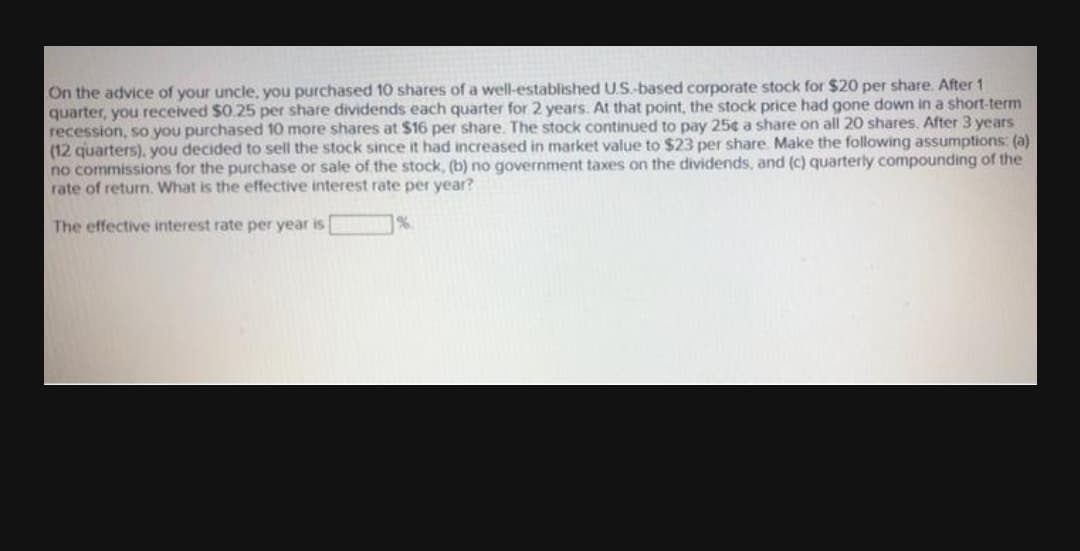

On the advice of your uncle, you purchased 10 shares of a well-established U.S-based corporate stock for $20 per share. After 1 quarter, you received $0.25 per share dividends each quarter for 2 years. At that point, the stock price had gone down in a short-term recession, so you purchased 10 more shares at $16 per share. The stock continued to pay 25e a share on all 20 shares. After 3 years (12 quarters), you decided to sell the stock since it had increased in market value to $23 per share. Make the following assumptions: (a) no commissions for the purchase or sale of the stock, (b) no government taxes on the dividends, and (c) quarterly compounding of the rate of return. What is the effective interest rate per year? The effective interest rate per year is %.

On the advice of your uncle, you purchased 10 shares of a well-established U.S-based corporate stock for $20 per share. After 1 quarter, you received $0.25 per share dividends each quarter for 2 years. At that point, the stock price had gone down in a short-term recession, so you purchased 10 more shares at $16 per share. The stock continued to pay 25e a share on all 20 shares. After 3 years (12 quarters), you decided to sell the stock since it had increased in market value to $23 per share. Make the following assumptions: (a) no commissions for the purchase or sale of the stock, (b) no government taxes on the dividends, and (c) quarterly compounding of the rate of return. What is the effective interest rate per year? The effective interest rate per year is %.

Chapter5: The Cost Of Money (interest Rates)

Section: Chapter Questions

Problem 6PROB

Related questions

Question

Mm6

Transcribed Image Text:On the advice of your uncle, you purchased 10 shares of a well-established U.S.-based corporate stock for $20 per share. After 1

quarter, you received $0.25 per share dividends each quarter for 2 years. At that point, the stock price had gone down in a short-term

recession, so you purchased 10 more shares at $16 per share. The stock continued to pay 25e a share on all 20 shares. After 3 years

(12 quarters), you decided to sell the stock since it had increased in market value to $23 per share Make the following assumptions: (a)

no commissions for the purchase or sale of the stock, (b) no government taxes on the dividends, and (c) quarterly compounding of the

rate of return. What is the effective interest rate per year?

The effective interest rate per year is

%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning