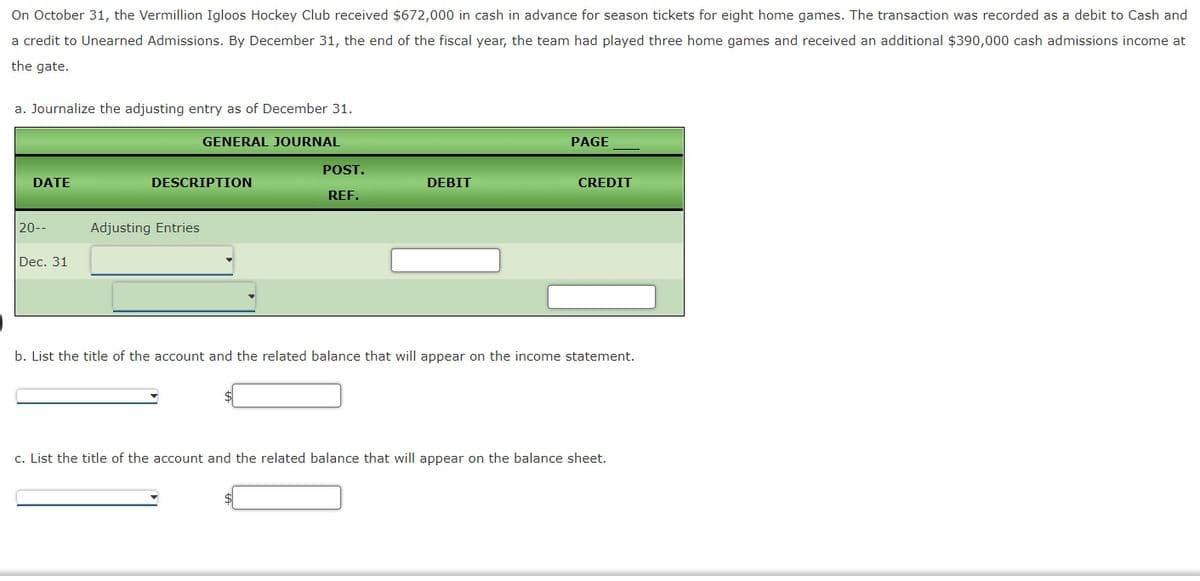

On October 31, the Vermillion Igloos Hockey Club received $672,000 in cash in advance for season tickets for eight home games. The transaction was recorded as a debit to Cash and a credit to Unearned Admissions. By December 31, the end of the fiscal year, the team had played three home games and received an additional $390,000 cash admissions income at the gate. a. Journalize the adjusting entry as of December 31. GENERAL JOURNAL PAGE POST. DATE DESCRIPTION DEBIT CREDIT REF. 20-- Adjusting Entries Dec. 31 b. List the title of the account and the related balance that will appear on the income statement. c. List the title of the account and the related balance that will appear on the balance sheet.

On October 31, the Vermillion Igloos Hockey Club received $672,000 in cash in advance for season tickets for eight home games. The transaction was recorded as a debit to Cash and a credit to Unearned Admissions. By December 31, the end of the fiscal year, the team had played three home games and received an additional $390,000 cash admissions income at the gate. a. Journalize the adjusting entry as of December 31. GENERAL JOURNAL PAGE POST. DATE DESCRIPTION DEBIT CREDIT REF. 20-- Adjusting Entries Dec. 31 b. List the title of the account and the related balance that will appear on the income statement. c. List the title of the account and the related balance that will appear on the balance sheet.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter11: Work Sheet And Adjusting Entries

Section: Chapter Questions

Problem 2E: On October 31, the Vermillion Igloos Hockey Club received 800,000 in cash in advance for season...

Related questions

Question

Please see image

Transcribed Image Text:On October 31, the Vermillion Igloos Hockey Club received $672,000 in cash in advance for season tickets for eight home games. The transaction was recorded as a debit to Cash and

a credit to Unearned Admissions. By December 31, the end of the fiscal year, the team had played three home games and received an additional $390,000 cash admissions income at

the gate.

a. Journalize the adjusting entry as of December 31.

GENERAL JOURNAL

PAGE

POST.

DATE

DESCRIPTION

DEBIT

CREDIT

REF.

20--

Adjusting Entries

Dec. 31

b. List the title of the account and the related balance that will appear on the income statement.

c. List the title of the account and the related balance that will appear on the balance sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning