Ontario Tax 2023 Ontario Surtax 2021 From Το Rate From To Rate $0 $45,142 5.05% $0 $5,315 0% $49,231 $90,287 9.15% $5,315 $6,802 20% $98,463 $150,000 11.16% $6,802 Infinity 56% $150,000 $220,000 12.16% $220,000 Infinity 13.16%

Q: A stock trades at $100 today. In a year it will either be $120 or $30. What is the price of a $90 -…

A: Answer image:Option Market is a Stock Market Strategy. Under which investor will not purchase the…

Q: Problem 11-10 (Algo) You are a newsvendor selling the San Pedro Times every morning. Before you get…

A: Given:Price P=$1.30Cost C=$0.40Salvage Value S= 0mean µ=325standard deviation σ=65Daily demand is…

Q: Bonds: Builtrite is planning on offering a $1000 par value, 20 year, 8% coupon bond with an expected…

A: To calculate the after-tax cost of internal common equity (retained earnings), we can use the…

Q: Project B: % c. If the WACC was 5% and A and B were mutually exclusive, which project would you…

A: WACC = 5%:For Project A:NPV = -$1000 + ($200 / (1 + 0.05)) + ($400 / (1 + 0.05)^2) + ($600 / (1 +…

Q: how to calculate the bond's year to maturity formula?

A: Although it isn't utilized directly, the yield to maturity (YTM) idea is connected to the method…

Q: An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected…

A: Formula: Standard Deviation of Optimal Portfolio = Sqrt(wA^2 * σA^2 + wB^2 * σB^2 + 2 * wA * wB * σA…

Q: Dewyco has preferred stock trading at $51 per share. The next preferred dividend of $3 is due in one…

A: Step 1: The calculation of the cost of capital for preferred stock AB1Preferred stock price $…

Q: am. 11111

A:

Q: Problem 11-14 (Algo) Charlie's Pizza orders all of its pepperoni, olives, anchovies, and mozzarella…

A: Step 1: Calculate Demand During Lead TimeFirst, we calculate the expected demand during the 3-week…

Q: Question list Question 31 Question 32 K a. Use the appropriate formula to determine the periodic…

A: Step 1: Calculate the periodic deposit The formula for finding the amount of periodic deposit given…

Q: Lugget Corp. has one bond issue outstanding with an annual coupon of 3.8%, a face value of $1,000…

A: Estimate the Yield to Maturity (YTM):There are various approximation formulas for YTM. Here, we'll…

Q: 23. Non-callable bonds currently sells for 755.90. they have a 10-year maturity with yield to…

A: To find the coupon rate of the non-callable bond, we need to use the formula for the present value…

Q: A collar is established by buying a share of stock for $64, buying a 6-month put option with…

A: Step 1:(a). delta of call = N(d1) delta of put = N(d2) - 1 Hence, in collar if stock price…

Q: A call with a strike price of $50 costs $5. A put with the same strike price and expiration date…

A: First, let's define the terms:Call Option: An agreement that gives an investor the right (but not…

Q: What is the change in the value of seven November heating oil contracts for the prices displayed?…

A: Price Change: We can see the price went from an open of $3.6730 per gallon to a close of $3.7324 per…

Q: Terrell Trucking Company is in the process of setting its target capital structure. The CFO believes…

A: Calculate the EPS and stock price at each debt level:Debt/Capital Ratio: 20%EPS: $3·15Stock Price:…

Q: Required information Section Break (8-11) [The following information applies to the questions…

A: Step 1:A minimum variance portfolio is the mix of stock fund and bond fund which minimizes risk or…

Q: Markman & Sons is considering Projects S and L. These projects are mutually exclusive, equally…

A: To determine the value forgone by choosing the project with the higher Internal Rate of Return…

Q: A couple has decided to purchase a $90000 house using a down payment of $14000. They can amortize…

A: a) : P = 90000, down payment = 14000, loan amount = P - down paymentr = 9 / 100 / 12n = 30 * 12PMT…

Q: You sell short 200 shares of DTI that are currently selling at $25 per share. You post additional…

A: 1. Calculate the initial short sale value:• You short sold 200 shares at $25 per share. The total…

Q: You are in discussions to purchase an option on an office building with a strike price of $55…

A: Please comment down for any doubt. I hope my answer helps you.

Q: HighGrowth Company has a stock price of $21. The firm will pay a dividend next year of $0.86, and…

A:

Q: Consider Hurd Co., a U.S.-based MNC that wishes to analyze its economic exposure with respect to the…

A: This Estimate of a1 suggests that an appreciation of pound reduces Hurd's total Cash Flows. We can…

Q: Juan purchases an annuity for $3720 that will make 20 annual payments, the first to come in one…

A: In summary from the step-by-step explanation above,To calculate the annual payment of an annuity…

Q: Question 4 (9 marks) ABC Inc. is considering investing in the following capital project that is…

A: Step 1: The Net Present Value (NPV) is the difference between the discounted/present value of future…

Q: What does it mean to vest in a defined benefit or defined contribution plan?

A: Vesting in a defined benefit or defined contribution plan refers to the process by which an employee…

Q: Table 3.6 Yield Curve on May 15, 2000 2/2 ield Maturity Yield Maturity Yield 0.25 6.33% 2.75 6.86%…

A: (a) 3-year zero coupon bond: \[ D_a = \frac{{1 \cdot 1000}}{{(1+0.0676/2)^6}} \div…

Q: Given the following information for Smashville, Inc., construct a balance sheet: Current…

A: Step 1: Calculation of stockholders' equityTotal assets = Cash + Operating assets + Fixed assets +…

Q: 11.

A: The below Excel sheet contains the detailed procedure to calculate the answers:

Q: Global Enterprises has just signed a $3 million (nominal value) contract. The contract calls for a…

A: Given information: (cashflows in million) Cash flow in year 0 (CF0) = $0.5 Cash flow in year 1 (CF1)…

Q: Fisher Equation: Nominal, Real, and Inflation = 10%. Expected inflation is E(T) = Q1) You lend money…

A: Step 1: 1)Using exact fisher Equation:(1+r)=1+E(π)1+iPutting i = 10% or 0.1, E(π) = 3.5% or 0.035:…

Q: Bob makes his first $1,000 deposit into an IRA earning 6% compounded annually on the day he turns 22…

A:

Q: am. 116.

A: Let's now use the parameters provided for the first scenario to determine the call option's…

Q: The price of a product is 30 dollars per unit. A firm can produce this good with variable costs of…

A: In above answer, In the first problem, we calculated the breakeven output level for a firm that…

Q: 24. Company has $1,000 face value bonds outstanding with a market price of $1,575.30. the bonds pay…

A: Calculate the annual interest payment:Since the bond pays semi-annually, divide the YTM (12%) by 2:…

Q: Bhupatbhai

A: Let's examine each computation in greater detail: a. Times Interest Earned Ratio: This ratio…

Q: You are offered a four-year investment opportunity costing $450,000 today. The investment will pay…

A: To determine whether we should accept the investment opportunity, let's calculate the net present…

Q: Operating cach Inflows Afirm is considerin enewing its equipment to meet increased d ad demand for…

A: The objective of the question is to calculate the incremental earnings before depreciation,…

Q: The table shows the specifications of an adjustable rate mortgage (ARM). Assume no caps apply. Find…

A: Step 1: Identify the loan terms.The loan amount or principal is $88,314.The loan term is 60 months,…

Q: Read; Eiteman, Stonehill and Moffett, Multinational Business Finance How do you calculate these…

A: Solving the Peso Change Problem (Question 1)Calculation:Find the difference in old and new peso…

Q: Provide correct answer and also provide correct and incorrect option explanation

A: Option a: This option is correct. Step 1:We have to first calculate the stock price at the end of…

Q: Please help with blanks. I have checked my work but I keep getting it wrong. Please help with A and…

A: Step 1:Let's calculate the free cash flows in Honduran lempiras (Lp) for each year:Year 0:…

Q: A project has an initial cash outflow of $40,500 and produces cash inflows of $16,450, $17,800, and…

A: Given information: Discount rate (i) = 11% or 0.11 Initial Investment or cash outflow (CF0) =…

Q: None

A: Step 1:We first calculate the weights of each securities.Calculations are shown below:Face value of…

Q: Vijay

A: Calculating the Adjusted Present Value (APV) of the ProjectHere's how to calculate the APV of the…

Q: Burger Queen can sell preferred stock for $75 with an estimated flotation cost of $5.00. It is…

A: In above answer, the cost of preferred stock for Burger Queen is calculated by dividing the dividend…

Q: Exhibit 8 Prices on Royal Dutch and Shell, January 3, 1996 Security Price/Location 1. Quoted share…

A: 1. Quoted Share Price in Europe: This is the price of Royal Dutch shares as quoted in Europe, which…

Q: What is the correct formula for B9? 1 A Bond Valuation 2 Settlement Date 2/15/2018 3 Maturity Date…

A: The objective of the question is to find the correct formula for calculating the current yield of a…

Q: Pakodi

A: Approach to solving the question: To approach solving this question, begin by understanding the…

Q: Parents wish to have $80,000 available for a child's education. If the child is now 8 years old, how…

A: Refer to the attached image for the detailed solution:

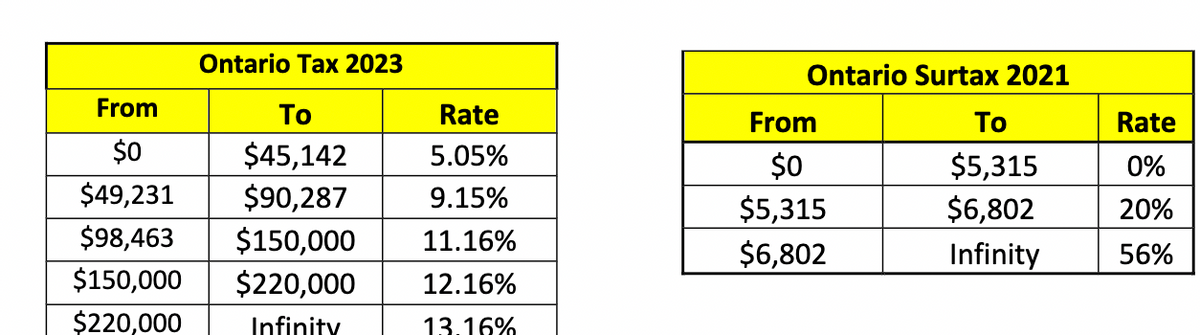

brackets and the surtax rates are provided below:

Part A: How much income results in paying $5,315 as provincial tax? How much income

leads to a $6,802 provincial tax?

Part B: Since the presence of surtax makes the tax system unnecessarily complicated,

we decide to eliminate it. However, we don’t want to reduce the amount of tax that the

provincial government collects. Using the two thresholds in Part A, as a result of

eliminating surtax, how would you change the provincial tax table such that each

individual pays the same amount of tax as before elimination of surtax? Note that number

of tax brackets and the tax rate in each bracket would be modified. Assume there is no

tax credit.

Step by step

Solved in 2 steps

- The following table pertains to C. J. Company: Year Taxable Income Tax Rate 2020 ($1,000,000) 25% 2021 $680,000 25% 2022 $725,000 20% What is income tax expense for 2021? Select one: a. $136,000 b. $80,000 c. $170,000 d. $0Red Velvet Corporation, a domestic corporation has the following data. 2021 2022 Gross Income 3,500,000.00 2,400,000.00 Taxable Income 125,000.00 500,000.00 The income tax payable for 2021 is 31,250 40,000 35,000 37,50057. GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 Nicanor, a Filipino Citizen residing in Manila, had the following data for the taxable year 2021: Gross income from rent of commercial spaces,net of P 60,000 withholding tax P 1,140,000 Dividend income From domestic corporation 50,000 From resident foreign corporation 60,000 From…

- 59. GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 Nicanor, a Filipino Citizen residing in Manila, had the following data for the taxable year 2021: Gross income from rent of commercial spaces,net of P 60,000 withholding tax P 1,140,000 Dividend income From domestic corporation 50,000 From resident foreign corporation 60,000 From…38. What is the total tax expense? A. P750,000 B. P600,000 C. P2,550,000 D. P300,000Taxpayer: Domestic Corporation (SME) It year of operation: 2017 Taxable period: 2021 Year 2017 2018 2019 2020 2021 2022 Gross Income 7,000,000 8,000,000 8,000,000 5,000,000 7,000,000 7,000,000 Deductions 8,000,000 7,500,000 6,000,000 6,000,000 5,900,000 6,000,000 Net (1,000,000) 500,000 2,000,000 (1,000,000) 1,100,000 1,000,000 Compute the corporate income tax should be paid in 2022?

- 20. Instructions Use the graduated tax table below if applicable: GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 A taxpayer made available the following financial information: Gross sales - Php 10,000,000 Cost of sales – Php 6,000,000 Expenses: Salaries and wages – Php 1,000,000 Transportation and travel – Php 20,000 Rental - Php 240,000 Representation expense – Php 200,000 Depreciation expense – Php 200,000 Office supplies – Php 20,000 Miscellaneous expenses – Php 10,000…GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 Nicanor, a Filipino Citizen residing in Manila, had the following data for the taxable year 2021: Gross income from rent of commercial spaces,net of P 60,000 withholding tax P 1,140,000 Dividend income From domestic corporation 50,000 From resident foreign corporation 60,000 From non-resident…GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 Nicanor, a Filipino Citizen residing in Manila, had the following data for the taxable year 2021: Gross income from rent of commercial spaces,net of P 60,000 withholding tax P 1,140,000 Dividend income From domestic corporation 50,000 From resident foreign corporation 60,000 From non-resident…

- GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 Nicanor, a Filipino Citizen residing in Manila, had the following data for the taxable year 2021: Gross income from rent of commercial spaces,net of P 60,000 withholding tax P 1,140,000 Dividend income From domestic corporation 50,000 From resident foreign corporation 60,000 From non-resident…How much is the total income tax expense recorded for the year ended December 31, 2019? a. P246,000 b. P270,000 c. P540,000 d. P786,00013. Instructions Use the graduated tax table below if applicable: GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 A taxpayer registered in 2020 made available the following financial information for TY2021: Balance Sheet: Asset - Php 500,000 Liability - Php 100,000 Stockholders' Equity - Php 400,000 Income Statement: Gross sales - Php 10,000,000 Cost of sales – Php 8,000,000 Operating Expenses - Php 5,000,000 How much is the income tax due under CREATE Law if the taxpayer is a domestic corporation? Group of answer choices Php 300,000 Php 600,000 Php 200,000…