Oregon Company is in the process of preparing its financial statements for 2024 Assume that no entries for any depreciation or accounting changes have been recorded in 2024 The following information related to depreciation of fixed assets is provided to you Oregon purchased a machine on July 1, 2022 at a cost of $80,000. The machine has a salvage value of $8,000 and a useful life o years Oregon's bookkeeper recorded straight line depreciation in 2022 and 2023 but erroneously assumed a useful life of 10 years Following all appropriate adjusting/correcting journal entres, the 12/31/24 balance of Accumulated Depreciation Machine will be Select one a $22.500 Ob $27,500 O $31,556 Od $23.400 O $18,000 Clear my choice

Oregon Company is in the process of preparing its financial statements for 2024 Assume that no entries for any depreciation or accounting changes have been recorded in 2024 The following information related to depreciation of fixed assets is provided to you Oregon purchased a machine on July 1, 2022 at a cost of $80,000. The machine has a salvage value of $8,000 and a useful life o years Oregon's bookkeeper recorded straight line depreciation in 2022 and 2023 but erroneously assumed a useful life of 10 years Following all appropriate adjusting/correcting journal entres, the 12/31/24 balance of Accumulated Depreciation Machine will be Select one a $22.500 Ob $27,500 O $31,556 Od $23.400 O $18,000 Clear my choice

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter10: Long-lived Tangible And Intangible Assets

Section: Chapter Questions

Problem 22E

Related questions

Question

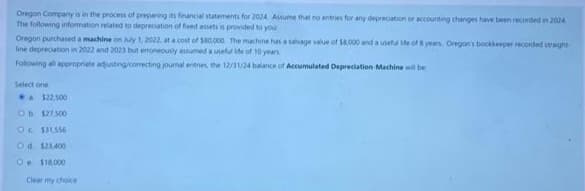

Transcribed Image Text:Oregon Company is in the process of preparing its financial statements for 2024 Assume that no entries for any depreciation or accounting changes have been recorded in 2024

The following information related to depreciation of fixed assets is provided to your

Oregon purchased a machine on July 1, 2022, at a cost of $80,000. The machine has a salvage value of $8,000 and a useful life of 8 years. Oregon's bookkeeper recorded straight

line depreciation in 2022 and 2023 but erroneously assumed a useful life of 10 years

Following all appropriate adjusting/correcting journal entries, the 12/31/24 balance of Accumulated Depreciation Machine will be

Select one

a $22,500

Ob $27.500

Oc $31,556

Od $23,400

O $18,000

Clear my choice

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning