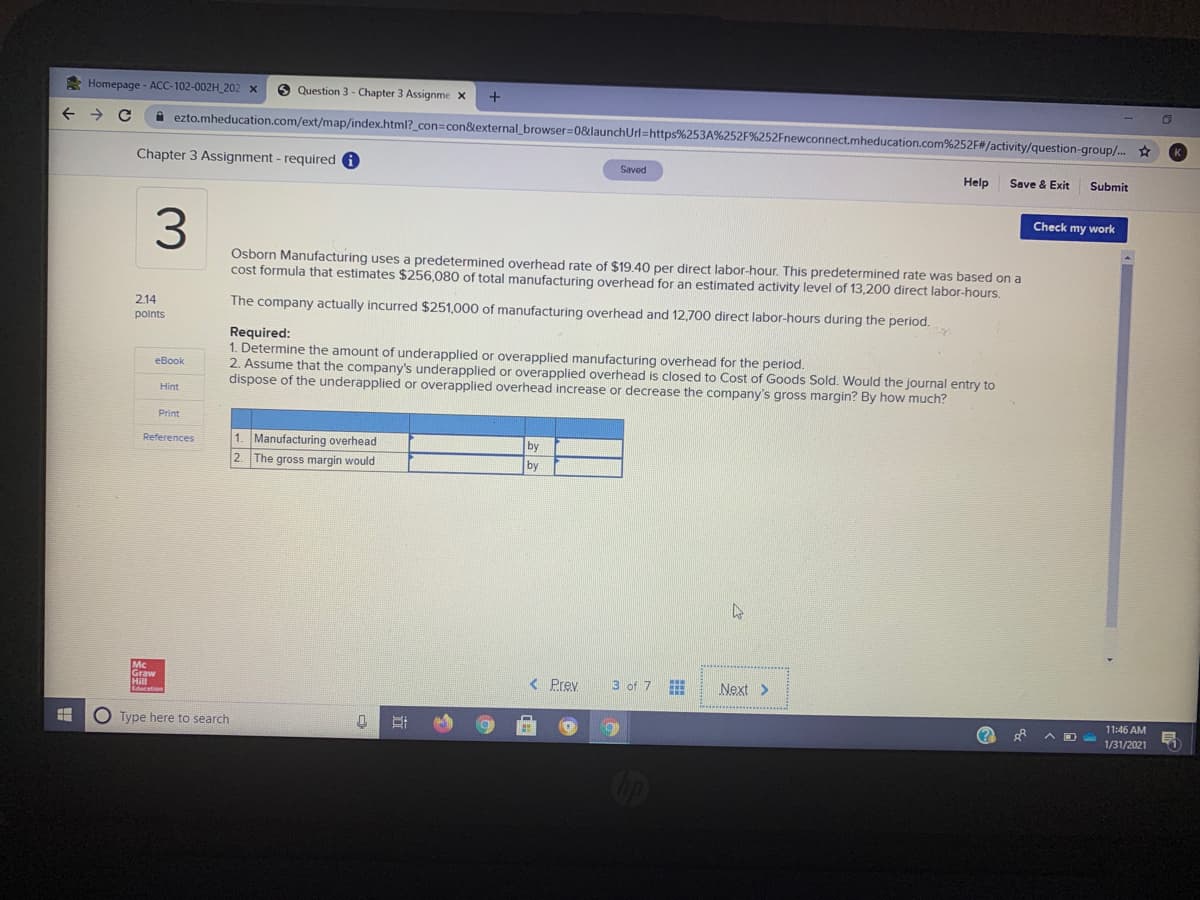

Osborn Manufacturing uses a predetermined overhead rate of $19.40 per direct labor-hour. This predetermined rate was based on a cost formula that estimates $256,080 of total manufacturing overhead for an estimated activity level of 13,200 direct labor-hours. The company actually incurred $251,000 of manufacturing overhead and 12,700 direct labor-hours during the period. Required: 1. Determine the amount of underapplied or overapplied manufacturing overhead for the period. 2. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Would the journal entry to dispose of the underapplied or overapplied overhead increase or decrease the company's gross margin? By how much? 1. Manufacturing overhead 2. The gross margin would by by

Osborn Manufacturing uses a predetermined overhead rate of $19.40 per direct labor-hour. This predetermined rate was based on a cost formula that estimates $256,080 of total manufacturing overhead for an estimated activity level of 13,200 direct labor-hours. The company actually incurred $251,000 of manufacturing overhead and 12,700 direct labor-hours during the period. Required: 1. Determine the amount of underapplied or overapplied manufacturing overhead for the period. 2. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Would the journal entry to dispose of the underapplied or overapplied overhead increase or decrease the company's gross margin? By how much? 1. Manufacturing overhead 2. The gross margin would by by

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 2RP

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

Transcribed Image Text:* Homepage - ACC-102-002H_202 x

O Question 3 - Chapter 3 Assignme x

+

A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-group/. *

Chapter 3 Assignment - required

Saved

Help

Save & Exit

Submit

Check my work

3.

Osborn Manufacturing uses a predetermined overhead rate of $19.40 per direct labor-hour. This predetermined rate was based on a

cost formula that estimates $256,080 of total manufacturing overhead for an estimated activity level of 13,200 direct labor-hours.

2.14

The company actually incurred $251,000 of manufacturing overhead and 12,700 direct labor-hours during the period.

polnts

Required:

1. Determine the amount of underapplied or overapplied manufacturing overhead for the period.

2. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Would the journal entry to

dispose of the underapplied or overapplied overhead increase or decrease the company's gross margin? By how much?

eBook

Hint

Print

1. Manufacturing overhead

2. The gross margin would

by

by

References

Graw

Hill

< Prev

3 of 7

Next >

11:46 AM

O Type here to search

1/31/2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you