Other secured loans $ Signature loans Risk-free securities $ $ What is the projected total annual return (in dollars)?

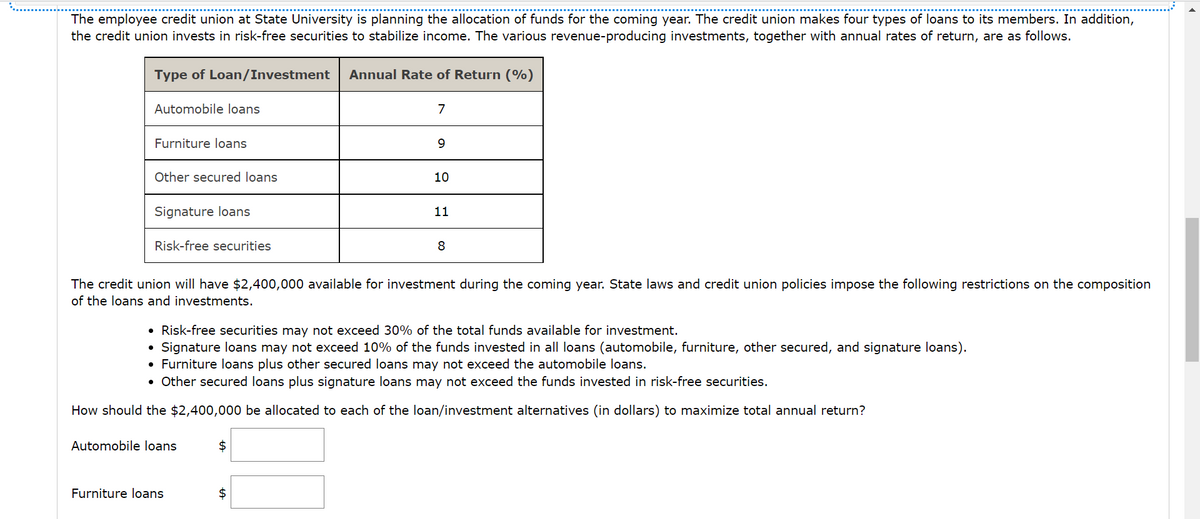

Q: which of the following is NOT a carrying inventory select one a.all of these b.caital costs…

A: Inventory management is the process of ordering, storing, using, and selling the inventory of the…

Q: A normally distributed process uses 66.7% (i.e. the +/- 3 ? from the mean) of the specification…

A: The percentage of specification width is the same as the 1Cp.…

Q: Analyzing Disaster Situations at Tech Two area hospitals have jointly initiated several planning…

A: Type of model: M/M/s (Multiple server model) Arrival rate λ = 18.5×60=7.06victims/hr Service rate μ…

Q: What do you understand by TQM? and Explain the role of TQM in an Organization.

A: Manufacturing is the process of transforming the raw materials into the finished products for the…

Q: Read the article below and answer the questions that follow. South Africa’s indigenous rooibos tea…

A: Based on the given case, there are 2 kinds of linkages commonly used. these are Supply chain…

Q: Please define automation as it relates to the business world.

A: Automation - In general, it is signified as the replacement of manual operations with electronics…

Q: Q. 1. The team at The Orange Girl is planning to improve their supply base by purchasing some of…

A: International purchase and supply in the above case refers to the process of logistics involving the…

Q: Q14.1. Determine the optimal order quantity. Q14.2. Determine the total minimum inventory cost,

A: Given data is as follows: The demand for PCs is 1200 units annually; the carrying cost will be $170…

Q: Dave Fletcher was able to determine the activity times for constructing his laser scanning machine.…

A: A network diagram related to the project shows the sequence of the task that is performed to…

Q: ment is a skill that needs to be constantly developed. Identify one skill required in this scenario…

A: A combination of talents called project management abilities is required to start, plan, and carry…

Q: Run and Shine, a manufacturer, purchases 2750 units of a certain component for his annual usage. The…

A: Find the Calculation Methods below: Exonomix Order Quantity = 2DSHD - Annual DemandS - Ordering…

Q: Vollmer Manufacturing makes three components for sale to refrigeration companies. The components are…

A: Also, the demand for 550 units of component 1 must be satisfied. Convert available hours in minutes…

Q: a) Activity that should be crashed first to reduce the project duration by 1 day is __ Part 3 b)…

A: A network diagram related to the project shows the sequence of the task that is performed to…

Q: A company can produce a part it uses in an assembly operation at the rate of 50 an hour. The company…

A: Economic run quantity or Economic production quantity (EPQ) is the optimal quantity that a company…

Q: which of the following modes of entry into foreign markets does a firm agree to set up an operating…

A: The franchise agreement is a binding legal document, laying forth the guidelines for the franchising…

Q: a) What is the crossover point (point of indifference) for the two machines? The crossover point…

A: Given data is as follows: Machine A: Fixed Cost = 77000VC = $18Capacity = 14000 Machine B:Fixed Cost…

Q: Using the FCFS rule for scheduling, the sequence is 1-2-3 For the schedule developed using the FCFS…

A: FCFS: FCFS stands for First Come and First Serve. As per the FCFS rule, the process…

Q: Saché, Incorporated, expects to sell 2,030 of its designer suits every week. The store is open seven…

A: Given data: The number of suits sells = 2,030 every week. EOQ =1,450 suits Safety stock of = 290…

Q: How does the Oracle, Walmart, and TikTok deal potentially impact US based tech companies such as…

A: Huge amount of money is spent in todays' scenario for the purpose of marketing and promotion each…

Q: The Problem The company business is production of porcelain The products are plates, cups…

A: Decision variable: Suppose-P be the no. of plates to be producedC be the no. of cups to be producedT…

Q: Why would a procurement professional decentralize inventory purchasing?

A: Decentralized purchasing is based on the practice of each branch & subdivision separately…

Q: Each column must have at least one value in some row to enable Pivot Tables to work properly. O True…

A: A Pivot Table is a powerful tool that helps in summarizing, calculating and analysing the data in…

Q: You are in charge of inventory control of a highly successful product retailed by your firm. Weekly…

A: Given data: Weekly demand =350 units Working days = 6 days per week, 50 weeks per year Then…

Q: Houston North Hospital is trying to improve its image by providing a positive experience for its…

A: Firstly, Calculating Fraction Size: Day No. of Unsatisfied Patients Sample Size Size Fraction 1…

Q: a) Based on the given information regarding the activities for the project, the project completion…

A: A network diagram related to the project shows the sequence of the task that is performed to…

Q: Plesae give me detail calculation to understand

A: Formulae used: Euclidean distances between two points:(X1,Y1)and (X2,Y2) d= (X1-X2)2+ (Y1-Y2)2…

Q: 7 69 6 8 5 3 4 Assume the lead time is 1.5 weeks, the inventory period is 4.6 weeks, and the…

A: Economic order quantity (EOQ) is the optimal order quantity that helps in minimizing the total…

Q: A.What is the Economic Order Quantity? B.What is the average inventory if the Economic Order…

A: Daily demand (d) = 8000 units Unit Cost = $ 150 Holding Cost (H) = 15% of $ 150 = $ 22.5 Ordering…

Q: Thomas Kratzer is the purchasing manager for the headquarters of a large insurance company chain…

A: Given that: Demand 5800 Cost 98 Inventory Carrying Cost 8 Ordering Cost 29 No. of days 5…

Q: Use the following LP problem below to determine the minimum cost MIN: 30x+40y s.t. 4x+2y ≤ 16 A…

A: Given data: Min Z = 30 x1 + 40 x2 subject to:4 x1+2 x2 ≤ 162 x1 -x2 ≥2x2≤1 x1,x2≥0.

Q: a. Draw the AOA network. b. Calculate the Early Event Time and Late Event Time for every node in the…

A: As per Bartleby guidelines, we can only solve the first three subparts of one question at a…

Q: The Gorman Manufacturing Company must decide whether to manufacture a component part at its Milan,…

A: Based on the given information, the decision tree will be as follows. Decision: Purchase component…

Q: A manager is simulating the number of times a machine operator stops a machine to make adjustments.…

A: I am not providing an explanation for the answer because It was already calculated in the given…

Q: An investor is given the following investment alternatives and percentage rates of return: 22/11/200…

A: In the given table, the percentage rates of return are given against each market scenario and…

Q: Question 2 An oil company must decide whether or not to drill an oil well in a particular area that…

A:

Q: What is the carrying cost for the toy manufacturer? A toy manufacturer uses 100,000 rubber wheels…

A: Given data is Annual demand (D) = 100,000 wheels Production (p) = 12000 per day Carrying cost (H) =…

Q: A division of the Winston Furniture Company manufactures dining tables and chairs. Each table…

A: Decision variable: Suppose-x represents the number of tables Winton manufacturesy represents the…

Q: anges to the Change Authorit on Management Approach

A: The project manager is the person in charge of managing the project. Therefore, a project's driving…

Q: 5 bad examples of CRM

A: It's no secret that CRM software has the most splendid failure rate—by a wide margin—among the five…

Q: Discuss any two (2) key points as to what Green manufacturing is?

A: The advancement of manufacturing technologies depends on multiple intrinsic and extrinsic factors. A…

Q: Borges Machine Shop, Inc., has a 1-year contract for the production of 250,000 gear housings for a…

A: Total Cost = Fixed Cost + X * (Variable Cost) X = Annual Volume. Total Cost (GPE) = 125000 + 16 * X…

Q: duration, and sequence shown in the table below, prepare a Gantt chart with details.

A: Gantt chart helps to identiy various project details such as project overall progress, critical…

Q: Question 4 Intermodals are the use of two or more carriers of different modes in the through…

A: Intermodal transportation entails transporting goods in an integrated package or vehicle via several…

Q: 3 examples of offshore outsourcing for an educational institution in Morocco

A: Morocco, Kingdom of Opportunities :Basic infrastructure-quality line with high international…

Q: The Scottsville Textile Mill produces several different fabrics on eight dobby looms that operate 24…

A: There are 8 dobby looms. Each Dobby loom turns 4.62 yards of fabric per hour. The looms operate 24…

Q: Employee Wanda Trews was working in the manufacturing facility at Coves Industrial. The employees of…

A: The detailed solution is given in Step 2

Q: Q2 Soon Lee company involved in the manufacturing of tire inner tubes and tire rim flaps for the…

A: SImplify the X and Y coordinates as shown below: For X coordinate: Arrange the factory in…

Q: An assembly line with 50 activities is to be balanced. The total amount of time to complete all 50…

A: Cycle time is indicating the available average time for producing each unit of items. Considering…

Q: Tesla Corporation has three different factories (A, B and C) where they make Premium Electric…

A: Transshipment is a special category of linear programming problem wherein the optimal solution is…

Q: Argue why “attractiveness of the company” and “reputation and image” are fundamental for…

A: A brand's reputation is how its customers, competitors, stakeholders, and the general public…

Please show step by step work on Excel

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

- This problem is based on Motorolas online method for choosing suppliers. Suppose Motorola solicits bids from five suppliers for eight products. The list price for each product and the quantity of each product that Motorola needs to purchase during the next year are listed in the file P06_93.xlsx. Each supplier has submitted the percentage discount it will offer on each product. These percentages are also listed in the file. For example, supplier 1 offers a 7% discount on product 1 and a 30% discount on product 2. The following considerations also apply: There is an administrative cost of 5000 associated with setting up a suppliers account. For example, if Motorola uses three suppliers, it incurs an administrative cost of 15,000. To ensure reliability, no supplier can supply more than 80% of Motorolas demand for any product. A supplier must supply an integer amount of each product it supplies. Develop a linear integer model to help Motorola minimize the sum of its purchase and administrative costs.The eTech Company is a fairly recent entry in the electronic device area. The company competes with Apple. Samsung, and other well-known companies in the manufacturing and sales of personal handheld devices. Although eTech recognizes that it is a niche player and will likely remain so in the foreseeable future, it is trying to increase its current small market share in this huge competitive market. Jim Simons, VP of Production, and Catherine Dolans, VP of Marketing, have been discussing the possible addition of a new product to the companys current (rather limited) product line. The tentative name for this new product is ePlayerX. Jim and Catherine agree that the ePlayerX, which will feature a sleeker design and more memory, is necessary to compete successfully with the big boys, but they are also worried that the ePlayerX could cannibalize sales of their existing productsand that it could even detract from their bottom line. They must eventually decide how much to spend to develop and manufacture the ePlayerX and how aggressively to market it. Depending on these decisions, they must forecast demand for the ePlayerX, as well as sales for their existing products. They also realize that Apple. Samsung, and the other big players are not standing still. These competitors could introduce their own new products, which could have very negative effects on demand for the ePlayerX. The expected timeline for the ePlayerX is that development will take no more than a year to complete and that the product will be introduced in the market a year from now. Jim and Catherine are aware that there are lots of decisions to make and lots of uncertainties involved, but they need to start somewhere. To this end. Jim and Catherine have decided to base their decisions on a planning horizon of four years, including the development year. They realize that the personal handheld device market is very fluid, with updates to existing products occurring almost continuously. However, they believe they can include such considerations into their cost, revenue, and demand estimates, and that a four-year planning horizon makes sense. In addition, they have identified the following problem parameters. (In this first pass, all distinctions are binary: low-end or high-end, small-effect or large-effect, and so on.) In the absence of cannibalization, the sales of existing eTech products are expected to produce year I net revenues of 10 million, and the forecast of the annual increase in net revenues is 2%. The ePIayerX will be developed as either a low-end or a high-end product, with corresponding fixed development costs (1.5 million or 2.5 million), variable manufacturing costs ( 100 or 200). and selling prices (150 or 300). The fixed development cost is incurred now, at the beginning of year I, and the variable cost and selling price are assumed to remain constant throughout the planning horizon. The new product will be marketed either mildly aggressively or very aggressively, with corresponding costs. The costs of a mildly aggressive marketing campaign are 1.5 million in year 1 and 0.5 million annually in years 2 to 4. For a very aggressive campaign, these costs increase to 3.5 million and 1.5 million, respectively. (These marketing costs are not part of the variable cost mentioned in the previous bullet; they are separate.) Depending on whether the ePlayerX is a low-end or high-end produce the level of the ePlayerXs cannibalization rate of existing eTech products will be either low (10%) or high (20%). Each cannibalization rate affects only sales of existing products in years 2 to 4, not year I sales. For example, if the cannibalization rate is 10%, then sales of existing products in each of years 2 to 4 will be 10% below their projected values without cannibalization. A base case forecast of demand for the ePlayerX is that in its first year on the market, year 2, demand will be for 100,000 units, and then demand will increase by 5% annually in years 3 and 4. This base forecast is based on a low-end version of the ePlayerX and mildly aggressive marketing. It will be adjusted for a high-end will product, aggressive marketing, and competitor behavior. The adjustments with no competing product appear in Table 2.3. The adjustments with a competing product appear in Table 2.4. Each adjustment is to demand for the ePlayerX in each of years 2 to 4. For example, if the adjustment is 10%, then demand in each of years 2 to 4 will be 10% lower than it would have been in the base case. Demand and units sold are the samethat is, eTech will produce exactly what its customers demand so that no inventory or backorders will occur. Table 2.3 Demand Adjustments When No Competing Product Is Introduced Table 2.4 Demand Adjustments When a Competing Product Is Introduced Because Jim and Catherine are approaching the day when they will be sharing their plans with other company executives, they have asked you to prepare an Excel spreadsheet model that will answer the many what-if questions they expect to be asked. Specifically, they have asked you to do the following: You should enter all of the given data in an inputs section with clear labeling and appropriate number formatting. If you believe that any explanations are required, you can enter them in text boxes or cell comments. In this section and in the rest of the model, all monetary values (other than the variable cost and the selling price) should be expressed in millions of dollars, and all demands for the ePlayerX should be expressed in thousands of units. You should have a scenario section that contains a 0/1 variable for each of the binary options discussed here. For example, one of these should be 0 if the low-end product is chosen and it should be 1 if the high-end product is chosen. You should have a parameters section that contains the values of the various parameters listed in the case, depending on the values of the 0/1 variables in the previous bullet For example, the fixed development cost will be 1.5 million or 2.5 million depending on whether the 0/1 variable in the previous bullet is 0 or 1, and this can be calculated with a simple IF formula. You can decide how to implement the IF logic for the various parameters. You should have a cash flows section that calculates the annual cash flows for the four-year period. These cash flows include the net revenues from existing products, the marketing costs for ePlayerX, and the net revenues for sales of ePlayerX (To calculate these latter values, it will help to have a row for annual units sold of ePlayerX.) The cash flows should also include depreciation on the fixed development cost, calculated on a straight-line four-year basis (that is. 25% of the cost in each of the four years). Then, these annual revenues/costs should be summed for each year to get net cash flow before taxes, taxes should be calculated using a 32% tax rate, and taxes should be subtracted and depreciation should be added back in to get net cash flows after taxes. (The point is that depreciation is first subtracted, because it is not taxed, but then it is added back in after taxes have been calculated.) You should calculate the company's NPV for the four-year horizon using a discount rate of 10%. You can assume that the fixed development cost is incurred now. so that it is not discounted, and that all other costs and revenues are incurred at the ends of the respective years. You should accompany all of this with a line chart with three series: annual net revenues from existing products; annual marketing costs for ePlayerX; and annual net revenues from sales of ePlayerX. Once all of this is completed. Jim and Catherine will have a powerful tool for presentation purposes. By adjusting the 0/1 scenario variables, their audience will be able to see immediately, both numerically and graphically, the financial consequences of various scenarios.Seas Beginning sells clothing by mail order. An important question is when to strike a customer from the companys mailing list. At present, the company strikes a customer from its mailing list if a customer fails to order from six consecutive catalogs. The company wants to know whether striking a customer from its list after a customer fails to order from four consecutive catalogs results in a higher profit per customer. The following data are available: If a customer placed an order the last time she received a catalog, then there is a 20% chance she will order from the next catalog. If a customer last placed an order one catalog ago, there is a 16% chance she will order from the next catalog she receives. If a customer last placed an order two catalogs ago, there is a 12% chance she will order from the next catalog she receives. If a customer last placed an order three catalogs ago, there is an 8% chance she will order from the next catalog she receives. If a customer last placed an order four catalogs ago, there is a 4% chance she will order from the next catalog she receives. If a customer last placed an order five catalogs ago, there is a 2% chance she will order from the next catalog she receives. It costs 2 to send a catalog, and the average profit per order is 30. Assume a customer has just placed an order. To maximize expected profit per customer, would Seas Beginning make more money canceling such a customer after six nonorders or four nonorders?