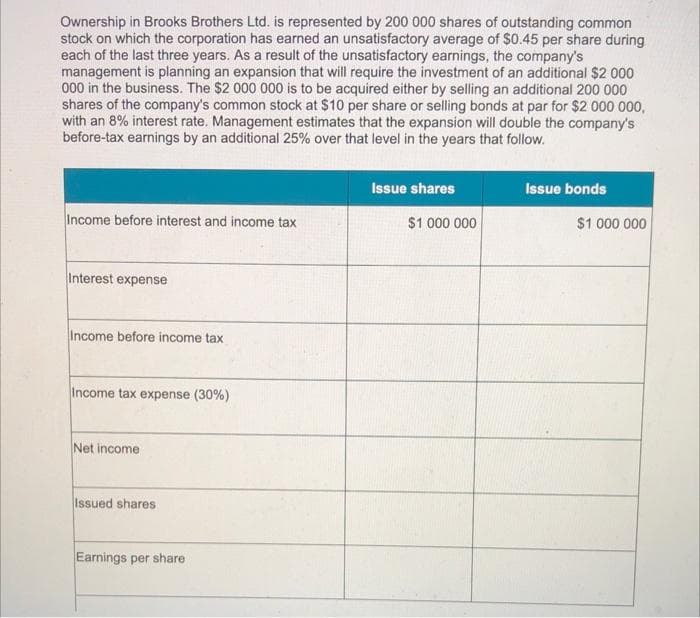

Ownership in Brooks Brothers Ltd. is represented by 200 000 shares of outstanding common stock on which the corporation has earned an unsatisfactory average of $0.45 per share during each of the last three years. As a result of the unsatisfactory earnings, the company's management is planning an expansion that will require the investment of an additional $2 000 000 in the business. The $2 000 000 is to be acquired either by selling an additional 200 000 shares of the company's common stock at $10 per share or selling bonds at par for $2 000 000, with an 8% interest rate. Management estimates that the expansion will double the company's before-tax earnings by an additional 25% over that level in the years that follow. Issue shares Issue bonds Income before interest and income tax $1 000 000 $1 000 000 Interest expense Income before income tax Income tax expense (30%) Net income Issued shares Earnings per share

Ownership in Brooks Brothers Ltd. is represented by 200 000 shares of outstanding common stock on which the corporation has earned an unsatisfactory average of $0.45 per share during each of the last three years. As a result of the unsatisfactory earnings, the company's management is planning an expansion that will require the investment of an additional $2 000 000 in the business. The $2 000 000 is to be acquired either by selling an additional 200 000 shares of the company's common stock at $10 per share or selling bonds at par for $2 000 000, with an 8% interest rate. Management estimates that the expansion will double the company's before-tax earnings by an additional 25% over that level in the years that follow. Issue shares Issue bonds Income before interest and income tax $1 000 000 $1 000 000 Interest expense Income before income tax Income tax expense (30%) Net income Issued shares Earnings per share

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 7P

Related questions

Question

Practice Pack

Please fill out the table attached and give your opinion on which alternative is preferable (The company’s management wants to finance the expansion in a way that will serve the best interests of present stockholders).

Transcribed Image Text:Ownership in Brooks Brothers Ltd. is represented by 200 000 shares of outstanding common

stock on which the corporation has earned an unsatisfactory average of $0.45 per share during

each of the last three years. As a result of the unsatisfactory earnings, the company's

management is planning an expansion that will require the investment of an additional $2 000

000 in the business. The $2 000 000 is to be acquired either by selling an additional 200 000

shares of the company's common stock at $10 per share or selling bonds at par for $2 000 000,

with an 8% interest rate. Management estimates that the expansion will double the company's

before-tax earnings by an additional 25% over that level in the years that follow.

Issue shares

Issue bonds

Income before interest and income tax

$1 000 000

$1 000 000

Interest expense

Income before income tax

Income tax expense (30%)

Net income

Issued shares

Earnings per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Includes step-by-step video

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning