|, income statement

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 9MC: Brooks Company reported a prior period adjustment of 512,000 in pretax financial "income" and...

Related questions

Question

Please help me experts

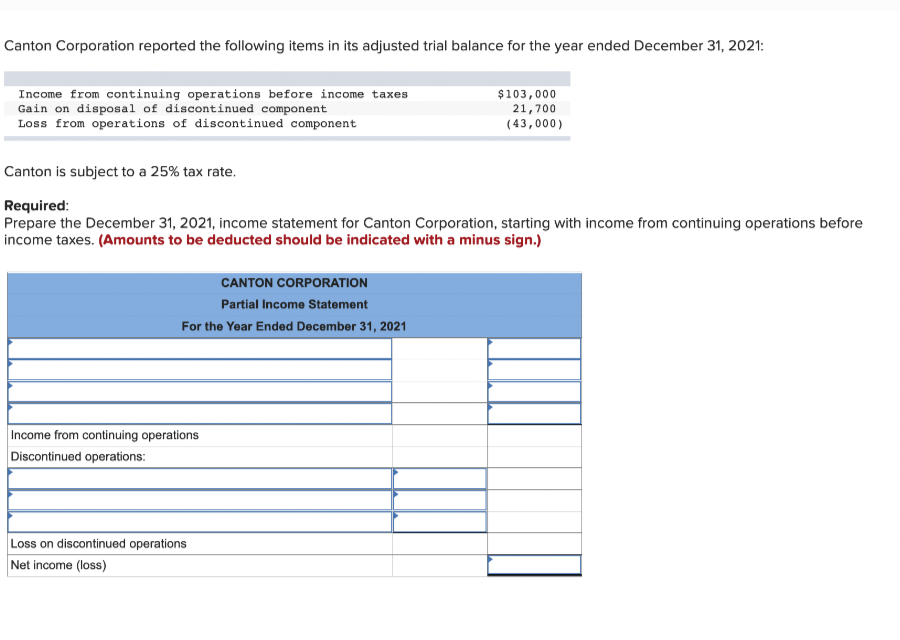

Transcribed Image Text:Canton Corporation reported the following items in its adjusted trial balance for the year ended December 31, 2021:

Income from continuing operations before income taxes

Gain on disposal of discontinued component

Loss from operations of discontinued component

$103,000

21,700

(43,000)

Canton is subject to a 25% tax rate.

Required:

Prepare the December 31, 2021, income statement for Canton Corporation, starting with income from continuing operations before

income taxes. (Amounts to be deducted should be indicated with a minus sign.)

CANTON CORPORATION

Partial Income Statement

For the Year Ended December 31, 2021

Income from continuing operations

Discontinued operations:

Loss on discontinued operations

Net income (loss)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning