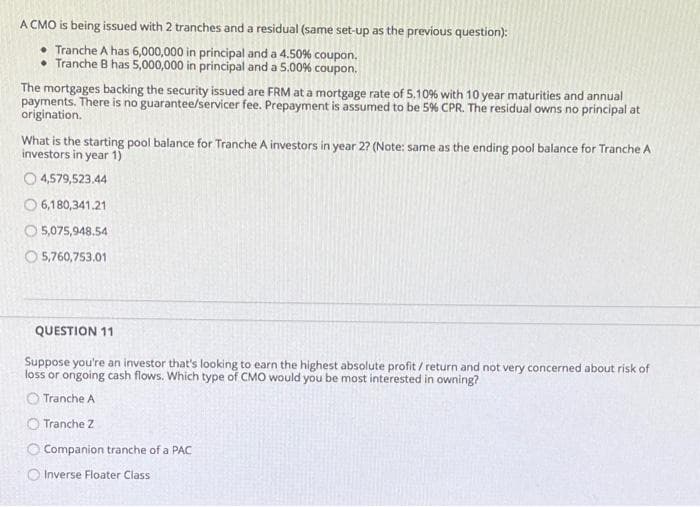

A CMO is being issued with 2 tranches and a residual (same set-up as the previous question): • Tranche A has 6,000,000 in principal and a 4.50% coupon. Tranche B has 5,000,000 in principal and a 5.00% coupon. The mortgages backing the security issued are FRM at a mortgage rate of 5.10% with 10 year maturities and annual payments. There is no guarantee/servicer fee. Prepayment is assumed to be 5% CPR. The residual owns no principal at origination. What is the starting pool balance for Tranche A investors in year 2? (Note: same as the ending pool balance for Tranche A investors in year 1) O 4,579,523.44 O 6,180,341.21 O 5,075,948.54 O 5,760,753.01

A CMO is being issued with 2 tranches and a residual (same set-up as the previous question): • Tranche A has 6,000,000 in principal and a 4.50% coupon. Tranche B has 5,000,000 in principal and a 5.00% coupon. The mortgages backing the security issued are FRM at a mortgage rate of 5.10% with 10 year maturities and annual payments. There is no guarantee/servicer fee. Prepayment is assumed to be 5% CPR. The residual owns no principal at origination. What is the starting pool balance for Tranche A investors in year 2? (Note: same as the ending pool balance for Tranche A investors in year 1) O 4,579,523.44 O 6,180,341.21 O 5,075,948.54 O 5,760,753.01

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:A CMO is being issued with 2 tranches and a residual (same set-up as the previous question):

• Tranche A has 6,000,000 in principal and a 4.50% coupon.

• Tranche B has 5,000,000 in principal and a 5.00% coupon.

The mortgages backing the security issued are FRM at a mortgage rate of 5.10% with 10 year maturities and annual

payments. There is no guarantee/servicer fee. Prepayment is assumed to be 5% CPR. The residual owns no principal at

origination.

What is the starting pool balance for Tranche A investors in year 27 (Note: same as the ending pool balance for Tranche A

investors in year 1)

O 4,579,523.44

O 6,180,341.21

O 5,075,948,54

O 5,760,753.01

QUESTION 11

Suppose you're an investor that's looking to earn the highest absolute profit / return and not very concerned about risk of

loss or ongoing cash flows. Which type of CMO would you be most interested in owning?

O Tranche A

O Tranche Z

O Companion tranche of a PAC

O Inverse Floater Class

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning