| CHAPTER 7 | WORKSHEET AND FINANCIAL STATEMENTS . After all of the account balances have been extended to the income statement columns of the worksheet, the totals of the debit and credit columns are P72,300 and P76,900, respectively. It can be concluded the company has a: net loss of P4,600 b. net income of P4,600 net income of P149,200 d. net loss of P149,200 a. с.

| CHAPTER 7 | WORKSHEET AND FINANCIAL STATEMENTS . After all of the account balances have been extended to the income statement columns of the worksheet, the totals of the debit and credit columns are P72,300 and P76,900, respectively. It can be concluded the company has a: net loss of P4,600 b. net income of P4,600 net income of P149,200 d. net loss of P149,200 a. с.

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 6.5APR: Multiple-step income statement and report form of balance sheet The following selected accounts and...

Related questions

Question

Transcribed Image Text:| CHAPTER 7 | WORKSHEET AND FINANCIAL STATEMENTS

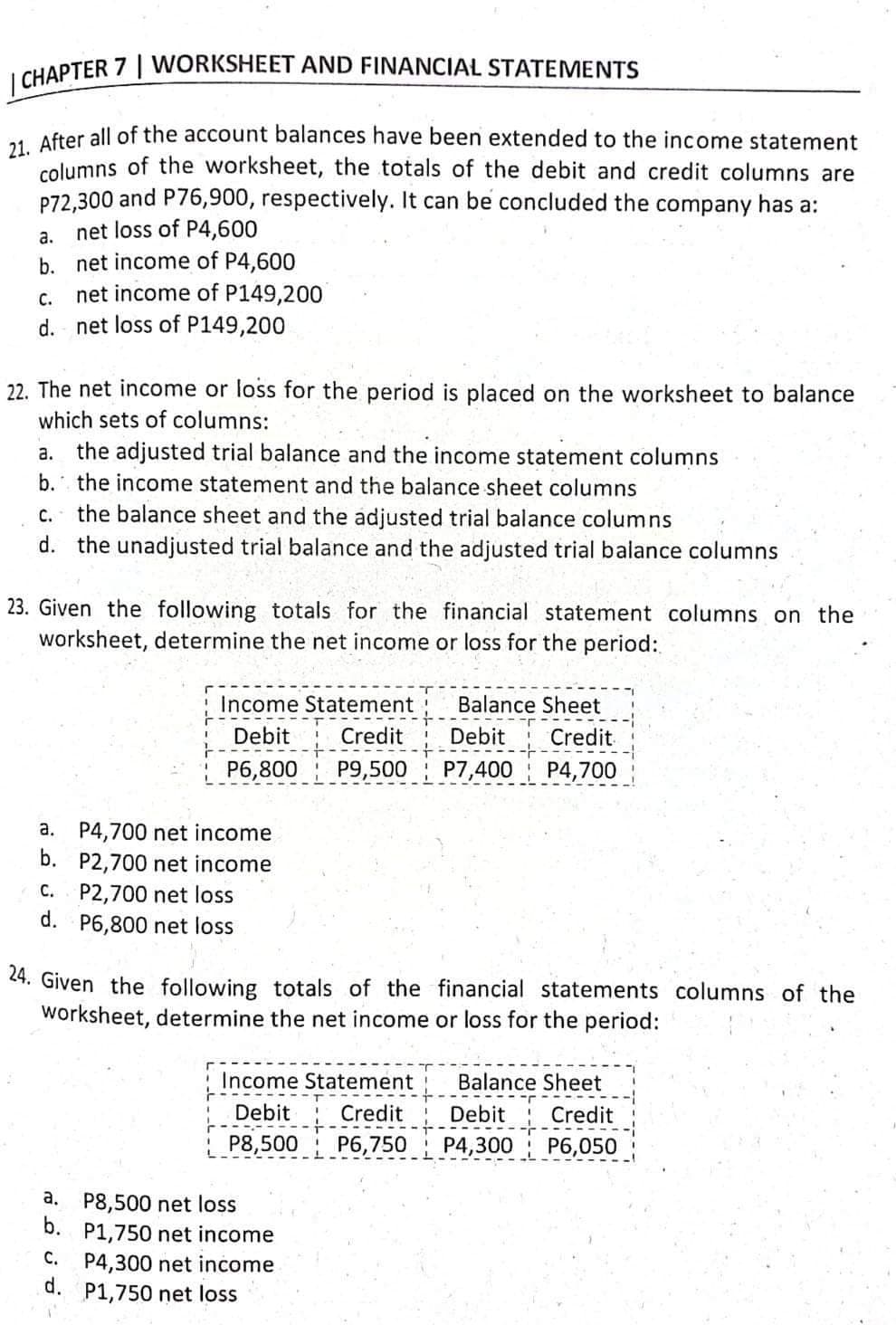

. After all of the account balances have been extended to the income statement

columns of the worksheet, the totals of the debit and credit columns are

P72,300 and P76,900, respectively. It can be concluded the company has a:

net loss of P4,600

b. net income of P4,600

net income of P149,200

d. net loss of P149,200

а.

С.

22. The net income or loss for the period is placed on the worksheet to balance

which sets of columns:

a.

the adjusted trial balance and the income statement columns

b. the income statement and the balance sheet columns

the balance sheet and the adjusted trial balance columns

d. the unadjusted trial balance and the adjusted trial balance columns

с.

23. Given the following totals for the financial statement columns on the

worksheet, determine the net income or loss for the period:

Income Statement

Balance Sheet

Debit

Credit

Debit

Credit

P6,800

Р9,500

P7,400

P4,700

a. P4,700 net income

b. P2,700 net income

C. P2,700 net loss

d. P6,800 net loss

24. Given the following totals of the financial statements columns of the

worksheet, determine the net income or loss for the period:

Income Statement

Balance Sheet

Debit

Credit

Debit Credit

P8,500

P6,750 P4,300 P6,050

a. P8,500 net loss

b. P1,750 net income

C. P4,300 net income

d. P1,750 net loss

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning