Outhouse Bottled Water is comparing two different capital structures. Under plan A,Outhouse would have 100,000 shares of stock outstanding and no debt. Under plan B,there would be 75,000 shares outstanding and $1 million in debt outstanding. Theinterest rate on the debt is 10 percent and there are no taxes. What is the break-evenEBIT? In other words, what EBIT would produce the same EPS under either capitalstructure?

Q: Honeycutt Co. is comparing two different capital structures. Plan I would result in 38,000 shares of…

A: Note: It is a situation where multiple subparts have been asked, so we are allowed to solve the…

Q: A firm is financed with a mix of risk-free debt (currently valued at £800,000) and equity (which has…

A: Weighted average cost of capital is the average cost of capital that the firm incur for raising…

Q: Wintermelon Corp.'s controller is considering a change in the capital structure consisting of 40%…

A: Cost of equity is the return required by the individual for equity investment or the return required…

Q: By how much would the capital structure shift change the firm's cost of equity? a. −5.40% b.…

A: Cost of equity refers to the cost incurred by the company for issuing new equity. When a company use…

Q: Lucky cement Co. is trying to establish its optimal capital structure. Its current capital structure…

A: Given information : Current debt = 30% Current equity = 70% Risk free rate RF = 5% Market risk…

Q: Maverick Stones is debating between a leveraged and unleverage capital structure. The all equity…

A: Break-Even Level of earnings is common value at which EPS(Earning per Share) for two entities is…

Q: Cyclone Software Co. is trying to establish its optimal capital structure. Its current capital…

A: The cost of equity is the cost of financed the funds from the equity shareholders.

Q: The Nunal Corporation finds that it is necessary to determine its marginal cost of capital. Nunal’s…

A: The Weighted Average Cost of Capital (WACC) refers to the financial ratio that calculates the…

Q: Memo Corporation is about to launch a new product. Depending on the success of the new product, Memo…

A: The value of firm is the total of value of debt and the value of equity. The value of debt means how…

Q: The market value of Lays Corporation's equity is 50 million $ and the market value of its debt is 27…

A: Cost of equity = Risk free rate + (Market rate of return - risk free rate) * Beta Weight of equity…

Q: Vafeas Inc.'s capital structure consists of 80% debt and 20% common equity, its beta is 1.60, and…

A: Levered Beta = 1.60 Calculating Unlevered beta Unlevered beta= Levered beta/ (1+(1-tax…

Q: Round Hammer is comparing two different capital structures: An all-equity plan (Plan I) and a…

A: a) Calculation of EPS:Thus, the EPS for Plan I and Plan II are $3.38 and $2.90 respectively.

Q: Globex Corp. currently has a capital structure consisting of 40% debt and 60% equity. However,…

A: The question is based on the concept of beta of a firm in leverage and unleveraged condition of a…

Q: Merriwether Building has operating income of $20 million, a tax rate of 25%, and no debt. It pays…

A: The conceptual formula used:

Q: Hi-Tech, Inc. has determined that it can minimize its weighted average cost of capital (WACC) by…

A: The WACC is the overall cost of capital from all the sources of finance. The WACC is the minimum…

Q: Daichi Inc. is reassessing its debt position. Its current capital structure is composed of 80% debt…

A: Answer Cost of equity (Ke) = Risk free rate + beta (market risk premium) Beta = 1.60 (Assume that…

Q: An all-equity firm currently has 1,000,000 shares of stock outstanding and is considering borrowing…

A: Current EBIT $15,00,000 Less: Tax (30%) $4,50,000 Profit after Tax $10,50,000 Number of Share…

Q: Cyclone Software Co. is trying to establish its optimal capital structure. Its current capital…

A:

Q: Trapper Corporation is comparing two different capital structures, an all-equity plan (Plan I) and a…

A: Solution:- We know Earnings per Share (EPS) means the amount of earnings available to each…

Q: ABC Company is re-evaluating its debt level. Its current capital structure consists of 72% debt and…

A: Risk-free rate (Rf)=0.05 Market risk premium (Rm-Rf)=0.069 Current beta (β)=1.63 Current Capital…

Q: Coldstream Corp. is comparing two different capital structures. Plan I would result in 10,000 shares…

A: Calculation of Price per share of Plan I and Plan II:The price per share of Plan I is $12.80 and…

Q: Stephens Electronics is considering a change in its target capital structure, which currently…

A: Given the following information: Current capital structure: 25% debt and 75% equity The CFO…

Q: American Exploration, Inc., a natural gas producer, is trying to decide whether to revise its…

A: We know that WACC = % of debt in capital * total after tax cost of debt + % of equity in capital *…

Q: The Nolan Corporation finds it is necessary to determine its marginal cost of capital. Nolan's…

A: The individual weight of the various element of the capital structure(debt, preferred equity, and…

Q: Coldstream Corp. is comparing two different capital structures. Plan I would result in 10,000 shares…

A: Since there are multiple subparts in the question, we will answer the first three. Please repost the…

Q: Petty Corporation is comparing 2 different capital structures: Plan 1 an all-equity plan and Plan 2…

A: Earning per share (EPS): It is the earning per outstanding share of the organization and it is…

Q: Des Chatels Corp. is comparing two different capital structures. Plan I would result in 13,000…

A: The price can be calculated by dividend the difference in debt of two plan by the difference in the…

Q: Trapper Corporation is comparing two different capital structures, an all-equity plan (Plan I) and a…

A: A company can raise funds using an optimal mix of debt and equity. The shareholders expect dividends…

Q: What is XYZ's WACC

A: A firm’s capital structure is the mix of debt and equity. The cost of procuring such debt and equity…

Q: A firm has two independent projects, each requiring investment of INR 3 million, but each of these…

A: Residual dividend policy is the policy in which the earnings of the company are first used for the…

Q: n all-equity firm currently has 1,000,000 shares of stock outstanding and is considering…

A: The earning per share is important factor for shareholders and if the EPS is increasing than it is…

Q: Hardware Co. is estimating its optimal capital structure. Hardware Co. has a capital structure that…

A: Solution:- Cost of equity means the minimum rate of return required by the equity shareholders of a…

Q: Trapper Corporation is comparing two different capital structures, an all-equity plan (Plan I) and a…

A: Given information, The plan I(All equity plan) No of shares outstanding = 205,000 Plan II(Levered…

Q: Wintermelon Corp.'s controller is considering a change in the capital structure consisting of 40%…

A: Unlevered beta =Levered beta /1+D/E(1-t)

Q: Vanier Corporation is comparing two different capital structures: an all-equity plan (Plan I) and a…

A: Given, Plan 1 No.of stocks outstanding = 195,000 Plan II No.of stocks outstanding = 140,000 Plan II…

Q: Wintermelon Corp.'s controller is considering a change in the capital structure consisting of 40%…

A: Beta is the measure of stock’s volatility in relation to the overall market.

Q: Consider the same two firms U and L - that are identical except for capital structure. Each firm…

A: EBIT= $650,000 Cost of Equity (Firm U)=10% Debt (Firm L)= $2 million with coupon rate 7% Tax rate=…

Q: vered with firm value at $640,000. maze is currently deciding whether including debt in its capital…

A: Cost of equity can be find out from the net income and value of equity.

Q: Round Hammer is comparing two different capital structures: An all-equity plan (Plan I) and a…

A: EPS FORMULA: EPS = NET INCOME/ NUMBER OF SHARES.

Q: Companies that use debt in their capital structure are said to be using financial leverage. Using…

A: Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Byrd Corporation is comparing two different capital structures, an all-equity plan (Plan I) anda…

A: Calculation: Formula snip:

Q: Horizon Corporation has decided to a capital restructuring. This process of restructuring involves…

A: The increased financial leverage will increase EPS. Under the old capital structure, the interest…

Q: Round Hammer is comparing two different capital structures: An all-equity plan (Plan I) and a…

A: a.Number of Outstanding Shares (Under Plan I) = 150,000 Number of Outstanding Shares (Under Plan II)…

Q: Trapper Corporation is comparing two different capital structures, an all-equity plan (Plan I) and a…

A: MM Proposition I maintains that the capital structure of the company has no bearing on its value…

Outhouse Bottled Water is comparing two different capital structures. Under plan A,

Outhouse would have 100,000 shares of stock outstanding and no debt. Under plan B,

there would be 75,000 shares outstanding and $1 million in debt outstanding. The

interest rate on the debt is 10 percent and there are no taxes. What is the break-even

EBIT? In other words, what EBIT would produce the same EPS under either capital

structure?

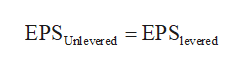

Break-even EBIT is the level of EBIT at which EPS of two firms will be same. That is:

Step by step

Solved in 2 steps with 2 images

- The Rivoli Company has no debt outstanding, and its financial position is given by the following data: What is Rivoli’s intrinsic value of operations (i.e., its unlevered value)? What is its intrinsic stock price? Its earnings per share? Rivoli is considering selling bonds and simultaneously repurchasing some of its stock. If it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 12% to reflect the increased risk. Bonds can be sold at a cost, rd, of 7%. Based on the new capital structure, what is the new weighted average cost of capital? What is the levered value of the firm? What is the amount of debt? Based on the new capital structure, what is the new stock price? What is the remaining number of shares? What is the new earnings per share?Ogier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%? What are the projected sales in Years 1 and 2? What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2? What is the projected FCF for Year 2?Trapper Corporation is comparing two different capital structures, an all-equity plan (Plan I) and a levered plan (Plan II). Under Plan I, the company would have 160,000 shares of stock outstanding. Under Plan II, there would be 110,000 shares of stock outstanding and $1.4 million in debt outstanding. The interest rate on the debt is 7 percent, and there are no taxes. a. If EBIT is $400,000, what is the EPS for each plan? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)b. If EBIT is $650,000, what is the EPS for each plan? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)c. What is the break-even EBIT? (Do not round intermediate calculations. Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.

- Trapper Corporation is comparing two different capital structures, an all-equity plan (Plan I) and a levered plan (Plan II). Under Plan I, the company would have 205,000 shares of stock outstanding. Under Plan II, there would be 155,000 shares of stock outstanding and $2.3 million in debt outstanding. The interest rate on the debt is 6 percent, and there are no taxes. a. If EBIT is $250,000, what is the EPS for each plan? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. If EBIT is $500,000, what is the EPS for each plan? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. What is the break-even EBIT? (Do not round intermediate calculations. Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.)Round Hammer is comparing two different capital structures: An all-equity plan (Plan I) and a levered plan (Plan II). Under Plan I, the company would have 200,000 shares of stock outstanding. Under Plan II, there would be 150,000 shares of stock outstanding and $3 million in debt outstanding. The interest rate on the debt is 8 percent, and there are no taxes. a. If EBIT is $675,000, what is the EPS for each plan? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. If EBIT is $925,000, what is the EPS for each plan? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. What is the break-even EBIT? (Do not round intermediate calculations. Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.)Round Hammer is comparing two different capital structures: An all-equity plan (Plan I) and a levered plan (Plan II). Under Plan I, the company would have 170,000 shares of stock outstanding. Under Plan II, there would be 120,000 shares of stock outstanding and $2.4 million in debt outstanding. The interest rate on the debt is 7 percent, and there are no taxes. a. If EBIT is $450,000, what is the EPS for each plan? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. If EBIT is $700,000, what is the EPS for each plan? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. What is the break-even EBIT? (Do not round intermediate calculations. Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) a. Plan I EPS Plan II EPS b. Plan I EPS Plan II EPS c. Break-even EBIT

- Galaxy Products is comparing two different capital structures, an all-equity plan (Plan I) and a levered plan (Plan II). Under Plan I, Galaxy would have 178,500 shares of stock outstanding selling at $24. Under Plan II, there would be 71,400 shares of stock outstanding and $1.79 million in debt outstanding. The interest rate on the debt is 10% and there are no taxes. If EBIT is $600,000 which plan will result in the higher EPS?Foundation, Inc., is comparing two different capital structures: an all- equity plan (Plan I) and a levered plan (Plan II). Under Plan I, the company would have 145,000 shares of stock outstanding. Under Plan II, there would be 125, 000 shares of stock outstanding and $716, 000 in debt outstanding. The interest rate on the debt is 8 percent, and there are no taxes. a. If EBIT is $300, 000, which plan will result in the higher EPS? b . If EBIT is $600,000, which plan will result in the higher EPS? c. What is the break - even EBIT? d. use M&M Proposition I to find the price per share of equity under each of the two proposed plans. What is the value of the firm?Goodday Corporation is comparing two different capital structures, an all-equity plan (Plan I) and a levered plan (Plan II). Under Plan I, the company would have 365,000 shares of stock outstanding. Under Plan II, there would be 285,000 shares of stock outstanding and $3.6 million in debt outstanding. The interest rate on the debt is 10 percent and there are not taxes. At what EBIT the EPS of the two plans is the same? $109,500 $1,095,000 or $0 $1,095,000 $0

- Foundation, Incorporated, is comparing two different capital structures, an all-equity plan (Plan I) and a levered plan (Plan II). UnderPlan I, the company would have 190,000 shares of stock outstanding. Under Plan II, there would be 140,000 shares of stockoutstanding and $2 million in debt outstanding. The interest rate on the debt is 8 percent, and there are no taxes.a. If EBIT is $625,000, what is the EPS for each plan?Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.b. If EBIT is $875,000, what is the EPS for each plan?Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.c. What is the break-even EBIT?Note: Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567.a. Plan I EPSPlan II EPSb. Plan I EPSPlan II EPSc. Break-even EBITThe Nunal Corporation finds that it is necessary to determine its marginal cost of capital. Nunal’s current capital structure calls for 45% debt, 15% preferred stock and 40% common equity. The costs of the various sources of financing are as follows: debt, after-tax 5.6%; preferred stock, 9%; retained earnings, 12%; and new common stock, 13.2%. If the firm has P12 million retained earnings, and Nunal has an opportunity to invest in an attractive project that costs P45 million, what is the marginal cost of capital of Nunal Corporation?Vafeas Inc.'s capital structure consists of 80% debt and 20% common equity, its beta is 1.60, and its tax rate is 40%. However, the CFO thinks the company has too much debt, and he is considering moving to a capital structure with 40% debt and 60% equity. The risk-free rate is 5.0% and the market risk premium is 6.0%. By how much would the capital structure shift change the firm's cost of equity? (Just calculate the change in the cost of equity). A. -5.20% B. -6.36% C. -7.69% D. -6.99% E. -5.65%