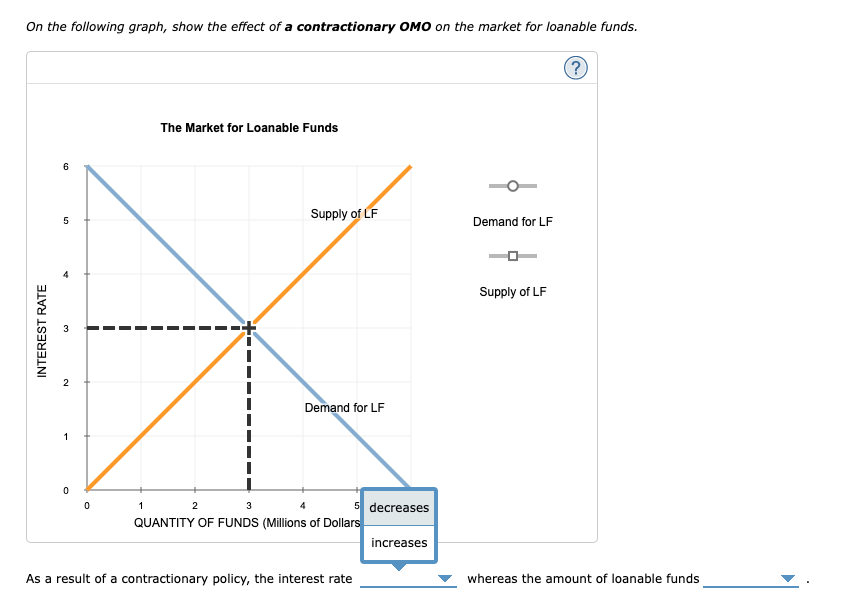

On the following graph, show the effect of a contractionary OMO on the market for loanable funds. ? INTEREST RATE 5 3 2 1 1 The Market for Loanable Funds Supply of LF Demand for LF 3 QUANTITY OF FUNDS (Millions of Dollars 5 decreases As a result of a contractionary policy the interest rate increases Demand for LF Supply of LF whereas the amount of loanable funds

On the following graph, show the effect of a contractionary OMO on the market for loanable funds. ? INTEREST RATE 5 3 2 1 1 The Market for Loanable Funds Supply of LF Demand for LF 3 QUANTITY OF FUNDS (Millions of Dollars 5 decreases As a result of a contractionary policy the interest rate increases Demand for LF Supply of LF whereas the amount of loanable funds

Macroeconomics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506756

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter13: Money And The Banking System

Section: Chapter Questions

Problem 16CQ

Related questions

Question

100%

Transcribed Image Text:On the following graph, show the effect of a contractionary OMO on the market for loanable funds.

INTEREST RATE

6

5

3

2

1

0

0

1

The Market for Loanable Funds

Supply of LF

Demand for LF

5 decreases

increases

2

3

4

QUANTITY OF FUNDS (Millions of Dollars

As a result of a contractionary policy, the interest rate

Demand for LF

Supply of LF

(?)

whereas the amount of loanable funds

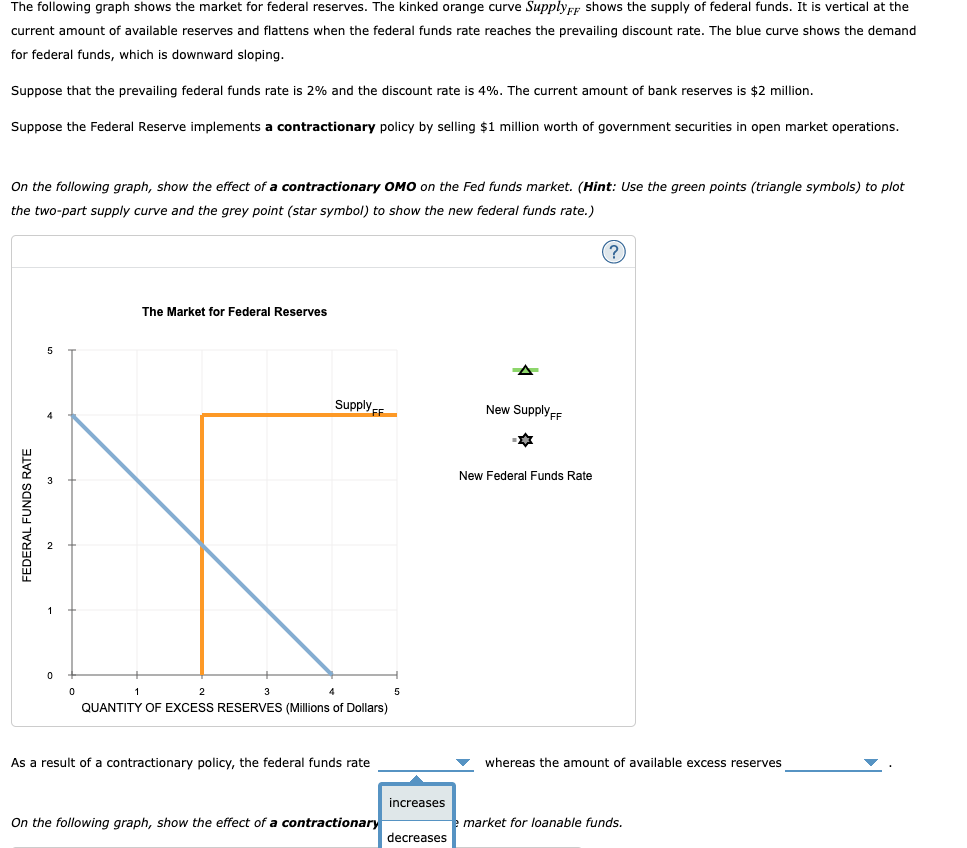

Transcribed Image Text:The following graph shows the market for federal reserves. The kinked orange curve Supply FF shows the supply of federal funds. It is vertical at the

current amount of available reserves and flattens when the federal funds rate reaches the prevailing discount rate. The blue curve shows the demand

for federal funds, which is downward sloping.

Suppose that the prevailing federal funds rate is 2% and the discount rate is 4%. The current amount of bank reserves is $2 million.

Suppose the Federal Reserve implements a contractionary policy by selling $1 million worth of government securities in open market operations.

On the following graph, show the effect of a contractionary OMO on the Fed funds market. (Hint: Use the green points (triangle symbols) to plot

the two-part supply curve and the grey point (star symbol) to show the new federal funds rate.)

FEDERAL FUNDS RATE

5

0

0

The Market for Federal Reserves

Supply FF

2

QUANTITY OF EXCESS RESERVES (Millions of Dollars)

3

As a result of a contractionary policy, the federal funds rate

On the following graph, show the effect of a contractionary

5

increases

decreases

New Supply FF

New Federal Funds Rate

(?)

whereas the amount of available excess reserves

market for loanable funds.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning