On September 1, 20A, Maria Theresa C Apostol, owner of Cateel Fitness Centre paid an advance rental on a space of the building it occupies in the amount of P84,000. This covers the period from September 1, 20A to September 1, 20B and the accounting period ends on December 31, 20A. Q-1 If Asset Method or Real Approach is used in recording the prepayment, what is your journal entry on September 1, 20A? Q-2. If Expense Method or Nominal Approach is used in recording the prepayment, what is your journal entry on September 1, 20A? Q-3. How much of the P84,000 advanced rental payment will expire or will be expensed at the end of each month?

On September 1, 20A, Maria Theresa C Apostol, owner of Cateel Fitness Centre paid an advance rental on a space of the building it occupies in the amount of P84,000. This covers the period from September 1, 20A to September 1, 20B and the accounting period ends on December 31, 20A. Q-1 If Asset Method or Real Approach is used in recording the prepayment, what is your journal entry on September 1, 20A? Q-2. If Expense Method or Nominal Approach is used in recording the prepayment, what is your journal entry on September 1, 20A? Q-3. How much of the P84,000 advanced rental payment will expire or will be expensed at the end of each month?

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 29P

Related questions

Question

Transcribed Image Text:lll 1:45 Od ended?

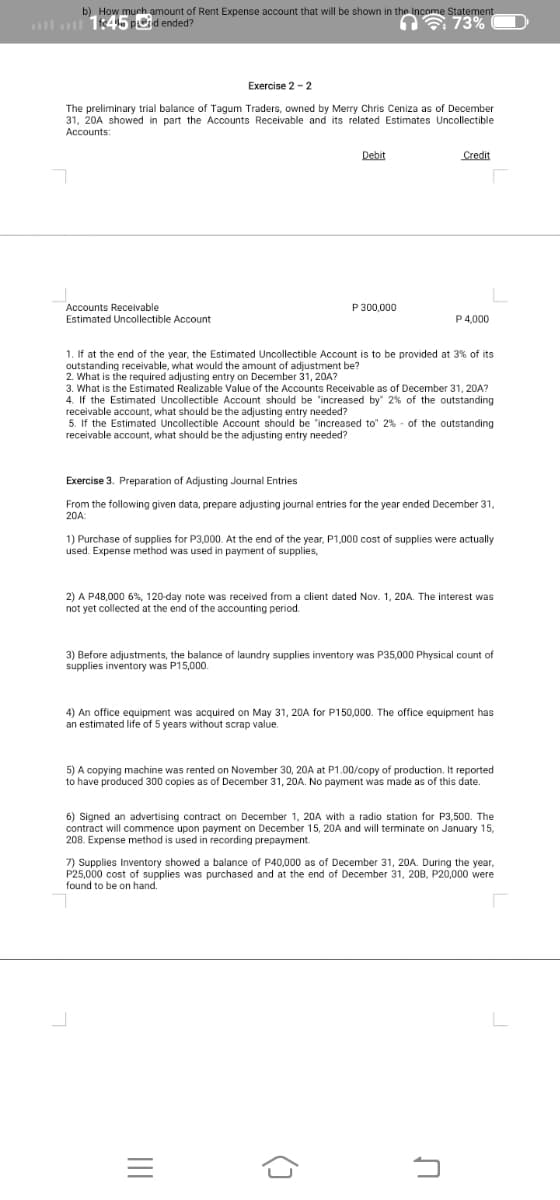

b) How munh amount of Rent Expense account that will be shown in the Income Statement

73%

Exercise 2 -2

The preliminary trial balance of Tagum Traders, owned by Merry Chris Ceniza as of December

31, 20A showed in part the Accounts Receivable and its related Estimates Uncollectible

Accounts:

Debit

Credit

P 300,000

Accounts Receivable

Estimated Uncollectible Account

P 4,000

1. If at the end of the year, the Estimated Uncollectible Account is to be provided at 3% of its

outstanding receivable, what would the amount of adjustment be?

2. What is the required adjusting entry on December 31, 20A?

3. What is the Estimated Realizable Value of the Accounts Receivable as of December 31, 20A?

4. If the Estimated Uncollectible Account should be 'increased by 2% of the outstanding

receivable account, what should be the adjusting entry needed?

5. If the Estimated Uncollectible Account should be "increased to" 2% - of the outstanding

receivable account, what should be the adjusting entry needed?

Exercise 3. Preparation of Adjusting Journal Entries

From the following given data, prepare adjusting journal entries for the year ended December 31,

20A:

1) Purchase of supplies for P3,000. At the end of the year, P1,000 cost of supplies were actually

used. Expense method was used in payment of supplies,

2) A P48,000 6%, 120-day note was received from a client dated Nov. 1, 20A. The interest was

not yet collected at the end of the accounting period.

3) Before adjustments, the balance of laundry supplies inventory was P35,000 Physical count of

supplies inventory was P15,000.

4) An office equipment was acquired on May 31, 20A for P150,000. The office equipment has

an estimated life of 5 years without scrap value.

5) A copying machine was rented on November 30, 20A at P1.00/copy of production. It reported

to have produced 300 copies as of December 31, 20A. No payment was made as of this date.

6) Signed an advertising contract on December 1, 20A with a radio station for P3,500. The

contract will commence upon payment on December 15, 20A and will terminate on January 15,

208. Expense method is used in recording prepayment.

7) Supplies Inventory showed a balance of P40,000 as of December 31, 20A. During the year,

P25,000 cost of supplies was purchased and at the end of December 31, 20B, P20,000 were

found to be on hand.

L

II

![lll 1:45 O

n 73%

[Template] E.DEFERRALS

Exercise 2-1

On September 1, 20A, Maria Theresa C Apostol, owner of Cateel Fitness Centre paid an advance

rental on a space of the building it occupies in the amount of Pg4,000. This covers the period

from September 1, 20A to September 1, 20B and the accounting period ends on December 31,

20A.

Q-1 If Asset Method or Real Approach is used in recording the prepayment, what is your

journal entry on September 1, 20A?

If Expense Method or Nominal Approach is used in recording the prepayment, what is

Q-2.

your journal entry on September 1, 20A?

Q-3. How much of the P84,000 advanced rental payment will expire or will be expensed at the

end of each month?

Q4. How many months will cover the expense portion?

from

to

Q5.

How many months will cover the asset portion?

from

to

Q6.

How much of the P84,000 prepayment will be considered as Expense?

as Asset?

Q7.

If Asset Method or Real Approach is used in recording the prepayment, what is your

adjusting journal entry on December 31, 20A?

Q8 If Expense Method or Nominal Approach is used in recording the prepayment, what is your

adjusting journal entry on December 31, 20A?

0-9 Regardless of what method is used in recording the prepayment,

a) How much amount of Prepaid Rent account that will be shown in the Balance Sheet as

of December 31, 20A?

b) How much amount of Rent Expense account that will be shown in the Income Statement

for the period ended?

Exercise 2 - 2

The preliminary trial balance of Tagum Traders, owned by Merry Chris Ceniza as of December

31, 20A showed in part the Accounts Receivable and its related Estimates Uncollectible

Accounts:

Debit

Credit

P 300,000

Accounts Receivable

Estimated Uncollectible Account

P 4,000

1If at the ond of tho voar the Ectimatod L Incolloctible Account ic to bo provided at 2e of itc](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F46e8c9e7-8346-452c-a618-66dcac25da13%2F871f143b-2930-474e-95cc-8afc7fea2a0f%2Ftistakk_processed.jpeg&w=3840&q=75)

Transcribed Image Text:lll 1:45 O

n 73%

[Template] E.DEFERRALS

Exercise 2-1

On September 1, 20A, Maria Theresa C Apostol, owner of Cateel Fitness Centre paid an advance

rental on a space of the building it occupies in the amount of Pg4,000. This covers the period

from September 1, 20A to September 1, 20B and the accounting period ends on December 31,

20A.

Q-1 If Asset Method or Real Approach is used in recording the prepayment, what is your

journal entry on September 1, 20A?

If Expense Method or Nominal Approach is used in recording the prepayment, what is

Q-2.

your journal entry on September 1, 20A?

Q-3. How much of the P84,000 advanced rental payment will expire or will be expensed at the

end of each month?

Q4. How many months will cover the expense portion?

from

to

Q5.

How many months will cover the asset portion?

from

to

Q6.

How much of the P84,000 prepayment will be considered as Expense?

as Asset?

Q7.

If Asset Method or Real Approach is used in recording the prepayment, what is your

adjusting journal entry on December 31, 20A?

Q8 If Expense Method or Nominal Approach is used in recording the prepayment, what is your

adjusting journal entry on December 31, 20A?

0-9 Regardless of what method is used in recording the prepayment,

a) How much amount of Prepaid Rent account that will be shown in the Balance Sheet as

of December 31, 20A?

b) How much amount of Rent Expense account that will be shown in the Income Statement

for the period ended?

Exercise 2 - 2

The preliminary trial balance of Tagum Traders, owned by Merry Chris Ceniza as of December

31, 20A showed in part the Accounts Receivable and its related Estimates Uncollectible

Accounts:

Debit

Credit

P 300,000

Accounts Receivable

Estimated Uncollectible Account

P 4,000

1If at the ond of tho voar the Ectimatod L Incolloctible Account ic to bo provided at 2e of itc

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT