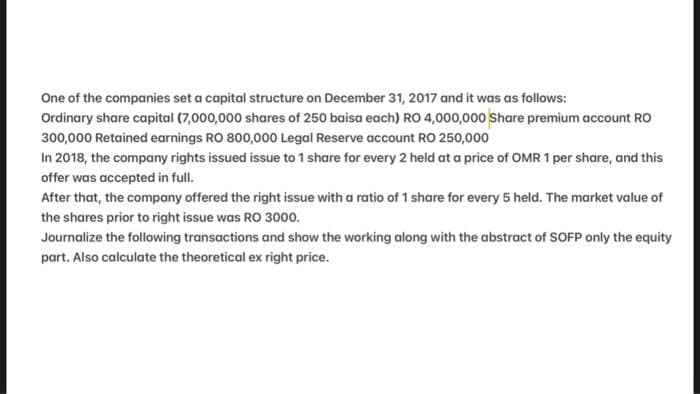

One of the companies set a capital structure on December 31, 2017 and it was as follows: Ordinary share capital (7,000,000 shares of 250 baisa each) RO 4,000,000 Share premium accour 300,000 Retained earnings RO 800,000 Legal Reserve account RO 250,000 In 2018, the company rights issued issue to 1 share for every 2 held at a price of OMR 1 per share, a offer was accepted in full. After that the company offered the right issue with a ratio of 1 share for every 5 held. The market v

Q: Two different product lines are manufactured and sold by Cheche Manufacturing Corp. Monthly fixed…

A: Breakeven point is the point at which the fixed costs of the entity recovered. It is the point at…

Q: America Inc., is considering the addition of a new maintenance services division. Opening the…

A: The cash flow stream is a systematic forecast of future cash flows. It is forecasted by professional…

Q: At the end of its first year of operations on December 31, 2022, the Metro Company reported pretax…

A: The temporary difference indicates the difference in the taxable income as per the accounting record…

Q: Excel File Dv A1 1 2 McGraw Hill Excel Question - Saved 33 Home Insert Draw Calibri Formulas Data…

A: DIRECT LABOUR BUDGET Direct Labour Budget is Prepared to estimates the total number of Direct…

Q: Using the following returns, calculate the arithmetic average returns, the variances, and the…

A: It has been provided: Required: Asset X: Average return ? Variance ? Standard…

Q: Direct Materials Variances The following data relate to the direct materials cost for the production…

A: The variance is the difference between the actual data and standard output of the production. The…

Q: E5-9 In its income statement for the year ended December 31, 2002, Chevalier Company reported the…

A: INCOME STATEMENT Income statement is One of the Important Financial Statements of the Company.…

Q: Freeport-McMoRan Copper & Gold Incorporated, headquartered in Phoenix, Arizona, is a leading…

A: Depletion is defined as the expense incurred on the mines that are indulged in removing natural…

Q: Manno Corporation has the following information available concerning its defined-benefit pension…

A: Pension expense is the expense a business charges in relation to the liabilities for pension payable…

Q: St. Mark's Hospital contains 560 beds. The occupancy rate varies between 60% and 90% per month, but…

A: Variable cost refers to those cost which changes with the changing level of sales or Production i.e.…

Q: djusting entries for accrued salaries Instructions Chart of Accounts Journal Instructions Paradise…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: K→ For this problem, you are to calculate the missing amounts that are represented by blanks. You…

A: Net sales = Sales - Sales Return - Sales Discount Sales = Net Sales + Sales Return + Sales…

Q: Questions #28-29 are based on the information below: On January 1, 2021, The Donut Stop purchased a…

A: 28. The entry to record the 2021 amortization expense for the patent should include: The annual…

Q: Problem 10-61 (LO 10-2, LO 10-3) (Algo) Chaz Corporation has taxable income in 2021 of $316,600 for…

A: Depreciation - Depreciation is an accounting technique for spreading out the expense of a tangible…

Q: 9-2, LO 9-3, LO 9-6] [The following information applies to the questions displayed below.] Randy's…

A: A journal is a detailed account that records all the financial transactions of a business, to be…

Q: 17. Noah gave $750 to a good friend whose house was destroyed by an earthquake. In addition, Noah…

A: Introduction: Generally Gifts to individuals are not deductible as charitable contributions because…

Q: Sunshine Financial buys and sells securities which it classifies as available-for-sale. On July 1,…

A: Bonds are a type of loan i.e., issued by company and the subscriber of bond, is entitled to interest…

Q: Rensing, Inc., has $800,000 of 4% preferred stock and $1,200,000 of common stock outstanding, each…

A: Dividend is the amount that is to received by the stockholders of the company that is preference and…

Q: On December 31, 20X1, Roe Company leased a machine from Colt for a five-year period. Equal annual…

A: Lease is a contract under which one party agrees to rent an asset and property owned by another…

Q: Factory Overhead Cost Variances Thomas Textiles Corporation began November with a budget for 35,000…

A: Factory overhead refers to the cost that is incurred in operating the business activities of the…

Q: Goldenrod Company makes artificial flowers and reports the following data for the month: Purchases…

A: Production cost: It implies to the expense that is incurred by a business in the process of…

Q: You just completed your taxes and had $3,79 withheld for income taxes and a final tax liability of…

A: A tax refund seems to be the difference between the total amount of tax paid and the total amount of…

Q: Keep or Drop AudioMart is a retailer of radios, stereos, and televisions. The store carries two…

A: Income Statement :— It is one of the financial statement that shows profitability of company during…

Q: What was the total amount deducted from Lily’s pay for Federal, State, and Local income tax?…

A: Total taxes to be paid depends on wages and there are different types of taxes to be paid local…

Q: Prepare entry for write-off, and determine cash realizable value. BE8.4 (LO 2), AP At the end of…

A: Accounts receivables are part of the assets representing the amount to be collected for credit sales…

Q: During 2022, Thomas Company made the following expenditures (all material) relating to plant…

A: Repairs and maintenance are expenses a business incurs to restore an asset to a previous operating…

Q: Using the following data, estimate the new Return on Investment if there is a 9% decrease in the…

A: The return on investment shows the percentage earned by investing amount. It is calculated by…

Q: A furniture store received an invoice from a supplier for $12282 dated July 13, 2022 with terms…

A: Since you have posted more than one question, we can solve only one question. If you want any…

Q: Comparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8…

A: Depreciation is considered an expense charge on the value of the Asset. It can be calculated by…

Q: of normal capacity of 7,700 hours. Variable costs: Indirect factory wages $22,330 Power…

A: Factory overhead refers to those expenses which are associated with the production process of goods…

Q: Journalize entries for recognizing accounts receivable. E8.3 (LO 1), AP The following are two…

A: Sales on Account - Sales on account are the revenue earned by the company from the sale of inventory…

Q: In divisional income statements prepared for Demopolis Company, the Payroll Department costs are…

A: Generally, a small-scale business has only one department, But when the business runs on a large…

Q: Using the information in the attachment, what is the amount of taxable income? Round to the nearest…

A: It has been provided: Gross salary = $60,000 Net income = $48,000 Dividend income = $190 Itemized…

Q: The characteristic of a partnership where a partner is an agent for other partners and the…

A: Every partner is an agent of all other partners and the partnership business which means each…

Q: hich of the following is true about forward contracts? a. The party that agrees to buy the asset…

A: Solution: A forward contract is a contract between two parties to buy or sell an asset at a…

Q: Describe strategies Fund Managers would employed to best manage PRIVATE equity finance within a…

A: The first step is to create a clear and concise business plan that outlines the goals and objectives…

Q: At the beginning of Year 3 Randall Company had a $10400 balance in its accounts receivable account…

A: The allowance for doubtful accounts is created to record estimated bad debt expense for the period.…

Q: Silicone Engine Inc. produces wrist-worn tablet computers. The company uses Thin Film Crystal (TFC)…

A: Introduction:- The following basic information as follows under:- Standard Quantity = 580 Standard…

Q: was $1.25 and the company used E als price variance for Pharoah for $180 favorable

A: Answer : Material price variance = (Standard price -Actual price) * Actual units

Q: The Righter Shoe Store Company prepares monthly financial statements for its bank. The November 30…

A: T-Account :— It is a type of ledger in which all journal entry transaction is posted. Journal…

Q: Questions # 16-20 are based on the information below: Nadal Athletic has the following transactions…

A: Inventory Valuation Methods are methods of valuation of inventory. There are three methods of…

Q: X-Tel budgets sales of $55,000 for April, $110,000 for May, and $70,000 for June. Sales are 50% cash…

A: Cash Receipt Schedule :— This budget is prepared to estimate the cash collection from customer…

Q: During 2021, Bob Collins purchased 300 shares of common stock issued by Doctor's Medical Supply for…

A: When a person makes investment in stocks and any other type of financial asset or security then it…

Q: By taking into account information from the latest programme of Walmart (ethics and compliance) and…

A: There are a number of ethical, legal and professional implications associated with information…

Q: 1. What is the unit product cost under variable costing? 2. What is the unit product cost under…

A: Variable costing and absorption costing both is managerial accounting cost concept. The main…

Q: A printing press that costs $288,400 is depreciated using the 1.5 declining-balance method. The…

A: Depreciation expense is the one which is charged on the non-current assets of the entity so as to…

Q: Using the following data, estimate the new Return on Investment if there is a 11% increase in sales…

A: There has been an increase of 11% in sales. So new sales will be $3,838,419+11%=$4,260,645.09…

Q: The government has recently implemented many tax changes due to the American Reinvestment and…

A: The 2009 American Reinvestment and Recovery Act (ARRA) made a number of changes to the tax code.…

Q: What is ending inventory using lifo periodic What is cost of goods sold using weighted average…

A:

Q: Prepare journal entries to record the salary and wages expenses and the payment of liabilities (if…

A: Given in the question: Normal Hours per day 8 Overtime Rate 1.5 James Hourly Rate…

Step by step

Solved in 2 steps

- Silva Company is authorized to issue 5,000,000 shares of $2 par value common stock. In its IPO, the company has the following transaction: Mar. 1, issued 500,000 shares of stock at $15.75 per share for cash to investors. Journalize this transaction.Tama Companys capital structure consists of common stock and convertible bonds. At the beginning of 2019, Tama had 15,000 shares of common stock outstanding; an additional 4,500 shares were issued on May 4. The 7% convertible bonds have a face value of 80,000 and were issued in 2016 at par. Each 1,000 bond is convertible into 25 shares of common stock; to date, none of the bonds have been converted. During 2019, the company earned net income of 79,200 and was subject to an income tax rate of 30%. Required: Compute the 2019 diluted earnings per share.Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73

- On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 0 par common stock at 0, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a held- to-maturitv long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 545, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method, q. Accrued interest for three months on the Dream Inc. bonds purchased in (1). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions Journalize the selected transactions. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016. Income statement data: Advertising expense 150,000 Cost of merchandise sold 3,700,000 Delivery expense 30,000 Depreciation expense -office buildings and equipment 30,000 Depreciation expensestore buildings and equipment 100,000 Dividend revenue 4,500 Gain on sale of investment 4,980 Income from Pinkberry Co. investment 76,800 Income tax expense 140,500 Interest expense 21,000 Interest revenue 2,720 Miscellaneous administrative expense 7.500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,254,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable 194,300 Accounts receivable 545,000 Accumulated depreciationoffice buildings and equipment 1,580,000 Accumulated depreciationstore buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Available for sale investments (at cost) 260,130 Bonds payable. 5%. due 2024 500,000 Cash 246,000 Common stock, 20 par (400,000 shares authorized; 100,000 shares issued. 94,600 outstanding) 2,000,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 500,000 Income tax payable 44,000 Interest receivable 1,125 Investment in Pinkberry Co. stock (equity method) 1,009,300 Investment in Dream Inc. bonds (long term) 90,000 Merchandise inventory [December 31, 2016). at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4.320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over parcommon stock 886,800 Excess of issue price over parpreferred stock 150,000 Preferred 5% stock. 80 par (30,000 shares authorized; 20,000 shares issued] 1,600,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 2016 9,319,725 Store buildings and equipment 12,560,000 Treasury stock (5,400 shares of common stock at cost of 33 per share) 178,200 Unrealized gain (loss) on available for sale investments (6,500) Valuation allowance for available for sale investments (6,500)Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a heldtomaturity long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method. q. Accrued interest for three months on the Dream Inc. bonds purchased in (l). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016.

- Cary Corporation has 50,000 shares of 10 par common stock authorized. The following transactions took place during 2019, the first year of the corporations existence: Sold 5,000 shares of common stock for 18 per share. Issued 5,000 shares of common stock in exchange for a patent valued at 100,000. At the end of Carys first year, total contributed capital amounted to: a. 40,000 b. 90,000 c. 100,000 d. 190,000Percy Company has 15,000 shares of common stock outstanding during all of 2019. It also has 2 convertible securities outstanding at the end of 2019. These are: 1. Convertible preferred stock: 1,000 shares of 9%, 100 par, preferred stock were issued in 2015 for 140 per share. Each share of preferred stock is convertible into 3.5 shares of common stock. The current dividends have been paid. To date, no preferred stock has been converted. 2. Convertible bonds: Bonds with a face value of 100,000 and an interest rate of 10% were issued at par on July 1, 2019. Each 1,000 bond is convertible into 35 shares of common stock. To date, no bonds have been converted. Percy earned net income of 54,000 during 2019. Its income tax rate is 30%. Required: Compute the 2019 diluted earnings per share. What earnings per share amount(s) would Percy report on its 2019 income statement?