At the start of the current year, SBC Corp. purchased 30% of Sky Tech Inc. for $51 million. At the time of purchase, the carrying value of Sky Tech's net assets was $80 million. The fair value of Sky Tech's depreciable assets was $20 million in excess of ther book value. For this yeat Sky Tech reported a net income of $80 million and declared and paid $20 milion in dividends. The total amount of additional depreciation to be recognized by SBC over the remaining ife of the assets is: Multiple Choice $6.0 million. $20 million

At the start of the current year, SBC Corp. purchased 30% of Sky Tech Inc. for $51 million. At the time of purchase, the carrying value of Sky Tech's net assets was $80 million. The fair value of Sky Tech's depreciable assets was $20 million in excess of ther book value. For this yeat Sky Tech reported a net income of $80 million and declared and paid $20 milion in dividends. The total amount of additional depreciation to be recognized by SBC over the remaining ife of the assets is: Multiple Choice $6.0 million. $20 million

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 62P

Related questions

Question

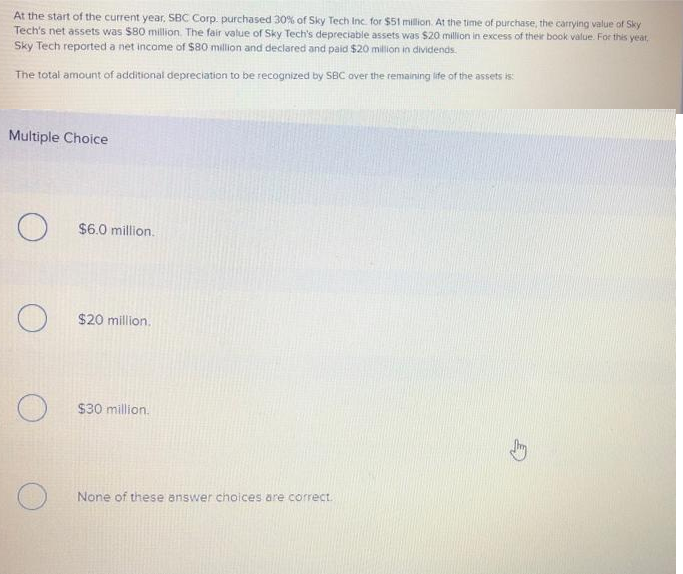

Transcribed Image Text:At the start of the current year, SBC Corp. purchased 30% of Sky Tech Inc. for $51 million. At the time of purchase, the carrying value of Sky

Tech's net assets was $80 million. The fair value of Sky Tech's depreciable assets was $20 million in excess of their book value. For this yeat,

Sky Tech reported a net income of $80 million and declared and paid S20 million in dividends.

The total amount of additional depreciation to be recognized by SBC over the remaining life of the assets is:

Multiple Choice

$6.0 million.

$20 million.

$30 million.

None of these answer choices are correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning