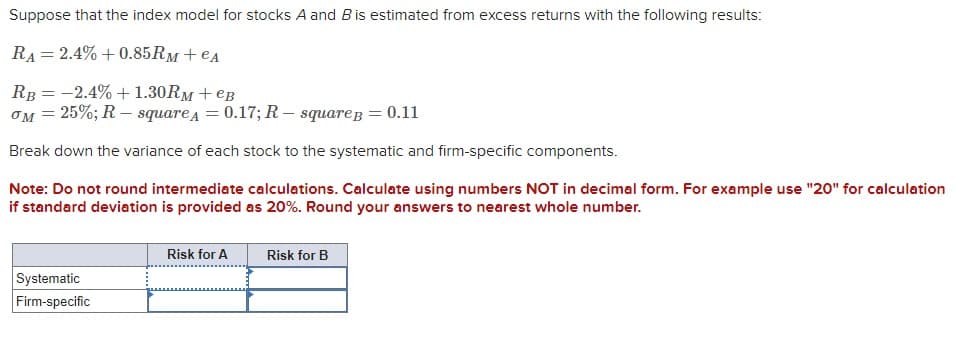

Suppose that the index model for stocks A and B is estimated from excess returns with the following results: RA 2.4%+0.85Rм+ еA = RB -2.4% +1.30Rм + еB = σM = 25%; R-squareA = 0.17; R-square B = 0.11 Break down the variance of each stock to the systematic and firm-specific components. Note: Do not round intermediate calculations. Calculate using numbers NOT in decimal form. For example use "20" for calculation if standard deviation is provided as 20%. Round your answers to nearest whole number. Systematic Firm-specific Risk for A Risk for B

Suppose that the index model for stocks A and B is estimated from excess returns with the following results: RA 2.4%+0.85Rм+ еA = RB -2.4% +1.30Rм + еB = σM = 25%; R-squareA = 0.17; R-square B = 0.11 Break down the variance of each stock to the systematic and firm-specific components. Note: Do not round intermediate calculations. Calculate using numbers NOT in decimal form. For example use "20" for calculation if standard deviation is provided as 20%. Round your answers to nearest whole number. Systematic Firm-specific Risk for A Risk for B

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter2: Risk And Return: Part I

Section: Chapter Questions

Problem 6P: The market and Stock J have the following probability distributions: a. Calculate the expected rates...

Related questions

Question

Pakodi

Transcribed Image Text:Suppose that the index model for stocks A and B is estimated from excess returns with the following results:

RA 2.4%+0.85Rм+ еA

=

RB -2.4% +1.30Rм + еB

=

σM = 25%; R-squareA = 0.17; R-square B = 0.11

Break down the variance of each stock to the systematic and firm-specific components.

Note: Do not round intermediate calculations. Calculate using numbers NOT in decimal form. For example use "20" for calculation

if standard deviation is provided as 20%. Round your answers to nearest whole number.

Systematic

Firm-specific

Risk for A

Risk for B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning