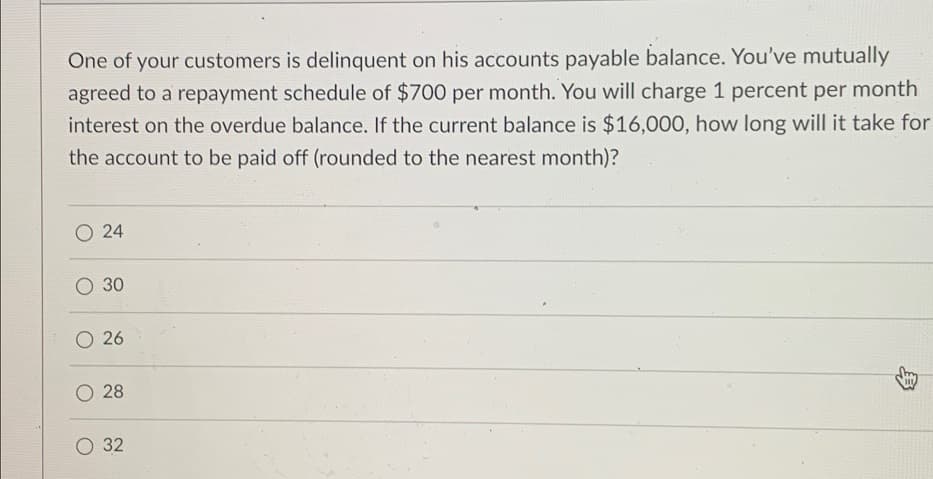

One of your customers is delinquent on his accounts payable balance. You've mutually agreed to a repayment schedule of $700 per month. You will charge 1 percent per month interest on the overdue balance. If the current balance is $16,000, how long will it take for the account to be paid off (rounded to the nearest month)? 24 O 30 26 28 32

One of your customers is delinquent on his accounts payable balance. You've mutually agreed to a repayment schedule of $700 per month. You will charge 1 percent per month interest on the overdue balance. If the current balance is $16,000, how long will it take for the account to be paid off (rounded to the nearest month)? 24 O 30 26 28 32

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 15MC: Marathon Peanuts converts a $130,000 account payable into a short-term note payable, with an annual...

Related questions

Question

Provide answer with explantion of correct and incorrect option

Transcribed Image Text:One of your customers is delinquent on his accounts payable balance. You've mutually

agreed to a repayment schedule of $700 per month. You will charge 1 percent per month

interest on the overdue balance. If the current balance is $16,000, how long will it take for

the account to be paid off (rounded to the nearest month)?

24

O 30

26

28

32

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning