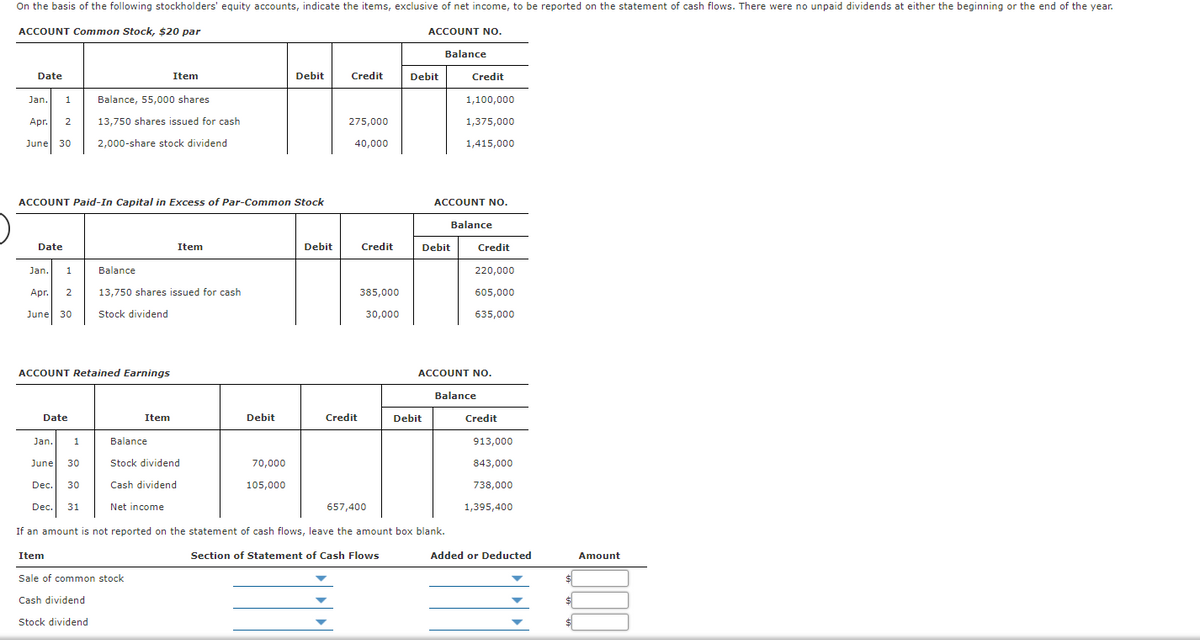

On the basis of the following stockholders' equity accounts, indicate the items, exclusive of net income, to be reported on the statement of cash flows. There were no unpaid dividends at either the beginning or the end of the year. ACCOUNT Common Stock, $20 par ACCOUNT No. Balance Date Item Debit Credit Debit Credit Jan. 1 Balance, 55,000 shares 1,100,000 Apr. 2 13,750 shares issued for cash 275,000 1,375,000 June 30 2,000-share stock dividend 1,415,000 40,000 ACCOUNT Paid-In Capital in Excess of Par-Common Stock ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Jan. 1 Balance 220,000 Apr. 2 13,750 shares issued for cash 385,000 605,000 June 30 Stock dividend 30,000 635,000 ACCOUNT Retained Earnings ACCOUNT No. Balance Date Item Debit Credit Debit Credit Jan. 1 Balance 913,000 June 30 Stock dividend 70,000 843,000 Dec. 30 Cash dividend 105,000 738,000 Dec. 31 Net income 657,400 1,395,400 If an amount is not reported on the statement of cash flows, leave the amount box blank. Item Section of Statement of Cash Flows Added or Deducted Amount Sale of common stock Cash dividend Stock dividend

On the basis of the following stockholders' equity accounts, indicate the items, exclusive of net income, to be reported on the statement of cash flows. There were no unpaid dividends at either the beginning or the end of the year. ACCOUNT Common Stock, $20 par ACCOUNT No. Balance Date Item Debit Credit Debit Credit Jan. 1 Balance, 55,000 shares 1,100,000 Apr. 2 13,750 shares issued for cash 275,000 1,375,000 June 30 2,000-share stock dividend 1,415,000 40,000 ACCOUNT Paid-In Capital in Excess of Par-Common Stock ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Jan. 1 Balance 220,000 Apr. 2 13,750 shares issued for cash 385,000 605,000 June 30 Stock dividend 30,000 635,000 ACCOUNT Retained Earnings ACCOUNT No. Balance Date Item Debit Credit Debit Credit Jan. 1 Balance 913,000 June 30 Stock dividend 70,000 843,000 Dec. 30 Cash dividend 105,000 738,000 Dec. 31 Net income 657,400 1,395,400 If an amount is not reported on the statement of cash flows, leave the amount box blank. Item Section of Statement of Cash Flows Added or Deducted Amount Sale of common stock Cash dividend Stock dividend

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter15: Statement Of Cash Flows

Section: Chapter Questions

Problem 12E

Related questions

Question

.

Transcribed Image Text:On the basis of the following stockholders' equity accounts, indicate the items, exclusive of net income, to be reported on the statement of cash flows. There were no unpaid dividends at either the beginning or the end of the year.

ACCOUNT Common Stock, $20 par

ACCOUNT NO.

Balance

Date

Item

Debit

Credit

Debit

Credit

Jan.

1

Balance, 55,000 shares

1,100,000

Apr.

2

13,750 shares issued for cash

275,000

1,375,000

June 30

2,000-share stock dividend

40,000

1,415,000

ACCOUNT Paid-In Capital in Excess of Par-Common Stock

ACCOUNT NO.

Balance

Date

Item

Debit

Credit

Debit

Credit

Jan.

Balance

220,000

Apr.

2

13,750 shares issued for cash

385,000

605,000

June 30

Stock dividend

30,000

635,000

ACCOUNT Retained Earnings

ACCOUNT NO.

Balance

Date

Item

Debit

Credit

Debit

Credit

Jan.

1

Balance

913,000

June

30

Stock dividend

70,000

843,000

Dec.

30

Cash dividend

105,000

738,000

Dec.

31

Net income

657,400

1,395,400

If an amount is not reported on the statement of cash flows, leave the amount box blank.

Item

Section of Statement of Cash Flows

Added or Deducted

Amount

Sale of common stock

Cash dividend

Stock dividend

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,