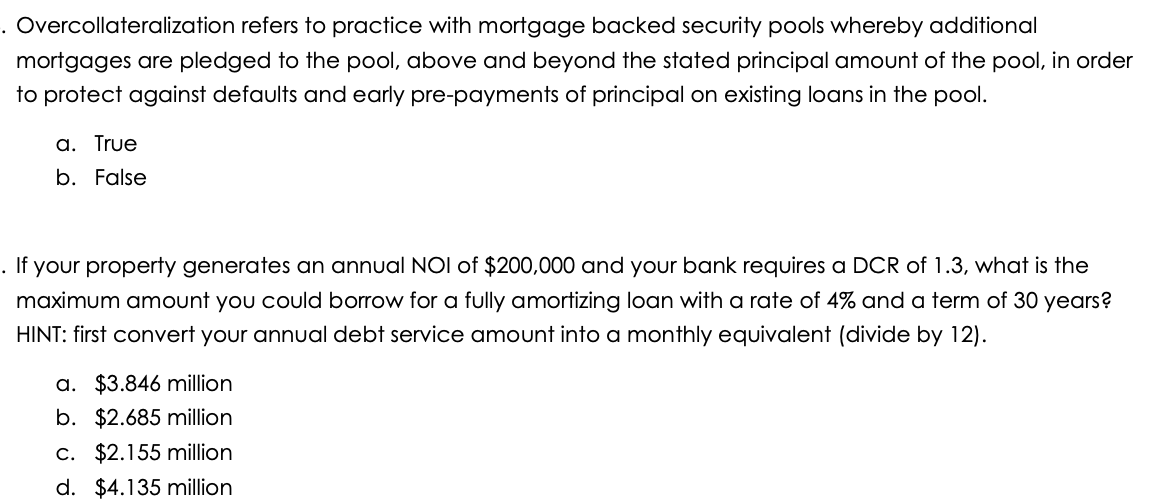

Overcollateralization refers to practice with mortgage backed security pools whereby additional mortgages are pledged to the pool, above and beyond the stated principal amount of the pool, in order o protect against defaults and early pre-payments of principal on existing loans in the pool. a. True b. False f your property generates an annual NOI of $200,000 and your bank requires a DCR of 1.3, what is the maximum amount you could borrow for a fully amortizing loan with a rate of 4% and a term of 30 years? HINT: first convert your annual debt service amount into a monthly equivalent (divide by 12). a. $3.846 million b. $2.685 million c. $2.155 million $4. 135 million

Overcollateralization refers to practice with mortgage backed security pools whereby additional mortgages are pledged to the pool, above and beyond the stated principal amount of the pool, in order o protect against defaults and early pre-payments of principal on existing loans in the pool. a. True b. False f your property generates an annual NOI of $200,000 and your bank requires a DCR of 1.3, what is the maximum amount you could borrow for a fully amortizing loan with a rate of 4% and a term of 30 years? HINT: first convert your annual debt service amount into a monthly equivalent (divide by 12). a. $3.846 million b. $2.685 million c. $2.155 million $4. 135 million

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 81.3C

Related questions

Question

Finance

Transcribed Image Text:. Overcollateralization refers to practice with mortgage backed security pools whereby additional

mortgages are pledged to the pool, above and beyond the stated principal amount of the pool, in order

to protect against defaults and early pre-payments of principal on existing loans in the pool.

a. True

b. False

. If your property generates an annual NOI of $200,000 and your bank requires a DCR of 1.3, what is the

maximum amount you could borrow for a fully amortizing loan with a rate of 4% and a term of 30 years?

HINT: first convert your annual debt service amount into a monthly equivalent (divide by 12).

a. $3.846 million

b. $2.685 million

c. $2.155 million

d. $4.135 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning