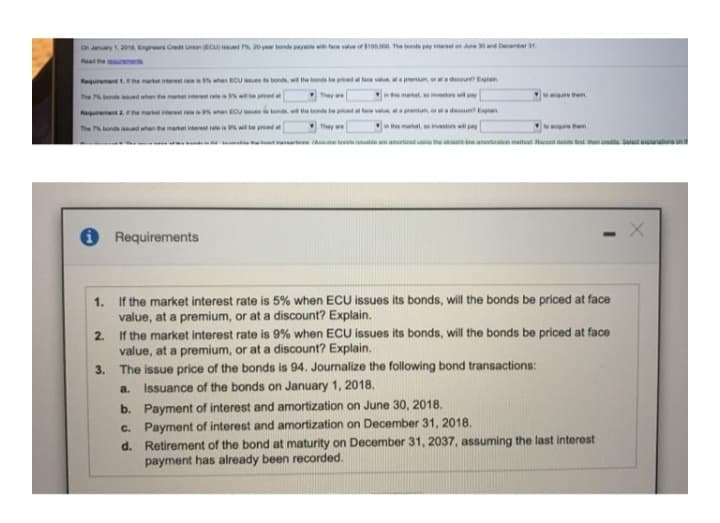

On y2 ngres C 0 dyn t e he y tn ent ae ments Requrementt.he na et n ECU tondw he bndstept e va m o d Etan hebendd whenee r e emente maet eU t e t te eva matat invet it py the bonds d whan eatelert e teed They we e manet, inny en en n and e etn mat d el un O Requirements 1. If the market interest rate is 5% when ECU issues its bonds, will the bonds be priced at face value, at a premium, or at a discount? Explain. 2. If the market interest rate is 9% when ECU issues its bonds, will the bonds be priced at face value, at a premium, or at a discount? Explain. 3. The issue price of the bonds is 94. Journalize the following bond transactions: a. Issuance of the bonds on January 1, 2018. b. Payment of interest and amortization on June 30, 2018. c. Payment of interest and amortization on December 31, 2018. d. Retirement of the bond at maturity on December 31, 2037, assuming the last interest payment has already been recorded.

On y2 ngres C 0 dyn t e he y tn ent ae ments Requrementt.he na et n ECU tondw he bndstept e va m o d Etan hebendd whenee r e emente maet eU t e t te eva matat invet it py the bonds d whan eatelert e teed They we e manet, inny en en n and e etn mat d el un O Requirements 1. If the market interest rate is 5% when ECU issues its bonds, will the bonds be priced at face value, at a premium, or at a discount? Explain. 2. If the market interest rate is 9% when ECU issues its bonds, will the bonds be priced at face value, at a premium, or at a discount? Explain. 3. The issue price of the bonds is 94. Journalize the following bond transactions: a. Issuance of the bonds on January 1, 2018. b. Payment of interest and amortization on June 30, 2018. c. Payment of interest and amortization on December 31, 2018. d. Retirement of the bond at maturity on December 31, 2037, assuming the last interest payment has already been recorded.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 12E: On October 1, 2019, Ball Company issued 9% bonds dated October 1, 2019, with a face amount of...

Related questions

Question

Transcribed Image Text:On dany 1.201 Engrers Cretu C 20y tdyn t v Oe The de pyretn n Denter

a e ens

Requiemnt.he mat itet %en CU ten the bons te ptte v pren oadou Etan

heenddhen te maet ted

matatinvet

Neqmentae mat r wheOU he bondte evaapu ea d

The P bonds ed when the martel tert e is wi te ped a

They are

manat, tin py

m

n nt t t a anutuada hea amotutn mathat d d ten da Sele uraton onit

ORequirements

If the market interest rate is 5% when ECU issues its bonds, will the bonds be priced at face

value, at a premium, or at a discount? Explain.

2.

If the market interest rate is 9% when ECU issues its bonds, will the bonds be priced at face

value, at a premium, or at a discount? Explain.

3. The issue price of the bonds is 94. Journalize the following bond transactions:

a.

Issuance of the bonds on January 1, 2018.

b. Payment of interest and amortization on June 30, 2018.

c. Payment of interest and amortization on December 31, 2018.

d. Retirement of the bond at maturity on December 31, 2037, assuming the last interest

payment has already been recorded.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning