one ecided that you will give Bob $15,000 per yE year for each of his last two years of colleE f each school year. You will make 5 equal a Il be made one year from today and the las wish to have just enough money in the bar

one ecided that you will give Bob $15,000 per yE year for each of his last two years of colleE f each school year. You will make 5 equal a Il be made one year from today and the las wish to have just enough money in the bar

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 37P

Related questions

Question

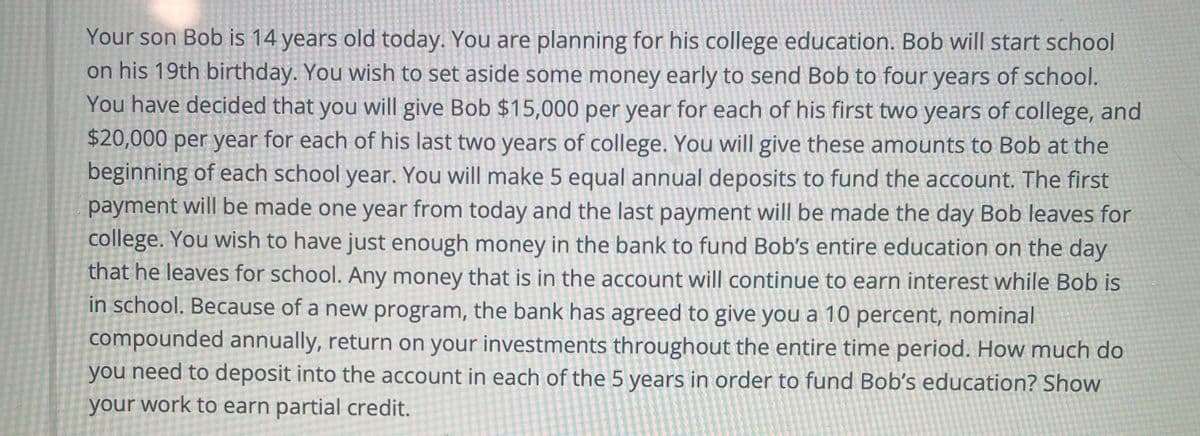

Transcribed Image Text:Your son Bob is 14 years old today. You are planning for his college education. Bob will start school

on his 19th birthday. You wish to set aside some money early to send Bob to four years of school.

You have decided that you will give Bob $15,000 per year for each of his first two years of college, and

$20,000 per year for each of his last two years of college. You will give these amounts to Bob at the

beginning of each school year. You will make 5 equal annual deposits to fund the account. The first

payment will be made one year from today and the last payment will be made the day Bob leaves for

college. You wish to have just enough money in the bank to fund Bob's entire education on the day

that he leaves for school. Any money that is in the aCcount will continue to earn interest while Bob is

in school. Because of a new program, the bank has agreed to give you a 10 percent, nominal

compounded annually, return on your investments throughout the entire time period. How much do

you need to deposit into the account in each of the 5 years in order to fund Bob's education? Show

your work to earn partial credit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning