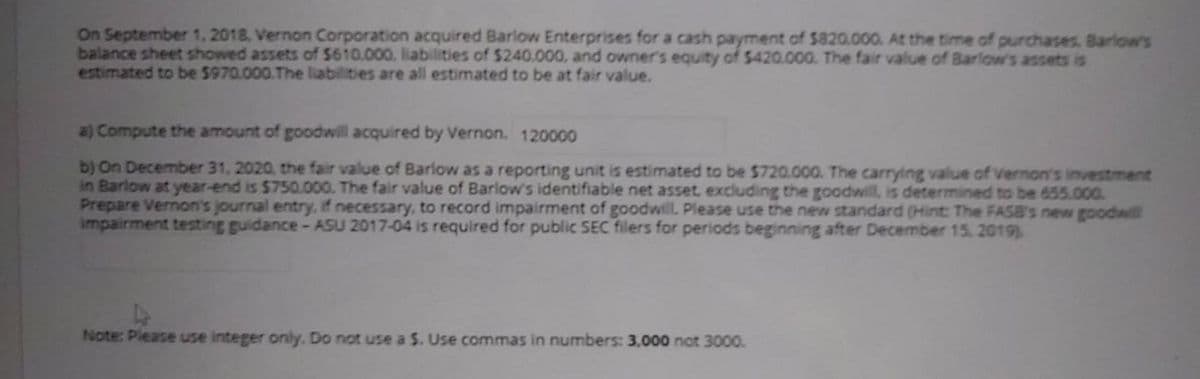

On September 1, 2018. Vernon Corporation acquired Barlow Enterprises for a cash payment of 5820.000. At the time of purchases. Barlow'S balance sheet showed assets of $610.000. liabilities of $240.000, and owner's equity of $420.000. The fair value of Barlow's assets is estimated to be 5970.000.The liabilities are all estimated to be at fair value. a) Compute the amount of goodwill acquired by Vernon. 120000 b) On December 31, 2020, the fair value of Barlow as a reporting unit is estimated to be $720.000. The carrying value of Vernon's investment in Barlow at year-end is $750.000. The fair value of Barlow's identifiable net asset, excluding the goodwill, is determined to be 655.000 Prepare Vernon's journal entry, if necessary, to record impairment of goodwill. Please use the new standard (Hint: The FASa's new goodwill Impairment testing guidance-ASU 2017-04 is required for public SEC filers for periods beginning after December 15, 2019) Note: Please use integer only. Do not use a S. Use commas in numbers: 3,000 not 3000.

On September 1, 2018. Vernon Corporation acquired Barlow Enterprises for a cash payment of 5820.000. At the time of purchases. Barlow'S balance sheet showed assets of $610.000. liabilities of $240.000, and owner's equity of $420.000. The fair value of Barlow's assets is estimated to be 5970.000.The liabilities are all estimated to be at fair value. a) Compute the amount of goodwill acquired by Vernon. 120000 b) On December 31, 2020, the fair value of Barlow as a reporting unit is estimated to be $720.000. The carrying value of Vernon's investment in Barlow at year-end is $750.000. The fair value of Barlow's identifiable net asset, excluding the goodwill, is determined to be 655.000 Prepare Vernon's journal entry, if necessary, to record impairment of goodwill. Please use the new standard (Hint: The FASa's new goodwill Impairment testing guidance-ASU 2017-04 is required for public SEC filers for periods beginning after December 15, 2019) Note: Please use integer only. Do not use a S. Use commas in numbers: 3,000 not 3000.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 30E

Related questions

Question

Transcribed Image Text:On September 1, 2018, Vernon Corporation acquired Barlow Enterprises for a cash payment of $820.000. At the time of purchases. Barlow's

balance sheet showed assets of $610.000. liabilities of $240.000, and owner's equity of $420.000. The fair value of Barlow's assets is

estimated to be 5970.000.The liabilities are all estimated to be at fair value.

a) Compute the amount of goodwill acquired by Vernon. 120000

b) On December 31, 2020, the fair value of Barlow as a reporting unit is estimated to be $720.000. The carrying value of Vernon's investment

in Barlow at year-end is $750.000. The fair value of Barlow's identifiable net asset, excluding the goodwill, is determined to be 655.000

Prepare Vernon's journal entry, if necessary, to record impairment of goodwill. Please use the new standard (Hint: The FASB's new goodwill

Impairment testing guidance- ASU 2017-04 is required for public SEC filers for periods beginning after December 15. 2019)

Note: Please use integer only. Do not use a S. Use commas in numbers: 3,000 not 3000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning