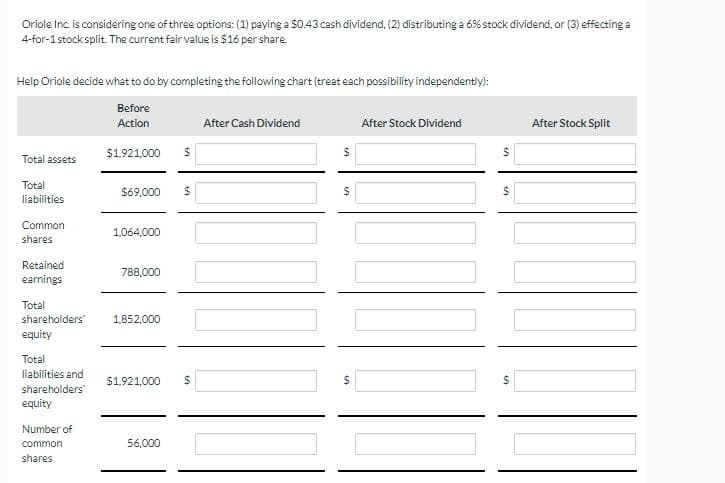

Oriole Inc is considering one of three options: (1) paying a S0.43 cash dividend, (2) distributing a 6% stock dividend, or (3) effecting a 4-for-1 stock split. The current fair value is $16 per share. Help Oriole decide what to do by completing the following chart (treat each possibility independentiy): Before Action After Cash Dividend After Stock Dividend After Stock Split $1.921,000 Total assets Total $69,000 liabilities Common 1,064,000 shares Retained 788,000 earnings Total shareholders 1.852,000 equity Total liabilities and shareholders $1.921,000 %24 equity Number of common 56,000 shares

Oriole Inc is considering one of three options: (1) paying a S0.43 cash dividend, (2) distributing a 6% stock dividend, or (3) effecting a 4-for-1 stock split. The current fair value is $16 per share. Help Oriole decide what to do by completing the following chart (treat each possibility independentiy): Before Action After Cash Dividend After Stock Dividend After Stock Split $1.921,000 Total assets Total $69,000 liabilities Common 1,064,000 shares Retained 788,000 earnings Total shareholders 1.852,000 equity Total liabilities and shareholders $1.921,000 %24 equity Number of common 56,000 shares

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 4RE: Use the same facts as in RE 16-3, but instead assume that Pickens declares and issues a 50% stock...

Related questions

Question

Transcribed Image Text:Oriole Inc is considering one of three options: (1) paying a $0.43 cash dividend, (2) distributing a 6% stock dividend, or (3) effecting a

4-for-1 stock split. The current fair value is $16 per share.

Help Oriole decide what to do by completing the following chart (treat each possibility independentiy):

Before

Action

After Cash Dividend

After Stock Dividend

After Stock Split

$1921,000

Total assets

Total

$69,000

liabilities

Common

1,064,000

shares

Retained

788,000

earnings

Total

shareholders'

1.852,000

equity

Total

liabilities and

$1.921,000

24

shareholders

equity

Number of

common

56,000

shares

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning