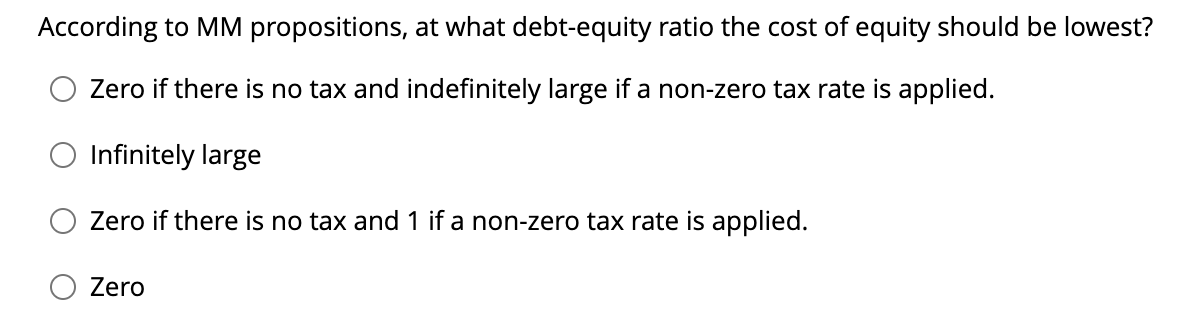

According to MM propositions, at what debt-equity ratio the cost of equity should be lowest? Zero if there is no tax and indefinitely large if a non-zero tax rate is applied. Infinitely large Zero if there is no tax and 1 if a non-zero tax rate is applied. Zero

Q: A zero-coupon bond with 20 years remaining to maturity has a duration of ____________ years, and a…

A: Solution:- Duration is the immunization period, where price effect becomes equal to reinvestment…

Q: Southern Pole is developing a special vehicle for Antarctic exploration. The development requires…

A: Solution:- Net Present value (NPV) means the net value in today’s terms after adjusting present…

Q: Which of the following statements is true? OA. When a large proportion of income is spent on a…

A: To find: which of the following statement is true

Q: A retail coffee company is planning to open new coffee 95 outlets that are expected to generate…

A: Solution:- Net Present Value (NPV) means the net value in today’s terms after adjusting initial…

Q: Two years after a person put $25,000 in a savings account that paid semiannually compounded interest…

A: Solution:- When an amount is invested somewhere, it earns interest. The amount invested at beginning…

Q: A salesman gets P10,000 commission on a sale of a item. This amount raised his average commission by…

A: Average It is the sum of all values divided by the number of values. For example, there are three…

Q: EXHIBIT 1 Illustration of Full Valuation Approach to Assess the Interest Rate Risk of a Bond…

A: Price of a bond The price of the bond is the present value of all cash inflows associated with the…

Q: In order to buy a vacation home, Neal and Lilly took out a 20-year mortgage for $220,000 at an…

A: 1. Calculating the monthly payments on original loan using the table given in question: Original…

Q: National Corporation expects to pay a dividend of P5 per share at the end of year one, P9 per share…

A: The most latest price at which a security was sold on an exchange is the current price. Buyers and…

Q: The conceptual framework underpinning the regulation of published financial statements, states…

A: Financial statements of a company is prepared for external users. Financial statements of a company…

Q: An investment will provide you with $100 at the end of each year for the next 10 years. What is the…

A: Time period is 10years Discount rate is 8% Annuity amount per year is $100 To Find: Present Value…

Q: Delta Itd has $820 in inventory, $640000 in fixed assets, $670 in accounts receivable, $800 in…

A: Given: Particulars Amount Fixed assets $640,000 Inventory $820 Accounts receivables $670…

Q: Compute the IRR statistic for Project E. The appropriate cost of capital is 9 percent. (Do not round…

A: IRR refers to the internal rate of return. It is an important capital budgeting tool that is used to…

Q: I $1216 P $7600 r 4% t years

A: Simple interest is the interest earned on a principal balance for a period of time at a specified…

Q: A firm has total interest charges of $10,000 per year, sates of $1 million, a tax rate of 40…

A: Times interest earned ratio or interest coverage ratio shows ability of the company in paying it's…

Q: Which of the following will most probably have the lowest WACC? 99% Debt, 1% Debt 100% Equity ●None…

A: In simple words we can say weighted average cost of capital is the average cost of capitalfrom all…

Q: What is the current price of a share of stock when last year’s dividend was P3, the growth rate is…

A: To calculate the current price of stock we will use the below formula Current price of stock =…

Q: 5 Consider a relation Stocks(B, O, I, S, Q, D), whose attributes may be thought of informally as…

A: Stocks are referred as the security types, which provides the stockholder the ownership's share in…

Q: carlos invests $6000 in a 24 month CD that has a 4.75 interest rate. use the formula to find how…

A: We need to use formula mention maturity formula to calculate worth at maturity A=P(1+r)n where A=…

Q: One major risk of engaging in global trade is that as national economies continue to integrate, an…

A: Global trade is one of the important type of business, which can be engaged for generating finance…

Q: 1. The text details 4 reasons to keep your records up to date and accurate. What are they? Why?

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: H11. The expected yearly interest rate for a deposit account is r1 from year 1 to year 5, and is r2…

A: Solution:- When an amount is deposited somewhere, it earns interest on it. The amount initially…

Q: Whenever the percentage change in EBIT due to percentage change in sales is lower than the…

A: Operating Leverage defined as “firms ability to use fixed operating costs to magnify effect of…

Q: What is the difference between simple interest and compound interest? Suppose you have $500 to…

A: Difference between Simple Interest and Compound interest Simple Interest is the interest that one…

Q: Your Investment Advisor faxed you the following information for a semi-annual coupon bond that he…

A: Bonds are debt instruments. The issuing entity has to pay periodic interest to the bond holders.

Q: Related to Checkpoint 9.3) (Bond valuation) Doisneau 18-year bonds have an annual coupon…

A: Given: Particulars Years 18 Coupon rate 14% Par value(FV) $1,000 Yield to maturity 16%

Q: You are preparing to produce some goods for sale. You will sell them in one year and you will incur…

A: Solution:- Net Present Value (NPV) means the net value in today’s terms after adjusting initial…

Q: What is the relationship between present value and future value?

A: Future Value : FV is that value which will be received in near future. Present Value : PV is that…

Q: What is the accumulated value after five years of payments of $20000 made at the beginning of each…

A: Solution:- When an equal amount of payment is made each period at the beginning of period, it is…

Q: What are the 4 basic option positions? Please draw their Profit/Loss Profile.

A: Option position means any open Long or short position in options derivatives. In options, we can buy…

Q: The construction market is suffering from a short-term economic recession, and one of the investors…

A: NPV is the one of the method in Capital budgeting for help in taking the decision on the basis of…

Q: our firm is considering purchasing an old office building with an estimated remaining service life…

A: Maximum amount that the firm will be willing to pay for the building and lot at the present time is…

Q: An investment offers a total return of 11 percent over the coming year. Alex Hamilton thinks the…

A: 1) Nominal return is 11% and real rate of return is 7.4% Nominal rate of return when adjusted for…

Q: National Corporation is expecting their sales to decline due to the increased interest is disposable…

A: Given, The Growth rate is -4% Dividend paid last year is P1.80 per share Required rate of return is…

Q: An article in the Wall Street Journal describes recent economic events as having "steepened the…

A: The yield curve shows the relationship between the yield to maturity and the term to maturity for…

Q: A bond's market price is $1,175. It has a $1,000 par value, will mature in 8 years, and has a…

A: Here, To Find: Yield to Maturity (YTM) =?

Q: You are getting ready to start a new project that will incur some cleanup and shutdown costs when it…

A: NPV ( Net present value) : It is the net of expected discounted cash inflows and cash outflows. NPV…

Q: What is the difference between a mortgage bond and a convertible bond?

A: Mortgage bond: A mortgage bond (also known as a secured bond) is a corporate bond that is secured by…

Q: A- Jason works Monday to Friday, from 10:00 AM to 6:00 AM, at $18.54/hour, including 30 min unpaid…

A: Solution:- Net pay is the amount of net salary payable to an employee after all the eligible…

Q: Requiring a relative short pay-back period for projects indicates a high risk avoiding propensity…

A: In capital budgeting payback period is an important tool used in capital budgeting. Payback period…

Q: (Yield-To-Maturity) for $990. You have just bought a 5% coupon $1,000 face-value bond with 3 years…

A: Given: Particulars Years(NPER) 3 Coupon rate 5% Par value $1,000 Current Price (PV)…

Q: In what circumstances might a large corporation sell stock rather than bonds to obtain long-term…

A: A Bond refers to a type of security where the issuer owes the holder a debt and has an obligation to…

Q: Determining Funded Status, Recording Pension Expense, Preparing Worksheet Rico Corporation…

A: a. In its December 31, 2020, balance sheet, net pension asset is $ 10,000.(85000-75000) Balance…

Q: A company produces 4 different products. Table 1 shows the selling price, production cost, and…

A: SD of assets measure the risk of any assets it will showing the risk associated with the assets for…

Q: Shane has a retirement plan with an insurance company. He can choose to be paid either $450 per…

A: Solution:- Every rational person wants to pay fewer amounts. So, the better option will be the one…

Q: Kyle invested money in a mutual fund for ten years. The interest rate on the mutual fund was 3%…

A: Accumulated Value at the end of 10 years "FV" is $41,788.50 Interest rate for first 5 years is 3%…

Q: Use the unpaid balance method to find the finance charge on the credit card account. Last month's…

A: As per the Unpaid Balance Method Finance Charges computed on the unpaid balance of prior period. It…

Q: The current liabilities section of the statement of financial position of HOPE CORP. as of December…

A: Liabilities is that amount which includes the fund raised by the company from various sources like…

Q: For a corporation, what are the advantages of corporate bonds over long-term loans?

A: A corporate bond is a type of financial security issued by a firm and sold to investors. The company…

Q: Using Exhibit 5.7, calculate the three-month forward premium or discount for the Swiss franc versus…

A: Compute the three-month forward premium or discount as follows: Forward (n, Swiss franc) = Forward…

Step by step

Solved in 2 steps

- According to MM propositions, at what debt-equity ratio should the cost of equity be the lowest? Group of answer choices Zero if there is no tax and 1 if a non-zero tax rate is applied. Zero. Infinitely large Zero if there is no tax and indefinitely large if a non-zero tax rate is applied.While computing the cost of equity using the formula , rs=D1P0+grs=D1P0+g, we do not make any adjustment to express the cost of equity on an after-tax basis whereas while computing the cost of debt, a tax adjustment is required to arrive at after-tax cost of debt. Why is this so?Where do we generally find optimal level of debt? A. where the tax shield is maximized B. the amount of debt such that the YTM is 5.5% or less C. where debt equals equity D. whatever will yield a FICO sore of 700 or better E. consistent with a low investment grade debt rating

- While computing the cost of equity using the formula , rs=D1P0+g, we do not make any adjustment to express the cost of equity on an after-tax basis whereas while computing the cost of debt, a tax adjustment is required to arrive at after-tax cost of debt. Why is this so? Explain briefly. (75-150 words)How would each of the following scenarios affect a firm's cost of debt, r d (l - t), t=tax rate; its cost of equity, rs; and its WACC? Indicate with an increase (I), a decreease (D), or no change (N) whether the factor would raise, lower, or have an indeterminate effect on the item in question. Assume for each answer that other things are held constant, even though in some instances this would probably not be true. rd (1-t) rs WACC 4) The dividend payout ratio is increased. 5) The firm expands into a risky new area. 6) Investors become more risk-averse. 7) The firm is an electric utility with a large investment innuclear plants. Several states are considering a ban on nuclear power generation.How would each of the following scenarios affect a firm's cost of debt, r d (l - t), t=tax rate; its cost of equity, rs; and its WACC? Indicate with an increase (I), a decreease (D), or no change (N) whether the factor would raise, lower, or have an indeterminate effect on the item in question. Assume for each answer that other things are held constant, even though in some instances this would probably not be true. rd (1-t) rs WACC 1) The corporate tax rate is lowered. 2) The Federal Reserve tightens credit. 3) The firm uses more debt; that is, it increases its debt ratio 4) The dividend payout ratio is increased. 5) The firm expands into a risky new area. 6) Investors become more risk-averse. 7) The firm is an electric utility with a large investment innuclear plants. Several states are considering a ban on nuclear power generation.

- How would each of the following scenarios affect a firm's cost of debt, r d (l - t), t=tax rate; its cost of equity, rs; and its WACC? Indicate with an increase (I), a decreease (D), or no change (N) whether the factor would raise, lower, or have an indeterminate effect on the item in question. Assume for each answer that other things are held constant, even though in some instances this would probably not be true. 1) The corporate tax rate is lowered. 2) The Federal Reserve tightens credit. 3) The firm uses more debt; that is, it increases its debt ratioAlpha Co. has a debt-equity ratio of 0.6, a pretax cost of debt of 7.5 percent, and an unlevered cost of equity of 12 percent. What is Alpha's cost of equity if you ignore taxes? Multiple choice question. 16.5% 9.3% 14.7% 12% Explain whyThe cost of debt is equal to one minus the marginal tax rate multiplied by the average coupon rate on all outstanding debt. True False

- According to theory, the value of a firm is maximized by: Issuing no debt Issuing the maximum amount of debt absorbed by the market place Increasing debt until the marginal tax benefit of debt is offset by distress costs Keeping the debt equity mix at 50/50Give typing answer with explanation and conclusion If the company were to borrow more (or less), how would that impact the cost of debt and the WACC? Provide a specific assumed example. Weight of Equity 76.10% Weight of Debt 23.90% Cost of Equity 6.98% Cost of Debt 2.55% Tax Rate WACC 5.92%Which of the following statements does correctly explain the effect of additional debt on the weighted average cost of capital (WACC)? Debtholders’ prior and “fixed” claim decreases the risk of stockholders’ “residual” claim, so the cost of stock (rs) goes down. Additional debt decreases the pre-tax of cost of debt (rd) because the decreased risk of bankruptcy. The net effect of additional debt on WACC is to increase WACC. The net effect of additional debt on WACC is uncertain.