onresidential real property is depreciated over 27

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 7BCRQ

Related questions

Question

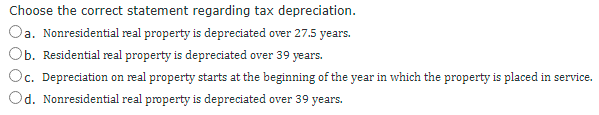

Transcribed Image Text:Choose the correct statement regarding tax depreciation.

a. Nonresidential real property is depreciated over 27.5 years.

Ob. Residential real property is depreciated over 39 years.

Oc.

c. Depreciation on real property starts at the beginning of the year in which the property is placed in service.

Od. Nonresidential real property is depreciated over 39 years.

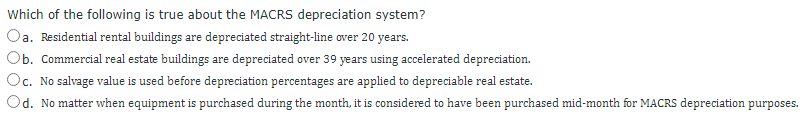

Transcribed Image Text:Which of the following is true about the MACRS depreciation system?

Oa. Residential rental buildings are depreciated straight-line over 20 years.

Ob. Commercial real estate buildings are depreciated over 39 years using accelerated depreciation.

Oc. No salvage value is used before depreciation percentages are applied to depreciable real estate.

Od. No matter when equipment is purchased during the month, it is considered to have been purchased mid-month for MACRS depreciation purposes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT