Use the information below for 3M Company to answer the requirements (perform these computations from the perspective of a 3M shareholder). 2014 ($millions) Sales Net income, consolidated Net income attributable to 3M shareholders Assets Total equity Equity attributable to 3M shareholders a. Compute return on equity (ROE). Round answer to two decimal places (ex: 0.12345= 12.35%) Profit margin b. Compute the DuPont model component measures for profit margin, asset turnover, and financial leverage. • Round profit margin to two decimal places (ex: 0.12345 = 12.35%) • Round asset turnover and financial leverage to three decimal places. 2015 $30,674 5,056 5,048 32,898 $31,389 11,747 13,142 11,708 13,109 Asset turnover 96 Financial leverage c. Compute ROA. Round answer to two decimal places (ex: 0.12345 = 12.35%) ROA 96

Use the information below for 3M Company to answer the requirements (perform these computations from the perspective of a 3M shareholder). 2014 ($millions) Sales Net income, consolidated Net income attributable to 3M shareholders Assets Total equity Equity attributable to 3M shareholders a. Compute return on equity (ROE). Round answer to two decimal places (ex: 0.12345= 12.35%) Profit margin b. Compute the DuPont model component measures for profit margin, asset turnover, and financial leverage. • Round profit margin to two decimal places (ex: 0.12345 = 12.35%) • Round asset turnover and financial leverage to three decimal places. 2015 $30,674 5,056 5,048 32,898 $31,389 11,747 13,142 11,708 13,109 Asset turnover 96 Financial leverage c. Compute ROA. Round answer to two decimal places (ex: 0.12345 = 12.35%) ROA 96

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 63P: Mike Sanders is considering the purchase of Kepler Company, a firm specializing in the manufacture...

Related questions

Question

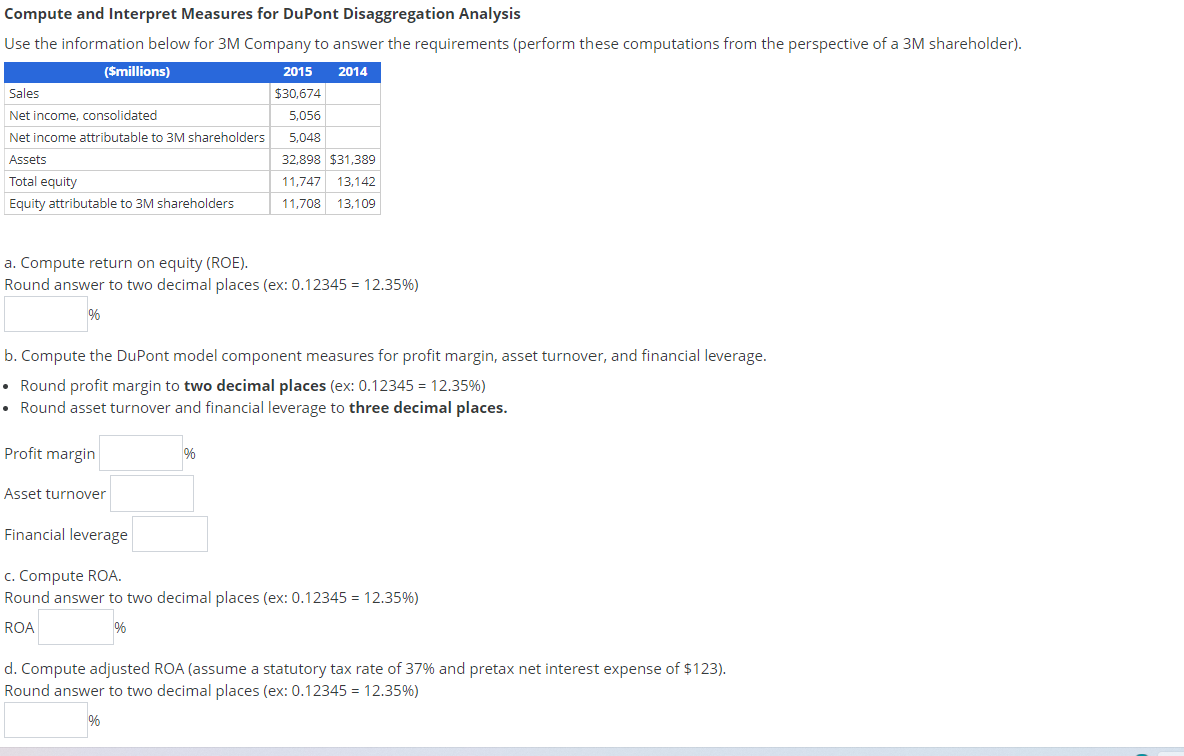

Transcribed Image Text:Compute and Interpret Measures for DuPont Disaggregation Analysis

Use the information below for 3M Company to answer the requirements (perform these computations from the perspective of a 3M shareholder).

2014

($millions)

Sales

Net income, consolidated

Net income attributable to 3M shareholders

Assets

Total equity

Equity attributable to 3M shareholders

a. Compute return on equity (ROE).

Round answer to two decimal places (ex: 0.12345= 12.35%)

%

2015

$30,674

5,056

5,048

32,898 $31,389

11,747 13,142

11,708 13,109

b. Compute the DuPont model component measures for profit margin, asset turnover, and financial leverage.

• Round profit margin to two decimal places (ex: 0.12345= 12.35%)

• Round asset turnover and financial leverage to three decimal places.

Profit margin

Asset turnover

%

Financial leverage

c. Compute ROA.

Round answer to two decimal places (ex: 0.12345= 12.35%)

ROA

%

d. Compute adjusted ROA (assume a statutory tax rate of 37% and pretax net interest expense of $123).

Round answer to two decimal places (ex: 0.12345= 12.35%)

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning