ounting profit before tax of Lindfield Ltd for the year as $150,000, including the following items of income rnment grant (exempt from tax) tainment expense (non-deductible) $ 5,000 14,000

ounting profit before tax of Lindfield Ltd for the year as $150,000, including the following items of income rnment grant (exempt from tax) tainment expense (non-deductible) $ 5,000 14,000

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 48P

Related questions

Question

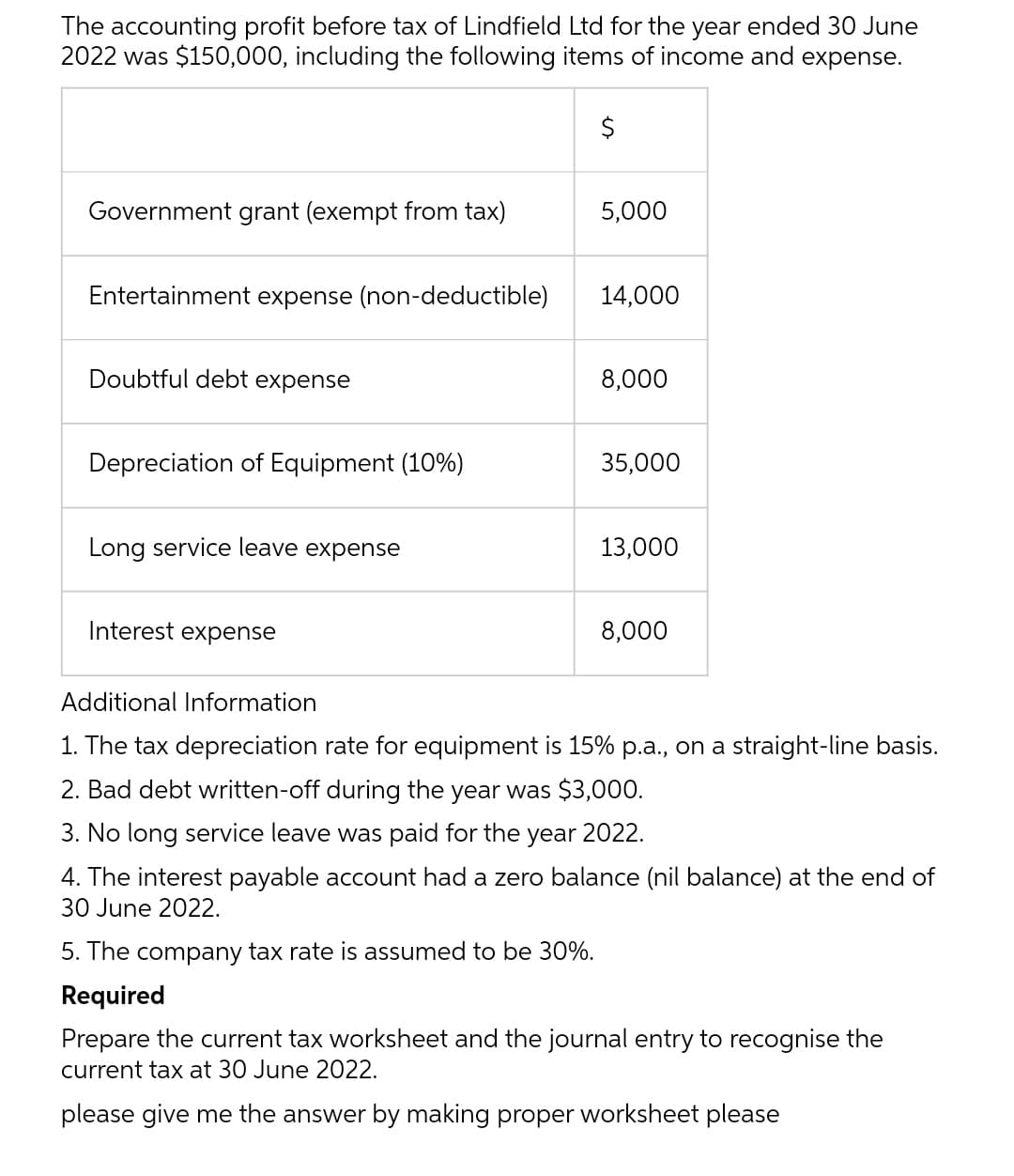

Transcribed Image Text:The accounting profit before tax of Lindfield Ltd for the year ended 30 June

2022 was $150,000, including the following items of income and expense.

$

Government grant (exempt from tax)

Entertainment expense (non-deductible)

Doubtful debt expense

Depreciation of Equipment (10%)

Long service leave expense

Interest expense

5,000

14,000

8,000

35,000

13,000

8,000

Additional Information

1. The tax depreciation rate for equipment is 15% p.a., on a straight-line basis.

2. Bad debt written-off during the year was $3,000.

3. No long service leave was paid for the year 2022.

4. The interest payable account had a zero balance (nil balance) at the end of

30 June 2022.

5. The company tax rate is assumed to be 30%.

Required

Prepare the current tax worksheet and the journal entry to recognise the

current tax at 30 June 2022.

please give me the answer by making proper worksheet please

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning