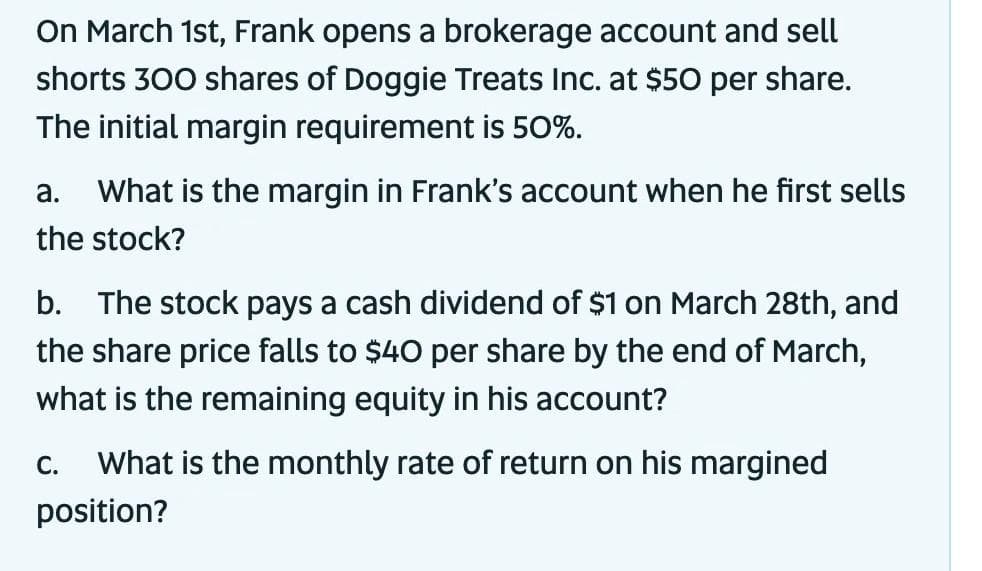

On March 1st, Frank opens a brokerage account and sell shorts 300 shares of Doggie Treats Inc. at $50 per share. The initial margin requirement is 50%. a. What is the margin in Frank's account when he first sells the stock? b. The stock pays a cash dividend of $1 on March 28th, and the share price falls to $40 per share by the end of March, what is the remaining equity in his account? c. What is the monthly rate of return on his margined position?

On March 1st, Frank opens a brokerage account and sell shorts 300 shares of Doggie Treats Inc. at $50 per share. The initial margin requirement is 50%. a. What is the margin in Frank's account when he first sells the stock? b. The stock pays a cash dividend of $1 on March 28th, and the share price falls to $40 per share by the end of March, what is the remaining equity in his account? c. What is the monthly rate of return on his margined position?

Chapter5: The Cost Of Money (interest Rates)

Section: Chapter Questions

Problem 2PROB

Related questions

Question

Transcribed Image Text:On March 1st, Frank opens a brokerage account and sell

shorts 300 shares of Doggie Treats Inc. at $50 per share.

The initial margin requirement is 50%.

a. What is the margin in Frank's account when he first sells

the stock?

b. The stock pays a cash dividend of $1 on March 28th, and

the share price falls to $40 per share by the end of March,

what is the remaining equity in his account?

C.

What is the monthly rate of retur on his margined

position?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT