onsists of a lean cell for each customer. The following information relates to only one customer's lean cell for the coming year. For the year, projected labor and overhead was $3,253,600 and materials costs were $34 per unit. Planned production included 5,312 hours to produce 16,600 motor drives. Actual production for August was 1,940 units, and motor drives shipped amounted to 1,480 units. Conversion costs are applied based on units of production From the foregoing information, determine the production costs transferred to Finished Goods during August. Oa. $446,200 Ob. $340,400 Oc. $382,214 Od. $184,785

onsists of a lean cell for each customer. The following information relates to only one customer's lean cell for the coming year. For the year, projected labor and overhead was $3,253,600 and materials costs were $34 per unit. Planned production included 5,312 hours to produce 16,600 motor drives. Actual production for August was 1,940 units, and motor drives shipped amounted to 1,480 units. Conversion costs are applied based on units of production From the foregoing information, determine the production costs transferred to Finished Goods during August. Oa. $446,200 Ob. $340,400 Oc. $382,214 Od. $184,785

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter13: Lean Manufacturing And Activity Analysis

Section: Chapter Questions

Problem 3PA: Lean accounting Dashboard Inc. manufactures and assembles automobile instrument panels for both eCar...

Related questions

Question

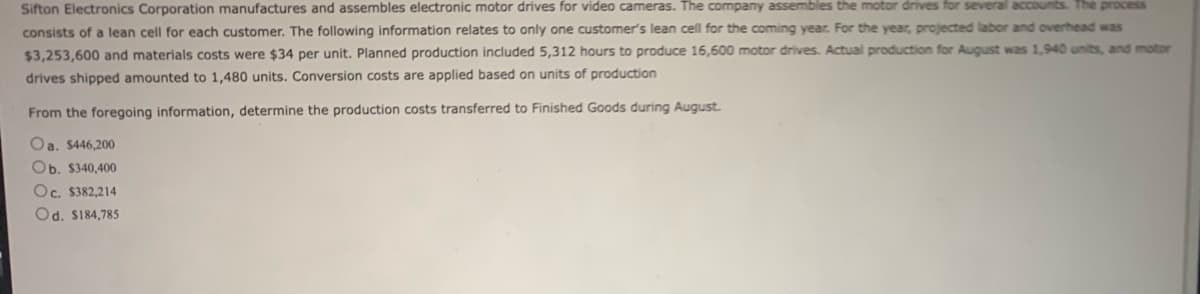

Transcribed Image Text:Sifton Electronics Corporation manufactures and assembles electronic motor drives for video cameras. The company assembles the motor drives for several accounts. The process

consists of a lean cell for each customer. The following information relates to only one customer's lean cell for the coming year. For the year, projected labor and overhead was

$3,253,600 and materials costs were $34 per unit. Planned production included 5,312 hours to produce 16,600 motor drives. Actual production for August was 1,940 units, and motor

drives shipped amounted to 1,480 units. Conversion costs are applied based on units of production

From the foregoing information, determine the production costs transferred to Finished Goods during August.

Oa. $446,200

Ob. $340,400

Oc. $382,214

Od. $184,785

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College