| Student Portal Main $ Third Party Resource LCS Learni X WileyPLUS edugen.wileyplus.com/edugen/Iti/main.uni LUS S Kieso, Intermediate Accounting, 17e Help | System Announcements CALCULATOR PRINTER VERSION (BACK MEX RCES Transactions during 2020 and other information relating to Windsor's long-term receivables were as follows. The $2,100,000 note receivable is dated May 1, 2019, bears interest at 10%, and represents the balance of the consideration received from the sale of Windsor's electronics division to New York Company. Principal payments of $700,000 plus appropriate interest are due on May 1, 2020, 2021, and 2022. The first principal and interest payment was made on May 1, 2020. Collection of the note installments is reasonably assured. 1. The $492,900 note receivable is dated December 31, 2019, bears interest at 9%, and is due on December 31, 2022. The note is due from Sean May, president of Windsor Inc. and is collateralized by 12,323 shares of Windsor's common stock. Interest is payable annually on December 31, and all interest payments were paid on their due dates through December 31, 2020. The quoted market price of Windsor's common stock was $44 per share on December 31, 2020. 2. On April 1, 2020, Windsor sold a patent to Pennsylvania Company in exchange for a $124,000 zero-interest-bearing note due on April 1, 2022. There was no established exchange price for the patent, and the note had no ready market. The prevailing rate of interest for a note of this type at April 1, 2020, was 10%. The present value of $1 for two periods at 10% is 0.826 (use this factor). The patent had a carrying value of $49,600 at January 1, 2020, and the amortization for the year ended December 31, 2020, would have been $9,920. The collection of the note receivable from Pennsylvania is reasonably assured. On July 1, 2020, Windsor sold a parcel of land to Splinter Company for $200,000 under an installment sale contract. Splinter made a $60,000 cash down payment on July 1. 2020, and signed a 4-year 9% note for the $140,000 balance, The equal annual payments of principal and interest on the note will be $45,125 payable on July 1, 2021, through July 1, 2024. The land could have been sold at an established cash price of $200,000. The cost of the land to Windsor was $150,000. Circumstances are such that the collection of the installments on the note is reasonably assured. 3. 4. Study (a) Prepare the long-term receivables section of Windsor's balance sheet at December 31, 2020. (Round answers to 0 decimal places, e.g. 5 125.) WINDSOR INC. Long-Term Receivables Section of Balance Sheet here to search

| Student Portal Main $ Third Party Resource LCS Learni X WileyPLUS edugen.wileyplus.com/edugen/Iti/main.uni LUS S Kieso, Intermediate Accounting, 17e Help | System Announcements CALCULATOR PRINTER VERSION (BACK MEX RCES Transactions during 2020 and other information relating to Windsor's long-term receivables were as follows. The $2,100,000 note receivable is dated May 1, 2019, bears interest at 10%, and represents the balance of the consideration received from the sale of Windsor's electronics division to New York Company. Principal payments of $700,000 plus appropriate interest are due on May 1, 2020, 2021, and 2022. The first principal and interest payment was made on May 1, 2020. Collection of the note installments is reasonably assured. 1. The $492,900 note receivable is dated December 31, 2019, bears interest at 9%, and is due on December 31, 2022. The note is due from Sean May, president of Windsor Inc. and is collateralized by 12,323 shares of Windsor's common stock. Interest is payable annually on December 31, and all interest payments were paid on their due dates through December 31, 2020. The quoted market price of Windsor's common stock was $44 per share on December 31, 2020. 2. On April 1, 2020, Windsor sold a patent to Pennsylvania Company in exchange for a $124,000 zero-interest-bearing note due on April 1, 2022. There was no established exchange price for the patent, and the note had no ready market. The prevailing rate of interest for a note of this type at April 1, 2020, was 10%. The present value of $1 for two periods at 10% is 0.826 (use this factor). The patent had a carrying value of $49,600 at January 1, 2020, and the amortization for the year ended December 31, 2020, would have been $9,920. The collection of the note receivable from Pennsylvania is reasonably assured. On July 1, 2020, Windsor sold a parcel of land to Splinter Company for $200,000 under an installment sale contract. Splinter made a $60,000 cash down payment on July 1. 2020, and signed a 4-year 9% note for the $140,000 balance, The equal annual payments of principal and interest on the note will be $45,125 payable on July 1, 2021, through July 1, 2024. The land could have been sold at an established cash price of $200,000. The cost of the land to Windsor was $150,000. Circumstances are such that the collection of the installments on the note is reasonably assured. 3. 4. Study (a) Prepare the long-term receivables section of Windsor's balance sheet at December 31, 2020. (Round answers to 0 decimal places, e.g. 5 125.) WINDSOR INC. Long-Term Receivables Section of Balance Sheet here to search

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 86BPSB

Related questions

Question

Need help with answering the questiins. Thank you

Transcribed Image Text:| Student Portal Main

$ Third Party Resource LCS Learni X

WileyPLUS

edugen.wileyplus.com/edugen/Iti/main.uni

LUS

S Kieso, Intermediate Accounting, 17e

Help | System Announcements

CALCULATOR

PRINTER VERSION

(BACK

MEX

RCES

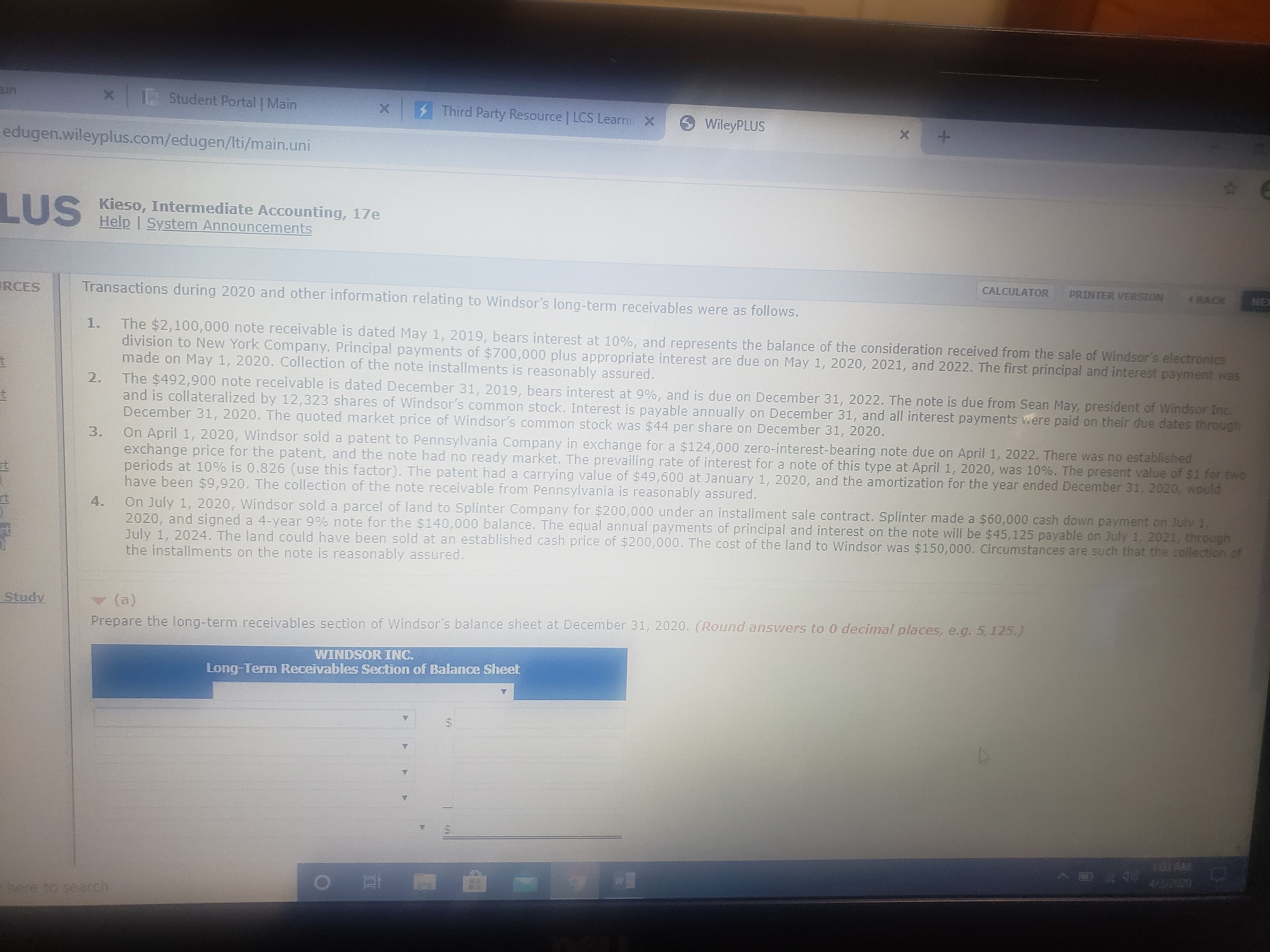

Transactions during 2020 and other information relating to Windsor's long-term receivables were as follows.

The $2,100,000 note receivable is dated May 1, 2019, bears interest at 10%, and represents the balance of the consideration received from the sale of Windsor's electronics

division to New York Company. Principal payments of $700,000 plus appropriate interest are due on May 1, 2020, 2021, and 2022. The first principal and interest payment was

made on May 1, 2020. Collection of the note installments is reasonably assured.

1.

The $492,900 note receivable is dated December 31, 2019, bears interest at 9%, and is due on December 31, 2022. The note is due from Sean May, president of Windsor Inc.

and is collateralized by 12,323 shares of Windsor's common stock. Interest is payable annually on December 31, and all interest payments were paid on their due dates through

December 31, 2020. The quoted market price of Windsor's common stock was $44 per share on December 31, 2020.

2.

On April 1, 2020, Windsor sold a patent to Pennsylvania Company in exchange for a $124,000 zero-interest-bearing note due on April 1, 2022. There was no established

exchange price for the patent, and the note had no ready market. The prevailing rate of interest for a note of this type at April 1, 2020, was 10%. The present value of $1 for two

periods at 10% is 0.826 (use this factor). The patent had a carrying value of $49,600 at January 1, 2020, and the amortization for the year ended December 31, 2020, would

have been $9,920. The collection of the note receivable from Pennsylvania is reasonably assured.

On July 1, 2020, Windsor sold a parcel of land to Splinter Company for $200,000 under an installment sale contract. Splinter made a $60,000 cash down payment on July 1.

2020, and signed a 4-year 9% note for the $140,000 balance, The equal annual payments of principal and interest on the note will be $45,125 payable on July 1, 2021, through

July 1, 2024. The land could have been sold at an established cash price of $200,000. The cost of the land to Windsor was $150,000. Circumstances are such that the collection of

the installments on the note is reasonably assured.

3.

4.

Study

(a)

Prepare the long-term receivables section of Windsor's balance sheet at December 31, 2020. (Round answers to 0 decimal places, e.g. 5 125.)

WINDSOR INC.

Long-Term Receivables Section of Balance Sheet

here to search

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning