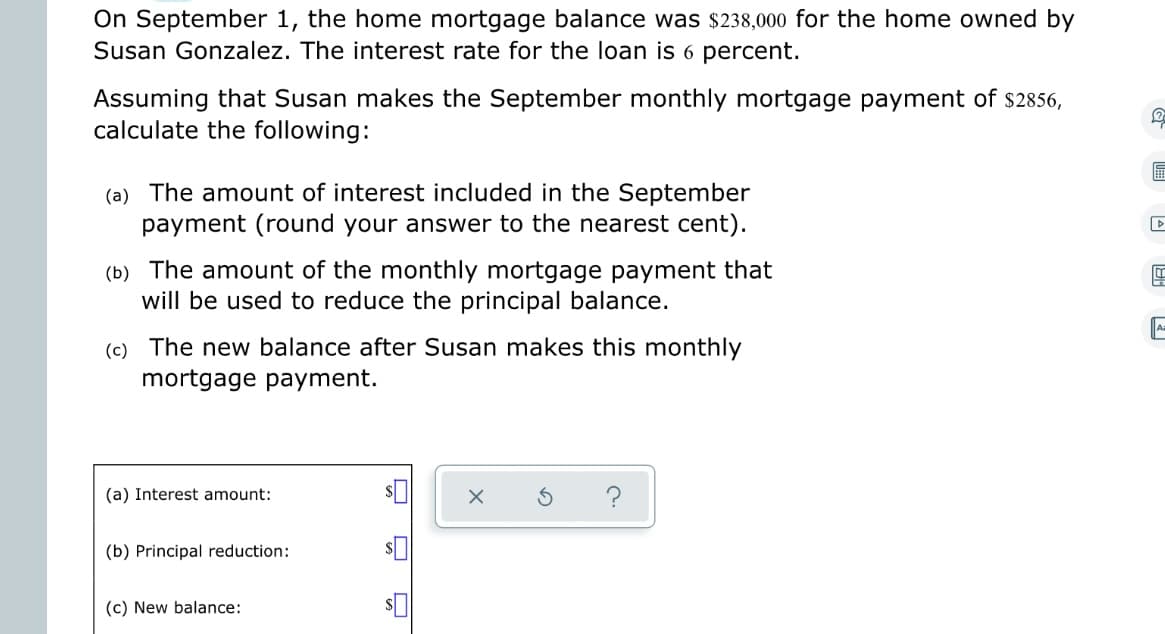

On September 1, the home mortgage balance was $238,000 for the home owned by Susan Gonzalez. The interest rate for the loan is 6 percent. Assuming that Susan makes the September monthly mortgage payment of $2856, calculate the following: (a) The amount of interest included in the September payment (round your answer to the nearest cent). (b) The amount of the monthly mortgage payment that will be used to reduce the principal balance. (c) The new balance after Susan makes this monthly mortgage payment. (a) Interest amount: X S (b) Principal reduction: (c) New balance: S

On September 1, the home mortgage balance was $238,000 for the home owned by Susan Gonzalez. The interest rate for the loan is 6 percent. Assuming that Susan makes the September monthly mortgage payment of $2856, calculate the following: (a) The amount of interest included in the September payment (round your answer to the nearest cent). (b) The amount of the monthly mortgage payment that will be used to reduce the principal balance. (c) The new balance after Susan makes this monthly mortgage payment. (a) Interest amount: X S (b) Principal reduction: (c) New balance: S

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 61P

Related questions

Question

Transcribed Image Text:On September 1, the home mortgage balance was $238,000 for the home owned by

Susan Gonzalez. The interest rate for the loan is 6 percent.

Assuming that Susan makes the September monthly mortgage payment of $2856,

calculate the following:

(a) The amount of interest included in the September

payment (round your answer to the nearest cent).

(b) The amount of the monthly mortgage payment that

will be used to reduce the principal balance.

(c) The new balance after Susan makes this monthly

mortgage payment.

(a) Interest amount:

(b) Principal reduction:

(c) New balance:

2

H

D

4

A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT