how solutio

Q: Indicate the effect that each transaction/event listed here will have on the financial ratio listed ...

A: Transaction/Event Explanation a. Purchased inventory on account. Purchases of inventory on accou...

Q: Flintstone Company is owned equally by Fred Stone and his sister Wilma, each of whom holds 1,700 sha...

A: The stock redemptions should be considered as exchange if they are substantially disproportionate wi...

Q: On Janaury 1, 2021, Eastern Corp. received P 1,077,200 for P 1,000,000 face amount 12% bonds. The bo...

A: Interest expense refers to the cost or expense which is incurred through the entity for the borrowed...

Q: 29. A VAT-taxpayer made the following sales during the year: P 100,000 Domestic Sales Export Sales 1...

A: 29. Amount subject to business tax is P220000

Q: P4.3A (LO 1, 2, 4) Financial Statement The completed financial statement columns of the work- sheet ...

A: 1. Closing Entries - Before making balance sheet some temporary accounts needs to be closed. Hence c...

Q: Bank CO approved a loan application of Client ME on January 1, 20A for P3,500,000. Client ME is requ...

A: Direct origination costs are initially added to the carrying amount of the loan and are subsequently...

Q: The ledger of Mai Company includes the following accounts with normal balances as of December 31: Co...

A:

Q: anhoe Leasing Company agrees to lease equipment to Shamrock Corporation on January 1, 2020. The foll...

A: Calculation of Annual Rental Payment A...

Q: On March 1, 2014, Medium Corp. issued at 103 excluding accrued interest, 1,000 of its 15% , P 1,000 ...

A: A bond is a fixed-income instrument that represents a loan made by an investor to a borrower.

Q: On January 1, 2002, Brownies Corp. issued 1,000 of its 10%, P1,000 bonds for P1,040,000. These bonds...

A: Solution:- Given, Brownies Corp. issued 1000 of its 10%, P1,000 bonds for P1,040,000 Bonds were to m...

Q: Three of the following are requisites of an obligation. Which is the exception? Efficient cause Pres...

A: The four essential elements of an obligation are: an Active Subject, a Passive Subject, The Prestati...

Q: In retail we are always adjusting our operations to ensure financial goals are met. Aside from adjus...

A: Introduction Adjustments is carried out to show the accurate picture of financial statement at the e...

Q: Tina taxpayer makes $75000 a year. what are her average and marginal tax rates if she required to p...

A: In order to determine the average tax rate, the total tax obligation is required to be divided by th...

Q: Asset A has an expected return of 20% and a standard deviation of 25%. The risk free rate is 10%. Wh...

A: Expected Return 20% Standard Deviation 25% Risk Free Rate of Return 10% Find - Reward ...

Q: aroah Company purchased equipment that cost $3180000 on January 1, 2020. The entire cost was recorde...

A: Solution: Depreciation expense amount for the year should be recorded as an expense. However while a...

Q: 9. A change in accounting principle requires that the cumulative effect of the change for prior peri...

A: Change in Accounting Principle - Change in the accounting principle includes changing the inventory ...

Q: Input Cost/Block Direct materials 0.5 Ib. @ $12/lb. $ 6.00 Direct manufacturing labour 1.4 hours @ $...

A: Variances mean the difference in the budgeted and actual figures. These can have both favorable (F) ...

Q: The Priceline Group Inc. (PCLN) is a leading provider of online travel reservation services, includi...

A: Free Cash Flow: Generally speaking, free cash flow (FCF) is the cash that a firm earns after deducti...

Q: 9. the BIR is under the supervision of the: A. Department of Budget B. Bureau of Customs 10. Which o...

A: 9.Answer: C. Department of Finance. The Bureau of Internal Revenue (Filipino: Kawanihan ng Rentas In...

Q: Required: 1. Determine budgeted cash collections for July and August. 2. Determine budgeted cash p...

A: Cash Collections for July = 70% of July Sales + 30% of July Credit Sales + 70% of June Credit Sales ...

Q: Super Pharma Company had the following transactions: 1. Issued capital stock for $935,000. 2. Purcha...

A: The financial statements of the business includes income statement, balance sheet and the statement ...

Q: 3. Below is information pertaining to The Lime Green Wasp Corporation for the current year. On a sep...

A: Income statement shows the net income of the company and it is the difference between total revenue ...

Q: Iguana, Inc., manufactures bamboo picture frames that sell for $20 each. Each frame requires 4 linea...

A: Solution 1: Sales Budget - Iguana Inc. Particulars April May June 2nd Quarter Total ...

Q: Super Pharma Company had the following transactions: 1. Issued capital stock for $935,000. 2. Purch...

A: Solution: A trial balance is a worksheet in which the balance of all ledgers are reported into debit...

Q: Indicate the effect that each transaction/event listed here will have on the financial ratio listed ...

A: Introduction Financial ratios are used for the interpretation of the financial and results of the op...

Q: The annual amount of a series of payments to be made at the end of the next twelve years is P500. Wh...

A: Answered:

Q: Absorption Costing Income Statement (Conversion from Variable Net Income) 4. LEGAZPI COMPANY manufac...

A: Solution... FIXED manufacturing overhead costs per unit under absorption costing = Total fixed ...

Q: Cost of long-term asset = $50,000 Accumulated Depreciation = S25,000 Sales price of L-T asset = $30,...

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in...

Q: shall be paid on September 15, 20X2. Find the final amount at the end of the load period.(Use banker...

A: Promissory note refers to an instrument or written document in which one party promise another party...

Q: Does the net income amount reported on the Balance Sheet always reflect the increase in cash during ...

A:

Q: It means "choice of the person". Due to this principle, no one can be a member of the partnership as...

A: As per the principle of choice of the person, every partner has a right to choose his partner.

Q: s a prospective member of the accounting profession detail what you consider to be the four (4) most...

A: competent professional accountant in business is considered to be Paramount and invaluable assets fo...

Q: ! Required information [The following information applies to the questions displayed below.] In 2021...

A: Opportunity tax credit is tax credit which helps to pay education expenses for 4 years after high s...

Q: Determine the annual cost of ownership for a vehicle that has the following cos Use an interest rate...

A: Cost of ownership includes all different cost incurred at various time from initial payment to other...

Q: As regards capitalist partners, the prohibition may extend to operation which is of

A: A capitalist partner is one who contributes money or property to the capital of the company.

Q: On January 1, a company issued and sold a $430,000, 5%, 10-year bond payable, and received proceeds ...

A: GIVEN On January 1, a company issued and sold a $430,000, 5%, 10-year bond payable, and received p...

Q: 1, 2021, Tim Co. sold 12% bonds with a face value of P600,000. The bonds mature in five years, and i...

A: Interest expense will be the sum of interest expenses for the first two semiannual periods. For this...

Q: d1 where the bonds wer

A: A bond refers to the form of a financial instrument which is used while investing in mutual funds or...

Q: Awe Company pays CU500,000,000 for a 30% interest in Groy Company on July 1, 19x2 when the book valu...

A: An intangible asset which is related to the purchase of one company by another is known as goodwill....

Q: Given the following data: Selling price per unit Variable production cost per unit Fixed production ...

A: Break-even point is the situation where the firm neither earns any profits nor suffers any losses.

Q: Alyssa bought a machine (7-year property) for her business on May 5, 2021 for $6.400. She uses the m...

A: Under MACRS, the first year depreciation rate for 7-year property is 14.29%. As the machine has been...

Q: Chavez Wholesale Inc. changed its method of valuing inventory from the average cost method to the FI...

A: A journal entry is an accounting entry which is used to record a commercial transaction in the accou...

Q: Equivalent Units of Production The following information concerns production in the Baking Departme...

A:

Q: On December 31, 2018, an entity reported the following equity items: 8% cumulative preference shares...

A: Common stock: Common stock is a type of stock recorded in the company's balance sheet as one of the ...

Q: On January 1, 2016, Truffle Corp. issued 9% bonds in the face amount of P 5,000,000, which maature o...

A: Interest expense = Issue price of the bonds x yield rate of interest x No. of months in calendar yea...

Q: Current Attempt in Progress Concord Manufacturing owns equipment that cost €66,600 when purchased on...

A: A journal entry is an accounting entry which is used to record a business recorded in the accounting...

Q: On January 1, 2016, Saul Company issued convertible bonds with a face amount of P 5,000,000 for P 6,...

A: Loss on extinguishement of convertible bonds on December 31,2018 = carrying amount as on date - fa...

Q: You have been engaged to review the financial statements of Flint Corporation. In the course of your...

A: Solution:- Preparation of the necessary correcting entries, assuming that Flint uses a calendar-year...

Q: apar int tenancy with right of At the time of the purcha hetter financial nosition .

A: So in present case Answer is option 1) $ 0 Explanation given below When one of the original owners...

Q: Calculate the amount of the annual rental payment required. (Round present value factor calculations...

A: The question is based on the concept of Financial Accounting.

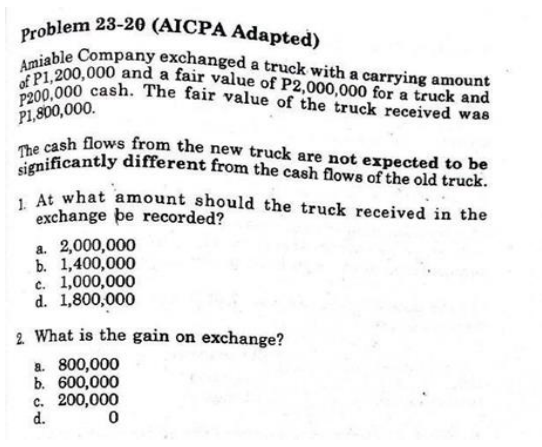

Show solution in good accounting form

Step by step

Solved in 2 steps with 2 images

- Amble, Inc. exchanged a truck with a carrying amount of ₱12,000 and a fair value of ₱20,000 for a truck and ₱5,000 cash. The fair value of the truck received was ₱15,000. At what amount should Amble record thetruck received in the exchange? a. 7,000 b. 9,000 c. 12,000 d. 15,000 Why is the correct answer is 15,000The company provided the data of PP&E in a cash-generating unit (CGU) as follows: Cost Accumulated Depreciation Equipment A $ 15,000 $ 8,000 Equipment B 30,000 19,000 Equipment C 45,000 23,000 The unit’s fair value less costs to sell was $25,000. The unit’s future cash flows was $32,000, and its present value was $28,000. The company adopted IFRS. Prepare journal entries to record impairment. If the recoverable amount of Equipment C is $19,000, prepare journal entries to record impairment. If the recoverable amount of Equipment C is $24,000, prepare journal entries to record impairment.Amble Inc. exchanged a truck with a book value of $12,000 and a fair value of $20,000 for a truck and $5,000 cash. The exchange has commercial substance. At what amount should Amble record the truck received? a. $12,000 b. $15,000 c. $20,000 d. $25,000

- Toro Co. has equipment with a carrying amount of$700,000. The expected future net cash flows from theequipment are $705,000, and its fair value is $590,000.The equipment is expected to be used in operations inthe future. What amount (if any) should Toro report asan impairment to its equipment?Winn Company exchanged an old machine having a carrying amount of P16,800, and paid a cash difference of P6,000 for a new machine having a total cash price of P20,500. The cash flows from the new machine are expected to be significantly different than the cash flows from the old machine. What amount of loss should Winn recognize on this exchange?On july 1, 2021, PAOLO exchanged its-non-monetary asset (equipment) with YEN's non-monetary asset (machinery). the following data were made available: PAOLO: Equipment P4,400,000 accumulated depreciation 2,000,000 cash received from gerald 3,000,000 YEN: Machinery P3,700,000 Accumulated depreiation 1,800,000 Fair value of the machinery 2,100,000 The exchange has significantly changed the cash flows of each entity. How much is the cost of the new asset of PAOLO?

- ABC has determined that one of its cash generating units (CGU) is impaired. The assets of the CGU at their book value are: Land – 4,000,000; Factory – 1,200,000; Machinery and Equipment – 1,800,000. The value in use of the cash generating unit is P5,500,000. The impairment loss allocated to Machinery and Equipment is? (do not round off the percentage, round off your final answer to the nearest peso)RCG Company, purchased machinery to be used in production forP6,500,000 on April 1, 2017. The machine had a 5-year life, P500,000 residual value, and was depreciated using the double declining balance method. On January 1, 2020 a test forimpairment indicated that the undiscounted cash flows from the machine are less than its carrying value. The machine's value in use on January 1, 2020 is P1,100,000. 1. What is the loss on impairment?Swifty Corporation has equipment with a carrying amount of $2540000. The expected future net cash flows from the equipment are $2575000, and its fair value is $2049000. The equipment is expected to be used in operations in the future. What amount (if any) should Swifty report as an impairment to its equipment? $35000. $491000. $526000. No impairment should be reported.

- On July 1, 2021, PAOLO exchanged its non-monetary asset (equipment) with YEN's non- monetary asset (machinery). The following data were made available: PAOLO: Equipment Accumulated depreciation Fair value of the Equipment P4.400,000 2.000,000 3,000,000 YEN: Machinery Accumulated depreciation Fair value of the machinery P3,700,000 1,800,000 2,100,000 The exchange has significantly changed the cash flows of each entity. How much is cost of the new asset of PAOLO?Calaveras Tire exchanged equipment for two pickup trucks. The book value and fair value of the equipment given up were $20,000 (original cost of $65,000 less accumulated depreciation of $45,000) and $17,000, respectively. Assume Calaveras paid $8,000 in cash and the exchange has commercial substance. (1) At what amount will Calaveras value the pickup trucks? (2) How much gain or loss will the company recognize on the exchange?ABC is testing a store branch for impairment. The assets of thebranch include a building with a carrying amount of P4,000,000,equipment of P3,000,000, inventory of P2,000,000 and goodwill ofP500,000. The fair value less cost to dispose of the inventory is P2,500,000.The expected cashflows from the branch are: Year Amount1 P 2,000,0002 1,700,0003 1,500,0004 1,500,0005 1,300,000 The effective interest rate is 9%. The present value of the cashflowsbeyond year 5 is estimated to be at P400,000. 10. Value in use of the store branch11. Total Impairment Loss12. Carrying value of the building after impairment13. Carrying value of the inventory after impairment14. Carrying value of the goodwill after impairment