amount. On April 30, 2022, the valuation of the trademark was finalized. The fair value of the acquisition date amounted to P212,000,000. Compute fpr the increase or (decrease) of the Goodwill in December 21 2032

On October 1, 2021, ABC acquired the net assets of DEF which resulted to goodwill. When ABC issued its December 31, 2021, financial statements, the valuation of an acquired trademark was incomplete. ABC used P10,000,000 as provisional fair value of trademarks and determined a 5-year amortization life. ABC appropriately disclosed in its December 31, 2021 financial statements that the trademark was measured at a provisional amount. On April 30, 2022, the valuation of the trademark was finalized. The fair value of the acquisition date amounted to P212,000,000. Compute fpr the increase or (decrease) of the Goodwill in December 21 2032

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter17: Business Tax Credits And The Alternative Minimum Tax

Section: Chapter Questions

Problem 7CE

Related questions

Question

Transcribed Image Text:On October 1, 2021, ABC acquired the net assets of DEF which resulted to goodwill. When ABC issued its

December 31, 2021, financial statements, the valuation of an acquired trademark was incomplete. ABC used

P10,000,000 as provisional fair value of trademarks and determined a 5-year amortization life. ABC

appropriately disclosed in its December 31, 2021 financial statements that the trademark was measured at a

provisional amount. On April 30, 2022, the valuation of the trademark was finalized. The fair value of the

acquisition date amounted to P212,000,000. Compute for the increase or (decrease) of the Goodwill in

December 31, 2022

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT