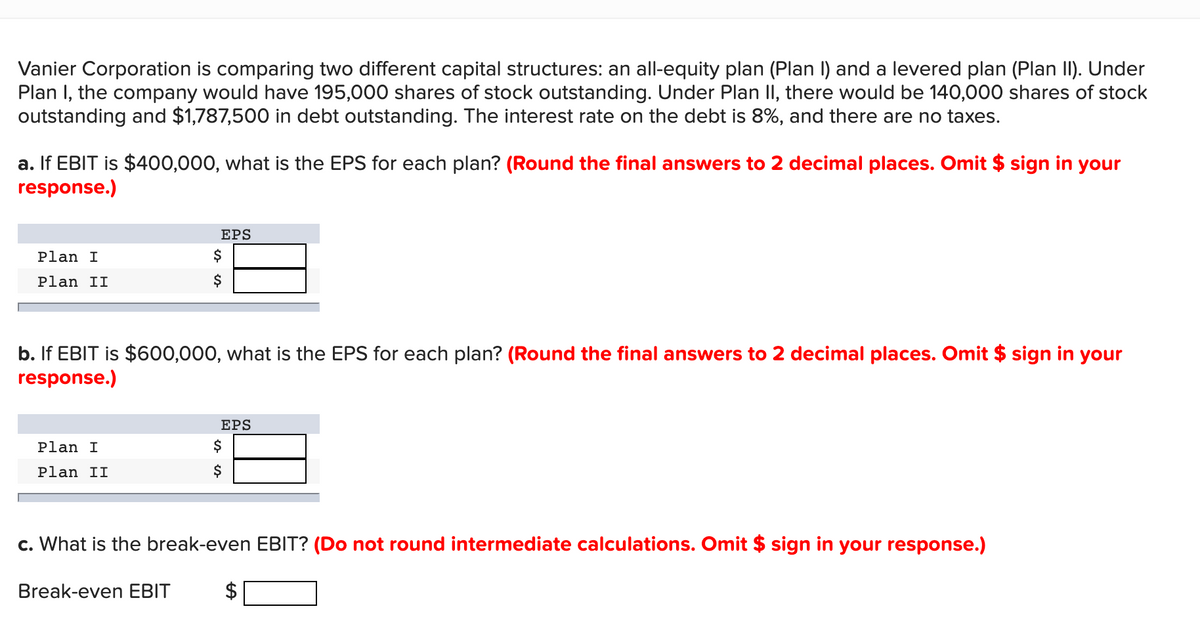

Vanier Corporation is comparing two different capital structures: an all-equity plan (Plan I) and a levered plan (Plan II). Under Plan I, the company would have 195,000 shares of stock outstanding. Under Plan II, there would be 140,000 shares of stock outstanding and $1,787,500 in debt outstanding. The interest rate on the debt is 8%, and there are no taxes. a. If EBIT is $400,000, what is the EPS for each plan? (Round the final answers to 2 decimal places. Omit $ sign in your response.) EPS Plan I Plan II b. If EBIT is $600,000, what is the EPS for each plan? (Round the final answers to 2 decimal places. Omit $ sign in your

Vanier Corporation is comparing two different capital structures: an all-equity plan (Plan I) and a levered plan (Plan II). Under Plan I, the company would have 195,000 shares of stock outstanding. Under Plan II, there would be 140,000 shares of stock outstanding and $1,787,500 in debt outstanding. The interest rate on the debt is 8%, and there are no taxes. a. If EBIT is $400,000, what is the EPS for each plan? (Round the final answers to 2 decimal places. Omit $ sign in your response.) EPS Plan I Plan II b. If EBIT is $600,000, what is the EPS for each plan? (Round the final answers to 2 decimal places. Omit $ sign in your

Chapter13: Capital Structure Concepts

Section: Chapter Questions

Problem 4P

Related questions

Question

21) Can i please get help with this practice question.

Transcribed Image Text:Vanier Corporation is comparing two different capital structures: an all-equity plan (Plan I) and a levered plan (Plan II). Under

Plan I, the company would have 195,000 shares of stock outstanding. Under Plan II, there would be 140,000 shares of stock

outstanding and $1,787,500 in debt outstanding. The interest rate on the debt is 8%, and there are no taxes.

a. If EBIT is $400,000, what is the EPS for each plan? (Round the final answers to 2 decimal places. Omit $ sign in your

response.)

EPS

Plan I

$

Plan II

$

b. If EBIT is $600,000, what is the EPS for each plan? (Round the final answers to 2 decimal places. Omit $ sign in your

response.)

EPS

Plan I

$

Plan II

$

c. What is the break-even EBIT? (Do not round intermediate calculations. Omit $ sign in your response.)

Break-even EBIT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning